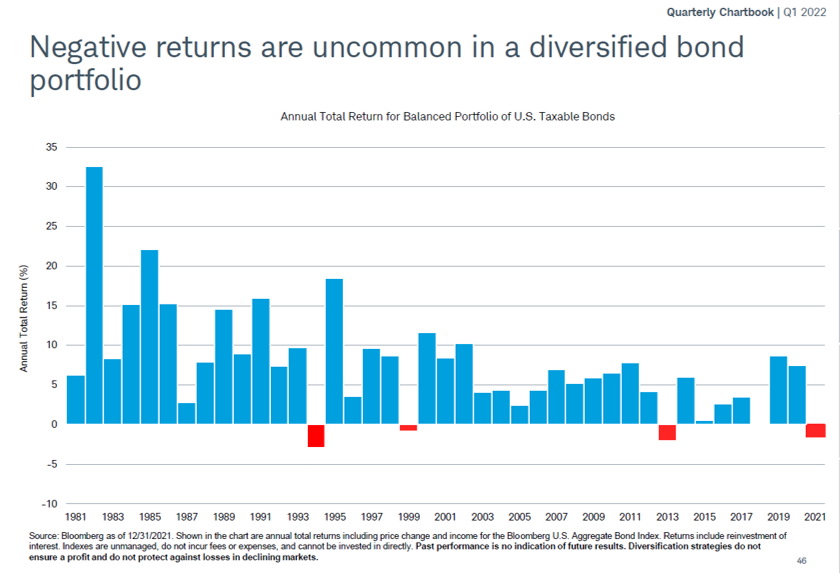

Interest rates are going up. And when rates rise, bond prices fall. So why should investors hold on to their bonds for the next 12-24 months?

Heritage President Sammy Azzouz posed this question to our Chief Investment Officer, Bob Weisse, during our 2022 Market Overview webinar last week. Listen to this roughly 90 second video clip for Bob’s response:

That Risk is Always Out There

As Bob reminds us, bonds play an important role for equity market investors that don’t want or can’t afford the full volatility and potential short-term losses that come with owning stocks. But bonds aren’t risk-free.

U.S. investment grade bonds, which typically make up the core bond holdings in a diversified portfolio, are often seen as a safe haven during a crisis. But they are interest rate sensitive (rates rise, prices fall). And with very low current yields they offer little return potential.

So how can investors take advantage of the stability bonds offer while protecting themselves from the risks present in today’s interest rate environment?

Looking beyond investment grade U.S. bonds opens up access to corporate and structured bonds issued by the U.S. and other foreign developed countries like France, Germany, the UK and Japan, as well as the use of derivatives, like futures that can hedge exposure to interest rates.

When you consider this expanded opportunity set for bond investments, there are increased overall diversification benefits as well as reduced exposure to interest rate sensitivity. At Heritage, we refer to this broader opportunity set of potential bond investments as “dynamic bonds”.

For our clients, we approach bond allocations as a mix of exposure to both Core and Dynamic bonds. This allows us to maintain a sense of stability that investors rely on with bond investments while also providing enhanced protection from bond price declines that come with rising interest rates.

It’s just another way of realizing the benefits of diversification through global investing.

-

Source: Schwab Asset Management Quarterly Chartbook

Curious if your bond investments are structured to weather the coming changes to interest rates? We’re happy to provide our opinion. Reach out to us here and let’s talk.

Want More?

Don’t forget to listen to the full replay of our 2022 Market Overview webinar.

Find more of our investment insights on our blog. Subscribe today!

Where are the Best Values in Global Stock Markets?

Which Price Increases are Here to Stay? Here’s What Our Team Thinks

How Much Should You Have Invested in Gold to Help You Hedge Inflation?