The last time inflation was more than 7% and The Federal Reserve’s Fed Funds Rate was rising was 1979. While rising interest rates, inflation and changing fixed income markets is not new, it may feel that way. A long history of falling interest rates and modest inflation have left many investors complacent about the risks and opportunities when investing in bonds. To combat that, let’s look at where bond returns are likely to come from as rates rise, and some practical strategies for investors to employ in this environment.

Refresher: How Do Bonds Work?

The primary source of returns from bonds comes from yield (often referred to as the coupon or the income from a bond). This makes the current yield of a fixed income portfolio both important and potentially predicative of future outcomes. The income component of fixed income securities also contributes to mitigating volatility and offsetting periods of time where the price return of bonds may be negative.

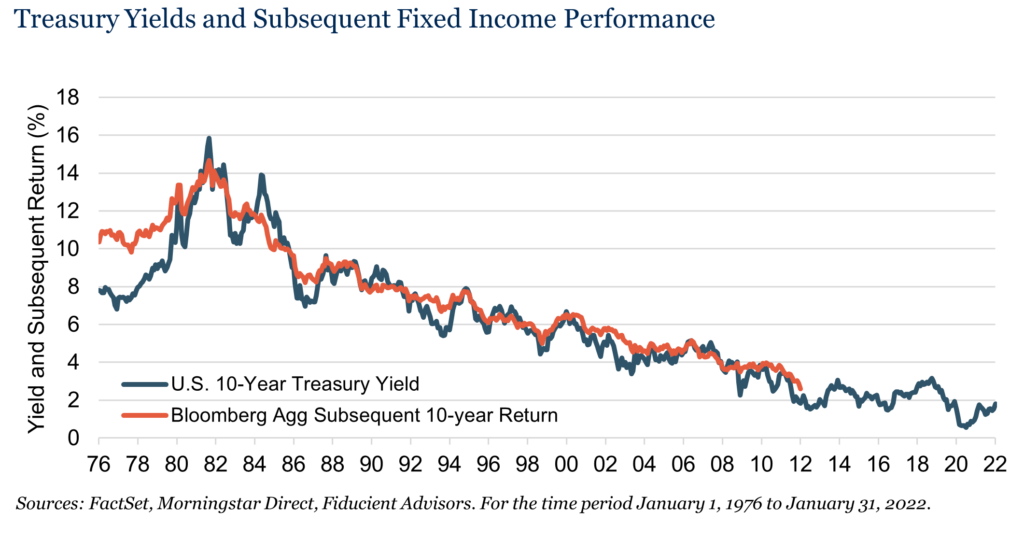

A bond’s starting yield is a strong indicator of future return

The chart below maps the 10-year U.S. Treasury yield with the future 10-year return of the Bloomberg U.S. Aggerate Bond Index. There is a significant connection between yield and future return. In fact, since 1976, the 10-year U.S. Treasury yield and the future subsequent 10-year return of the Index had a 94% correlation.

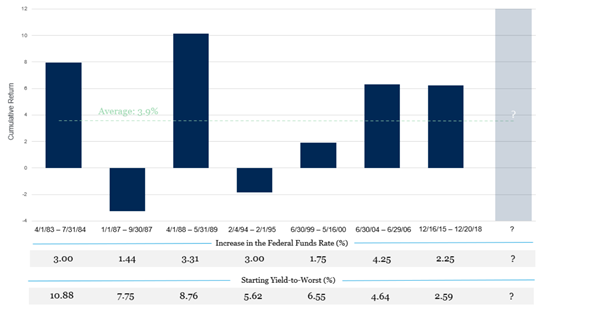

Since 1983 there have been seven rate rising cycles and, as outlined below, markets have reacted differently across those cycles. On average, the Index returned 3.9% during these rate rising periods. However, as demonstrated above, yield is an important variable to future outcomes. In past cycles, the average starting yield-to-worst was 6.7%. This gave fixed income investors a significant head start to positive outcomes.

Bloomberg U.S. Aggregate During Rate Hike Cycles

(Sources: Capital Group. Bloomberg Index Services Ltd., Morningstar. As of 10/31/21. Daily results for the index are not available prior to 1994. For those earlier periods, returns were calculated from the closest month-end to the day of the first hike through the closest month-end to the day of the final hike. Starting Yield to Worst sourced from FactSet and is taken from the start of the month in the period displayed.)

Today, we do not have the same luxury. Yields are materially lower and moreover, the duration of the Index is higher than it has been in recent past. As a result, the Index is more sensitive to interest rate movements than in previous environments, yet is offering investors less compensation in return for that risk.

Do bonds still have a place in my portfolio?

Yes! Fixed income has historically been a return generating and risk mitigating asset. Given the current level of interest rates and inflation, positive real returns are likely to be more difficult within fixed income going forward. However, as a risk mitigating asset, we believe it can still play an important role in a diversified allocation.

Over the last 20 years, the Bloomberg U.S. Aggregate Bond Index has outperformed the S&P 500 100% of the time when the S&P 500 experienced a drawdown of 3% or more.

Recent notable examples of this capital preservation benefit include the selloff in the spring of 2020 at the onset of the COVID-19 pandemic and the 2008 Global Financial Crisis. Having an allocation to core fixed income during these events helped protect portfolio assets.

What now?

With some notable headwinds facing fixed income including low current rates, longer duration, and inflation, positive real returns within fixed income are likely to be challenged. But bonds still have an important role in globally diversified portfolios for long-term investors. Rather than engaging in market timing – trying to decide when to get into or out of bond investments based on changing market conditions – Heritage Financial supports investors identifying a long-term strategic asset allocation that aligns with their overall financial plan.

Here’s what we are doing in our client portfolios:

- Diversify a portfolio’s fixed income exposure away from traditional core fixed income. Dynamic bond strategies that allocate across the fixed income landscape can help insulate investors from potential rising rate scenarios. These strategies often have lower duration profiles compared to traditional core fixed income and may be able to take advantage of greater volatility in fixed income as a source of return.

- Alternatives strategies, like private credit, can provide some protection from traditional sources of risk like rising interest rates. The floating rate nature of private credit results in less interest rate risk. Heritage accesses private credit strategies for our wealth management clients through both interval funds and private investment vehicles for qualified purchasers.

- Of course the most logical way to avoid potential headwinds in fixed income is to own less of it. That’s easier said than done given the important role of price stability that bonds play over the long-term. That said, we shifted some of our clients’ bond allocations to real assets like real estate, infrastructure, farmland, and timberland, in the face of rising rates.

Learn more about Boston-based Heritage Financial’s overall market outlook and our investment process. If you are curious about using some of these fixed income strategies in your portfolio, let’s talk.

Other Insights You Might Be Interested In:

3 Reasons to Invest in Real Assets (And How to Do It)

Have the Markets Priced In Projected Interest Rate Changes?