Discussions about inflation aren’t losing any steam. The October reading for CPI was even higher than the prior few months, coming in at a 6.2% year over year increase. Here’s what else is fueling the discussion:

- The supply chain in the U.S. is still facing issues, which is particularly concerning ahead of the holiday season.

- The next legislative spending plan (Build Back Better) just passed the House and has moved to the Senate. While it’s far from an easy pass in the Senate, significant new spending is one step closer to potentially becoming a reality.

- There’s much less use of the word “transitory” in discussions about inflation. Even the Fed is using stronger language about fighting it rather than waiting it out.

A few weeks ago Heritage Financial hosted a webinar titled “What’s Next for the Recovery and Bull Market?”. During the discussion, our Chief Investment Officer, Bob Weisse, and institutional consulting partner, Brad Long with Fiducient Advisors, tackled questions about inflation head on. And Senior Wealth Manager Sammy Azzouz asked the question that’s on a lot of minds:

What About Gold as an Inflation Hedge?

If you’ve been wondering about how much you should have invested in gold right now, listen to this 90 second detailed explanation of gold as an investment in times of inflation.

So what should you do?

We think this insight and advice from Dimensional Fund Advisors is spot on:

- History shows us that stocks have outperformed inflation over time. In fact, over the past three decades through June 2021, the S&P 500 had an annualized return of 8.5% after adjusting for inflation. In that time, there was not a reliable connection between periods of high inflation and stock returns.

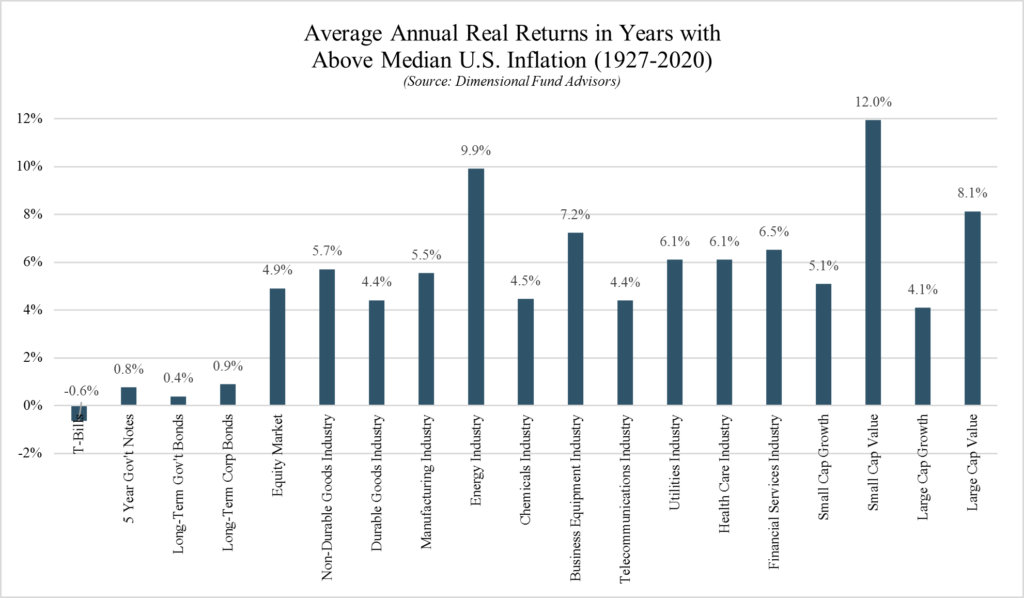

- But what about periods with double digit inflation, like the 1940s and 70s? We find similar results going back to 1927 through 2020. The chart below shows the real returns of various asset classes in years with above average inflation (5.5% or more). Each of these assets outpaced inflation except for T-Bills.

As DFA concludes, the best answer to the question “What should I be doing about inflation?” may be boring.

As DFA concludes, the best answer to the question “What should I be doing about inflation?” may be boring.

“Timing markets around inflation expectations can be difficult and risky. Instead of trying to outguess the market, investors may find comfort learning that the market incorporates expectations around supply chains, demand, government spending, and yes, even inflation.”

Working with a wealth manager that combines detailed financial planning, diversified investment strategies, and meticulous oversight by a skilled team of family-friendly and relentlessly thorough professionals is the best way to develop a personalized plan that you can stick with in a variety of environments.

If you aren’t working with Heritage Financial yet, let’s talk.