Jamie Dimon, CEO of JPMorgan Chase, made headlines earlier this month for his prediction of an impending economic “hurricane”.

While his comments on the surface are concerning for investors, they warrant some perspective. Below we share additional insight on the current environment for stocks, including thoughts from Heritage Chief Investment Officer, Bob Weisse, and interesting research from JPMorgan Chairman of Market and Investment Strategy, Michael Cembalest.

Let’s Put the Hurricane Into Perspective

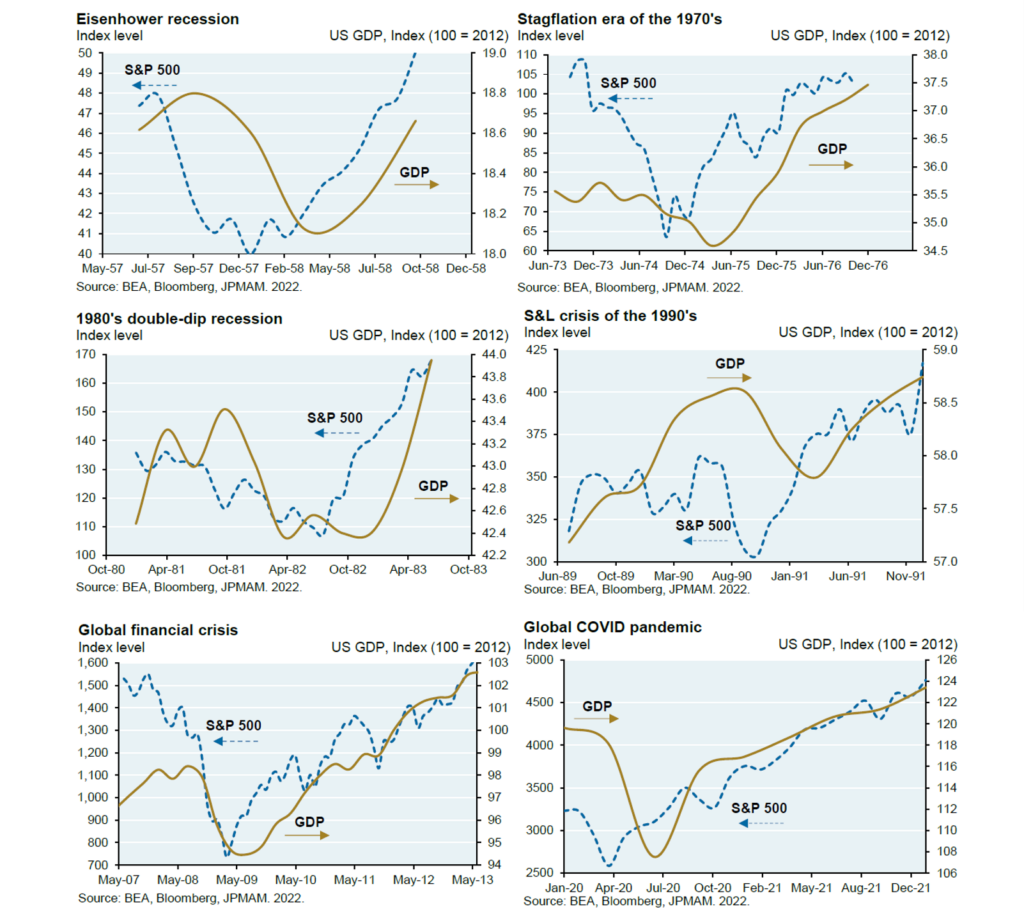

- Bob reminds us that while Dimon’s comments focused on the economy, there is a difference between the economy and markets. And, more importantly, he reiterates that equity markets lead the economy. Investors will see the good or bad news reflected in stocks first, before we feel it in the economy. To hammer this point home, Cembalest points to six different major post-war economic downturns dating back to the 1950s. In all six instances, stock markets started rising off bear market lows before the economy turned around.

- Don’t forget, a lot of “hurricanes” have already hit various areas of the public markets this year, including Chinese internet stocks, pandemic favorites like Peloton, SPACs, meme stocks, crypto, and more. Many of these investments are down 50% or more so far this year. Bob points out that these are all areas that Heritage Financial has avoided as part of our value-driven, globally diversified approach to portfolio management.

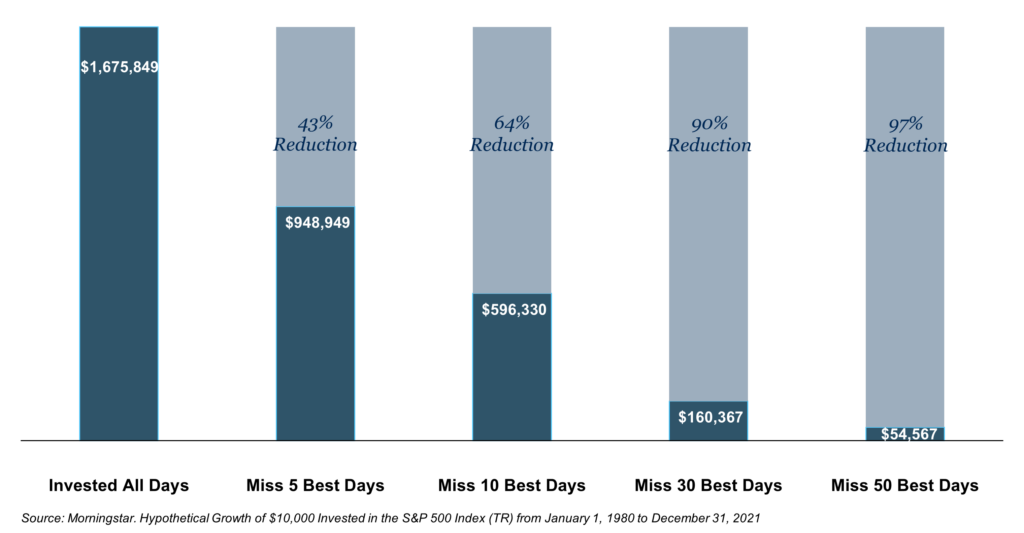

- Equity markets may not have bottomed yet, but it’s impossible to time bottoms and tops perfectly. Remember, most of the market’s best days happen during the fear of a bear market, and the opportunity cost of missing just a handful of these days can be immense.

The bottom line?

Stocks may not have seen the bottom yet. Investors should be prepared for another possible leg down. But there’s been a lot of pain in the most expensive parts of the market. So it’s likely that we aren’t too far from the bottom. Serious investors won’t try to guess when the bottom hits. They will stay invested to make sure they capture all the upside that awaits, knowing that the turning point for stocks will likely be before we see the worst of the economy.

Learn more about Heritage Financial’s value-driven, globally diversified investment approach, and reach out to us if you’d like our team to make recommendations for your portfolio and overall financial plan.