The month-over-month inflation reading for December was lower than that of November. But the full year rate of change came in at 7%, higher than any reading in the last 40 years.

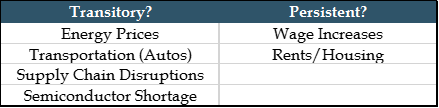

In our recently released 2022 Market Outlook, our Investment Team discussed inflation in-depth. They addressed which inflationary pressures are likely to be with us for the foreseeable future. They also highlighted which ones have a better chance of easing soon.

Inflation: Transitory or Persistent? Both!

“In 2021, inflation was led by rising energy prices, supply chain issues and shortages. Inflation in 2022 and beyond is likely to see these factors subside, but only to be supplanted by persistent recent changes like rising wages and the cost of housing.”

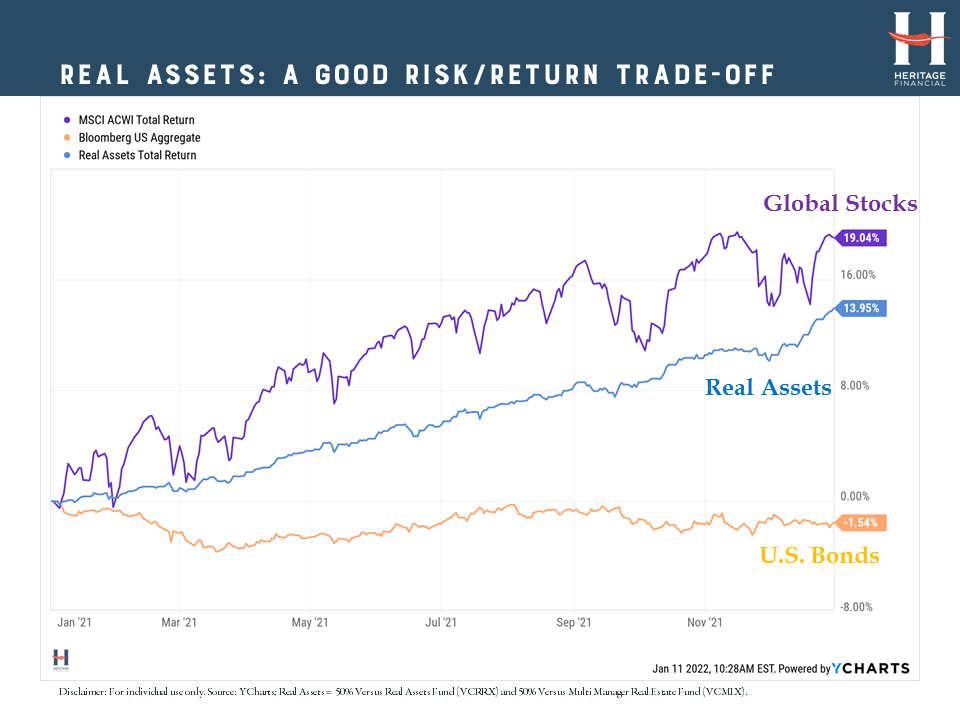

Our team believes that inflation-related assets may be impacted in a number of different ways over the coming year. They recommend broadening exposure to real assets to help guard against the shifting tides and sources of inflation and help maintain long-term purchasing power of portfolios while diversifying away from equity risks.

Real Assets: A Good Risk-Return Trade-Off

An allocation to real assets proved to be a good risk-return trade-off in 2021. The combination of real assets like farmland, timberland, and infrastructure, along with real estate, resulted in a valuable combination of equity-like returns and bond-like volatility.

Hear More About How We Are Positioning Portfolios for 2022

Read our 2022 Market Outlook in full for more insights. And join us on January 25th at 11:00 AM EST for a live discussion about our outlook with our Chief Investment Officer, Bob Weisse. Register here and come ready to ask questions about where we see the best opportunities and how we are managing risk in the current environment. Can’t make it live? Register anyway and we will send you a replay of the discussion that you can watch at your convenience.