Key Observations

- Markets were generally positive in August, despite a tough start to the month as investors wrestled with weakening economic data, geopolitical unrest and global growth.

- Shifting language at the Federal Reserve’s Jackson Hole summit indicated a renewed focus on the employment situation more so than inflation.

- Markets have priced in a first rate cut this month, shifting the question of “when?” to “how much?”

Market Recap

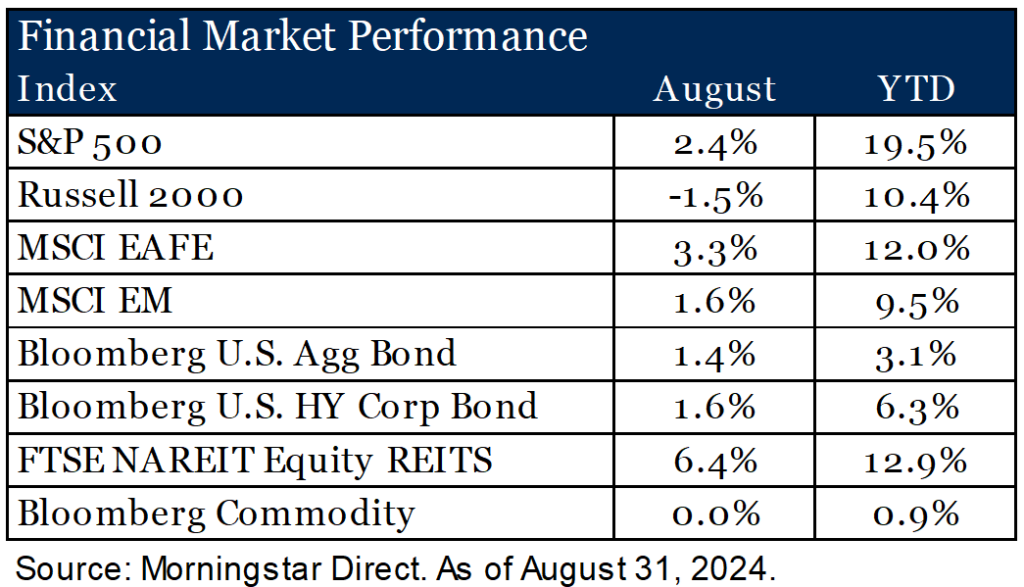

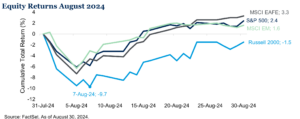

July’s volatility carried into early August as investors navigated the unwind of the Japanese yen carry trade, geopolitical unrest in the Middle East and growing concerns about economic growth following weak ISM and labor market reports. Equity markets initially declined in the first week, with U.S. small caps hit hardest. However, a favorable earnings season and shifting sentiment at the Federal Reserve’s Jackson Hole summit ultimately boosted markets.

Most equity markets finished higher, led by international developed stocks (MSCI EAFE Index), which benefited from a weakening U.S. dollar. The S&P 500 Index (U.S. large cap) also ended the month up, supported by a strong earnings season. With 93% of companies reporting, Q2 blended year-over-year earnings growth for the S&P 500 reached 10.9%, the highest measure since 2021.1 Small-cap stocks (Russell 2000 Index) rebounded but remained just below positive territory for the month.

Interest rates moved lower during the month on improving inflation as U.S. CPI fell below 3% for the first time since March 2021.2 This was a boon for fixed income and other related assets as both high-quality and below-investment-grade sectors of the fixed income market delivered positive returns. REITs were the standout in August, crossing into double-digit return territory on a year-to-date basis. Commodity markets were mixed, resulting in a flat overall return. Metals performed well and were driven by strong demand and a weakening U.S. dollar, while energy prices declined amid uncertainty about global economic growth. Additionally, OPEC’s plans to ease production cuts later this year could create further headwinds for oil prices.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” – Jerome Powell3

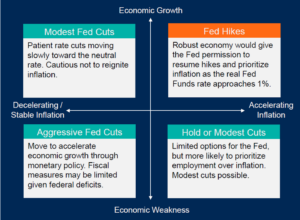

Sentiment shifted at the Federal Reserve’s annual Jackson Hole summit following weaker economic data, including signs of a cooling labor market with unemployment rising to 4.3% and significant downward revisions to previous non-farm payrolls.2 Inflation continues to progress toward the Fed’s 2% target, and markets now anticipate the Fed’s first rate cut will occur at this month’s FOMC meeting, shifting the question from “when?” to “how much?” Whether the initial cut is 25 or 50 basis points, we believe the ultimate direction of interest rates is downward, with multiple paths leading there. The Fed has indicated a willingness to support the labor market if needed. While all scenarios are possible, we believe the most probable outcomes are either cuts based on moderating inflation and economic resilience or more aggressive cuts in response to economic weakness.

Outlook

We expect greater clarity from the Fed on upcoming policy actions, creating a potential tailwind for fixed income assets with several paths for rate cuts. While inflation is improving, recent economic data has been trending downward. We remain mindful that the upcoming election, global geopolitical tensions and unforeseen events may continue to keep market volatility elevated. Diversified portfolios and thoughtful asset allocation to enhance resilience are important as we prepare for the markets ahead.

Listen and subscribe to our Wealthy Behavior podcast to stay up-to-date on the latest on the market, economic and investment news that affects your wealth. If you like what you hear, please leave our show a review on Apple Podcasts or Spotify so we can reach more people like you!

1.FactSet Earnings Insight as of August 16, 2024.

2.FactSet. BLS. As of August 31, 2024.