Consumer sentiment hit an all-time low based on the University of Michigan Consumer Sentiment Index. According to Surveys of Consumers’ Director, Joanne Hsu:

“The final June reading confirmed the early-June decline in consumer sentiment, settling 0.2 Index points below the preliminary reading and 14.4% below May for the lowest reading on record. Consumers across income, age, education, geographic region, political affiliation, stockholding and homeownership status all posted large declines. About 79% of consumers expected bad times in the year ahead for business conditions, the highest since 2009.”

Here’s the good news from that reading

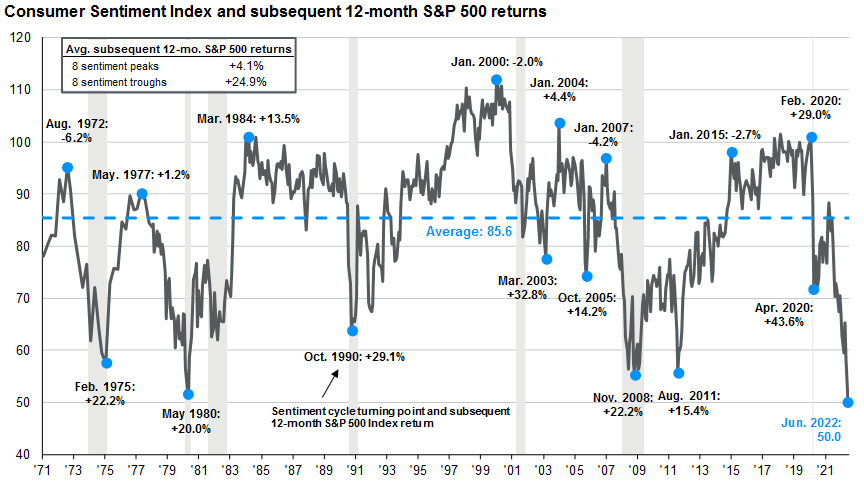

According to JPMorgan, lows in consumer confidence often precede robust returns for stocks. As the chart below shows, the average one-year return for stocks following a low in the consumer sentiment index is 24.9%.

Source: FactSet, Standard & Poor’s, University of Michigan, J.P. Morgan Asset Management. Peak is defined as the highest index value before a series of lower lows, while a trough is defined as the lowest index value before a series of higher highs. Subsequent 12-month S&P 500 returns are price returns only, which excludes dividends. Past performance is not a reliable indicator of current and future results. Guide to the Markets – U.S. Data are as of June 30, 2022.

As Heritage President, Sammy Azzouz, and Chief Investment Officer, Bob Weisse, discussed in depth on our Wealthy Behavior podcast, nobody knows when stocks will bottom. But markets are forward-looking. Consumer sentiment appears to be catching up to stocks being down around 20% already this year.

The Bottom Line

Economic data may continue to get worse, but that doesn’t mean stocks will. Read more about our Investment Team’s thoughts on what to expect in markets going forward:

Why You Don’t Need to be Panicked About an Economic Hurricane