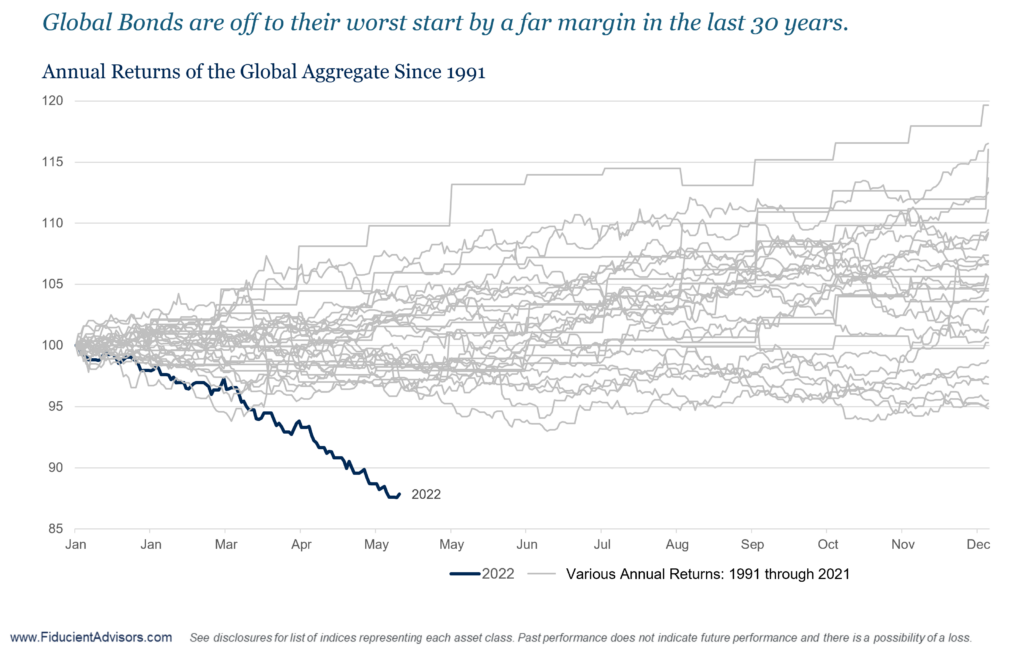

Bonds have had a rough year. The Bloomberg U.S. Aggregate Bond Index suffered its third worst quarterly return in history during the first quarter of 2022. As the chart below shows, global bonds had the worst start to a calendar year in the past 30 years.

Last week on our blog, we discussed how rare it is for bonds to be thought of as “risky”. But that’s how most investors are feeling about them these days. Over the past few months, we’ve shared a lot about why investors shouldn’t just run for the exits despite current conditions:

Why Should Investors Hold On To Their Bonds For the Next 12-24 Months

Are Bonds A Good Investment Today?

We reiterate our stance here that bonds are an important part of a globally diversified portfolio. Historically, they have been both a return generating and risk mitigating asset.

In addition to sharing why you shouldn’t just sell your bonds, we wanted to share our insight on what type of bonds you might want to consider in this more challenging environment.

At Heritage Financial, more than half of the bond investments we make on behalf of our wealth management clients are currently in securitized bonds, which have outperformed most areas of the bond market this year. So let’s take a look at what these bonds are, and why we like them.

What are Securitized Bonds?

Bonds are debt instruments. U.S. Government bonds represent the debt of the U.S. Government. Corporate bonds represent the debt of a corporation. Securitized bonds hold the debt of a pool of income-generating assets, and are backed by said underlying asset. As an example, residential mortgage-backed securities (RMBS) are a type of securitized debt. An RMBS is a bond holding a pool of home mortgages. The debt of an RMBS is backed by the principal and interest payments on the underlying mortgages. Other examples of securitized bonds include commercial mortgage-backed securities (CMBS), credit card receivables, auto loans, and student loans.

