2022 started with a thud and plenty of market moving headlines. Omicron, inflation and the Federal Reserve, among other topics, weighed on the minds of investors. Most major indexes sold off with some crossing into a technical correction. Additionally, fixed income markets pulled back over the period as investors weighed new information from the Fed. Value stocks took a strong lead ahead of their growth counterparts to start the year. Here’s a quick recap and thoughts on what’s next.

- Many markets entered a technical correction (defined as a 10% pull back or more) in

January as headline inflation reached levels not seen since the 1980s and the Federal Reserve continued to shift its stance, becoming less accommodative. - It is worth noting the level and pace of the pullback year to date is typical. According to data from Fiducient Advisors, the median intra-year draw down in the S&P 500 since 1980 is 9.3%.

- Our 2022 Outlook outlines our expectation for higher volatility and a focus on managing risk.

Outlook Overview

While the 20 trading days in January are a far cry from a full year, our 2022 Outlook is certainly starting off on the right foot. Within our Outlook, we detail our view of volatility ahead and a focus on interest rate risk, among other themes. Here’s an overview of our thoughts on inflation and interest rate risk.

Inflation

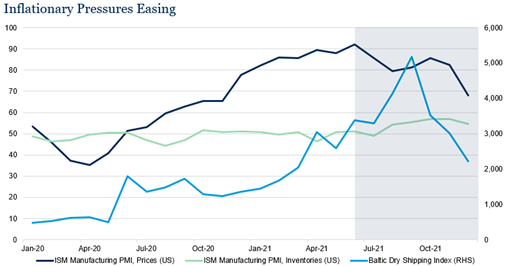

While CPI figures in January were eyebrow-raising and may persist longer than some would prefer, we believe they are unsustainable. A combination of cooling in the red-hot energy market, easing shortages of semiconductors and used car prices, and unkinking of the global supply chain can help moderate headline figures. Early signs of easing can be seen below in the ISM manufacturing data and the Baltic Dry Shipping Index, which moderated from highs in 2021. With that said, we do not anticipate inflation dropping to the 1-2% range we have seen over the past two decades. We fully anticipate a more robust inflation environment in the coming years at 3%+ and believe portfolios should be positioned accordingly.

Source: FactSet as of January 31, 2022

The Fed & Interest Rates

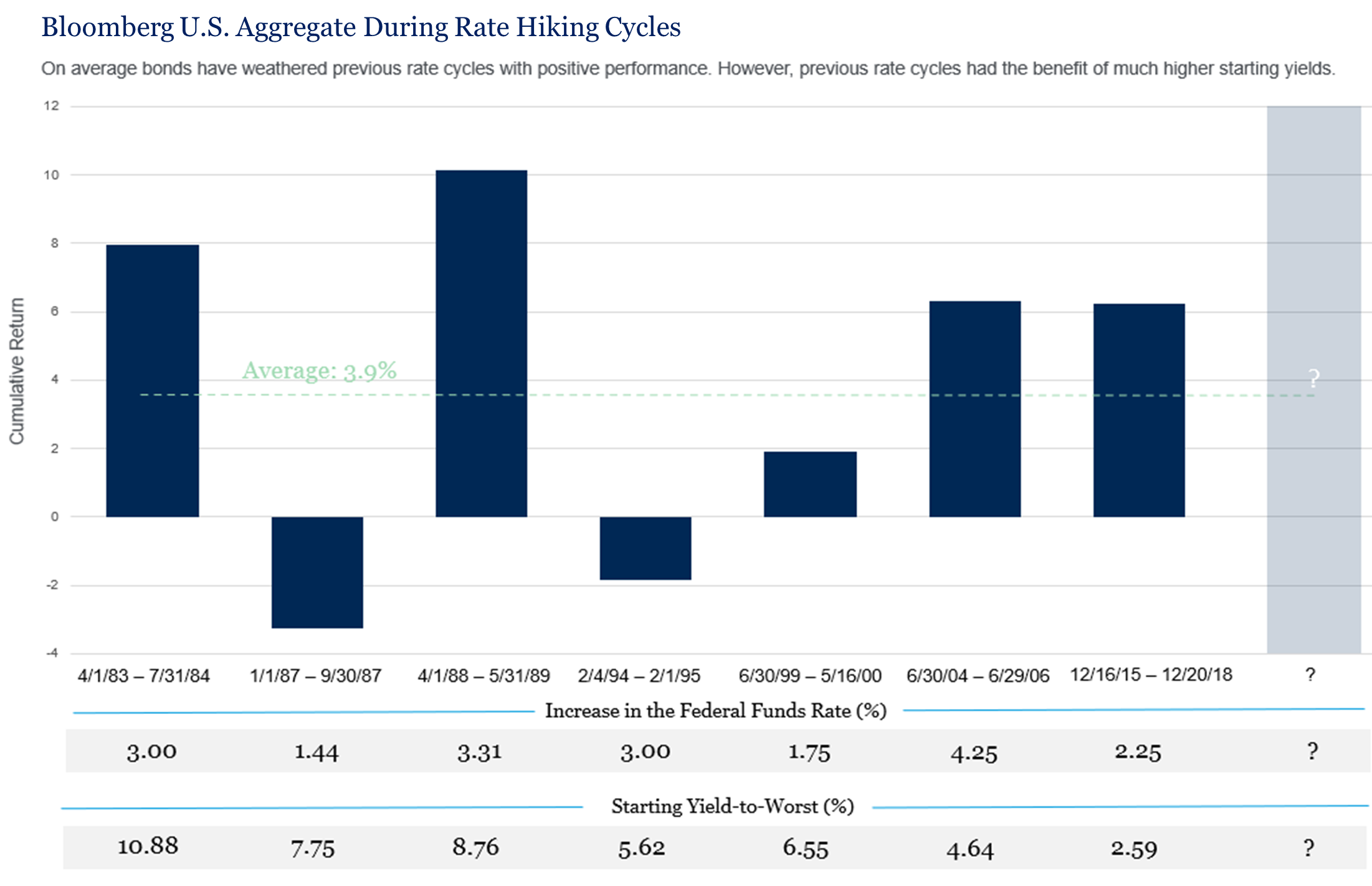

As depicted in the chart below, the Federal Reserve initiated seven cycles of rate increases since April 1983. The average return of the Bloomberg U.S. Aggregate Index over those time periods was 3.9%. However, the average starting yield to worst (YTW) of the index across those periods was 6.7%. As of January 31, 2022, the Bloomberg Barclays Aggregate YTW was much lower at 2.1%.

-

Sources: Capital Group, Bloomberg Index Services Ltd., Morningstar, as of October 31, 2021. Daily results for the index are not available prior to 1994. For those earlier periods, returns were calculated from the closest month-end to the day of the first hike through the closest month-end day of the final hike. Starting Yield to Worst sourced from FactSet and is taken from the start of the month in period displayed.

Overall, we believe the death of bonds is likely overstated. They can still play a critical role in portfolio diversification to control volatility. Read more about that in our recent blog, Why Should Investors Hold On To Their Bonds for the Next 12-24 Months.

That said, investors should consider their current exposures carefully. In our opinion, dynamic bond strategies that include a broader opportunity set and less overall interest rate sensitivity are an important part of a global investment portfolio in the current environment.