November was anything but calm for global financial markets. Here are some notes from our institutional investment consulting partner, Fiducient Advisors (formerly DiMeo, Schneider & Associates), on what has been impacting recent market returns.

- Global equity markets took a step back in November, with investors favoring safe-haven assets.

- Emergence of the new Omicron COVID variant and more hawkish comments by the Federal Reserve led to market volatility late in the month.

- U.S. political gridlock eased with passage of the $1 trillion infrastructure bill and with the House advancing the “Build Back Better Act” (BBBA).

Markets

S&P 500 earnings grew almost 40 percent year-over-year for the third quarter. Despite this, volatility picked up as events unfolded late in November. Specifically, news of a new COVID-19 variant, “Omicron”, surfaced late in the month. In addition, the tone of the Federal Reserve’s comments on inflation became more concerning.

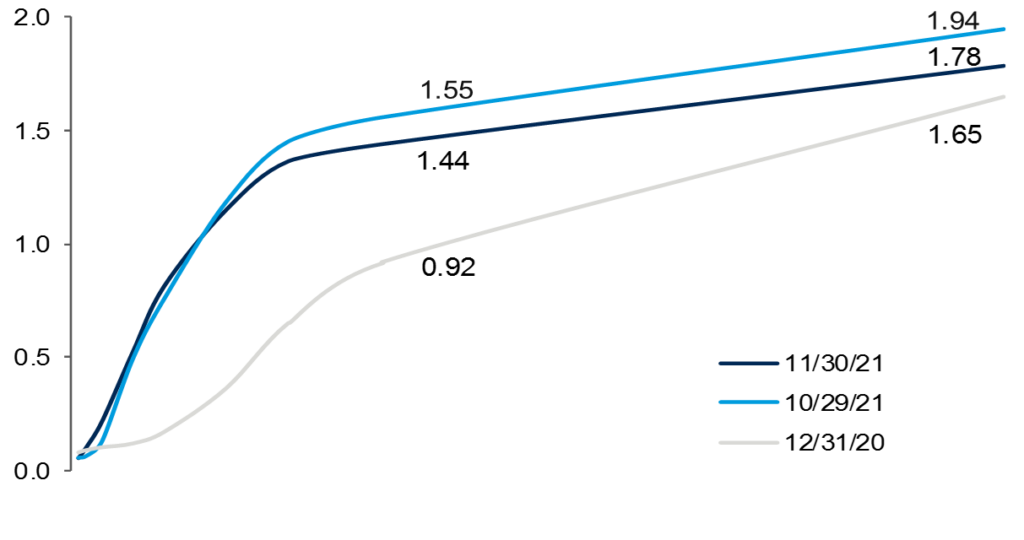

Fixed income markets performed relatively well compared to equity markets, despite elevated interest rate volatility. Interest rates climbed higher earlier in the month in light of higher U.S. inflation readings. Later in the month, Fed Chairman Jerome Powell acknowledged that higher inflation will likely remain into 2022. His comments sparked a sell-off in equities and investors flocked into safe-haven fixed income.

U.S. Treasury Yield Curve

Policy Update

Political gridlock eased slightly in November, with the House passing the $1 trillion infrastructure bill (the ‘Infrastructure Investment and Jobs Act’) on Friday, November 5. The House vote (228-206) largely followed party lines, though the final vote was crucially aided by the support of 13 House Republicans. With the Senate having already approved the measure in August (on a rarely bipartisan basis, 69-30), the bill went to President Biden’s desk and was signed into law on Monday, November 15. While the final infrastructure bill was scaled back from earlier proposals to garner adequate support, the bill ultimately provides $550 billion in new federal spending for roads, bridges and highways, broadband access and the utility grid.

The House then passed the roughly $2 trillion Build Back Better bill on Friday, November 19. The final vote (220-213) passed along strict party lines, with only one Democrat dissenting. Attention now turns to the Senate, which will consider the bill over the coming weeks. Amid an evenly divided Senate (50-50) and with the expectation of no Republican support, centrists Joe Manchin (D-West Virginia) and Kyrsten Sinema (D-Arizona) will wield considerable power in upcoming negotiations; passing the bill using a process called ‘reconciliation’ will ultimately require unanimous Democratic support (50 votes). Senate Majority Leader Charles Schumer (D-N.Y.) cited a goal of the Senate passing the bill prior to Christmas, though that timeline may be in question.

Outlook

Despite this pause in the markets in November, the economy remains on solid footing. Consumer health remains favorable as does the corporate environment. But concerns about the Omicron variant, stubbornly high inflation and the Federal Reserve’s tapering is clearly at the forefront of investors’ thoughts. These recent developments have added a layer of uncertainty and could contribute to additional market volatility as we close out the year. It will be important to remember that, in a historical context, volatility is a normal occurrence and often creates investment opportunities. We believe diversified portfolios tied to long-term strategic investment goals should put investors in the best position to capture opportunities amid a variety of economic outcomes.

Looking for More Investment Insights?

Check out these recent blog posts:

Markets, Interest Rates, and Human Kindness

How Much Should You Have Invested in Gold to Help You Hedge Inflation?

What Does Fed Tapering Mean for Stocks?