Here are four reasons we like securitized bonds in this rising interest rate environment

1. Lower Interest Rate Risk

When interest rates rise, bond prices fall. And duration is a measure of interest rate sensitivity. The higher a bond’s duration, the more sensitive it is to rate changes. In this environment, we’ve seen bonds with higher duration experience bigger declines in value relative to lower duration bonds. One reason we’ve had a healthy allocation to securitized debt over the past year is because these types of bonds have a lower duration than traditional government and corporate bonds.

For example, as of March 31, 2022, the Bloomberg U.S. Aggregate Bond Index had a duration of 6.58 years. U.S. government bonds in the index had a duration of more than 6 years, while corporate bonds in the index were at just over 8 years. In contrast, the securitized bonds in the index had a much lower duration of approximately 5 years. (Source: DoubleLine, Bloomberg)

Historically speaking, securitized bonds have been one of the best performing sectors of the bond market during periods of rising rates according to DoubleLine. Since 1986, the 10-year Treasury yield rose by 1% or more on 15 separate occasions. During these periods, the Securitized sector outperformed U.S. government bonds 100% of the time and corporate bonds 80% of the time.

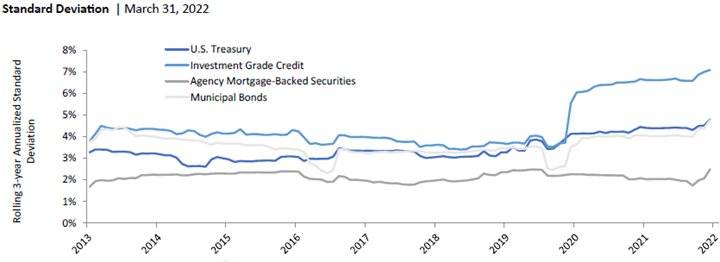

2. Lower Volatility

Given their relatively lower duration, securitized bonds have exhibited lower volatility relative to other sectors of the bond market over time.

3. Yield Advantage

Yield is an important part of the return potential of a bond. In stable rate environments, yield provides income to the investor. In periods of rising rates, yield helps to offset the decline in the price of a bond. When we compare the yield per unit of duration for various bond types, securitized bonds have a more favorable yield profile relative to government or corporate bonds. With a Yield/Duration ratio of 0.58 as of 3/31/22, the yield on securitized debt is able to offset as much as a 0.58% rise in interest rates in a given year. Government bond yields are only able to offset an increase in rates of 0.36%, while corporate bonds can offset only a 0.44% rise in rates. (Source: DoubleLine) Simply put, the yield on securitized debt offers a higher buffer against rising rates.

4. Lower Correlation to Stocks (Better Diversifier)

Securitized debt has historically had a lower correlation to the S&P 500 Index relative to the Corporate sector. Said a different way, securitized bonds are a better diversifier than corporate bonds when it comes to a portfolio invested in stocks and bonds. In fact, the last three times the S&P 500 Index declined by 10% or more from peak to trough, securitized bonds were positive in two of the three periods. In contrast, the Corporate sector’s returns were negative in all three periods. (Source: DoubleLine, Bloomberg)

Should You Be Investing in Securitized Bonds?

It depends on your overall financial plan and corresponding long-term investment objectives and goals. Also, while it may make sense in the current environment where rates are low and rising, the attractiveness of this type of bond investment can change as market conditions change. Of course, if it does make sense for your portfolio, you’ll want to do your due diligence on the variety of fixed income managers that provide access to these types of securities, mostly through mutual funds, exchange traded funds, or interval funds.

Does it sound overwhelming? Well, that’s where we come in.

For most of our clients, their work and family are their passion. It’s where their focus needs to be. We know they don’t have the time or expertise to handle all the small details around taxes, investments, estate planning, and more. That’s why we work with prospective clients to review their current portfolio holdings and assess overall risk level and return potential before they sign on as clients. We take them through our proprietary Three Meeting Process before we are officially engaged and charging for our services. This way both parties can feel comfortable that there is a good fit for a long-term working relationship before anyone signs anything.

Interested in learning more about working with us? Let’s get a dialogue started.