We are just past the half point of 2021. This week we are sharing some words of wisdom from several smart investors and our Investment Team’s thoughts on what to expect for the second half of the year.

Turn Off the TV

Given the somewhat wild ride in the stock market last week, it’s a good time for a reminder about intra-year declines. Sammy Azzouz, President of Heritage Financial says:

“You have to expect annual double digit corrections every year as a stock market investor and learn not to overreact to them.”

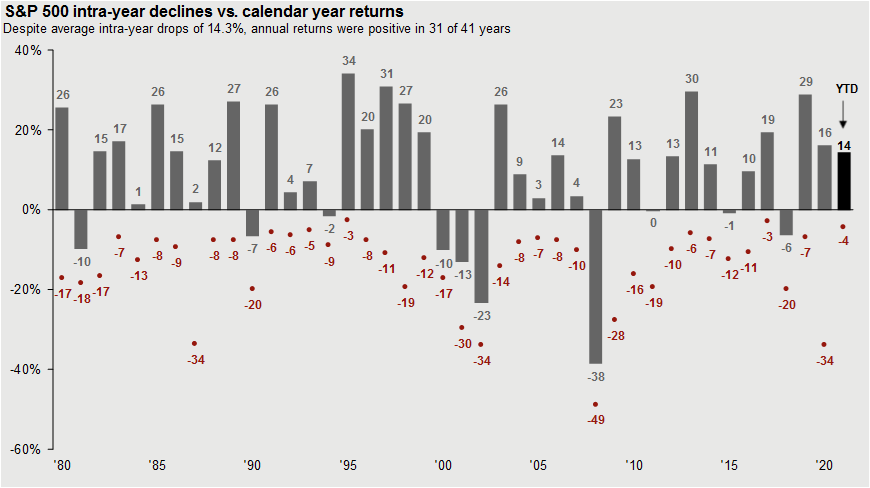

Last Monday’s decline wasn’t even close to double digits. But it could have easily been the start of one. You can’t get rattled when the business news channels are flashing red. Remember, on average the markets experience an annual decline of 14.3% (see chart below). And declines of 5-10% happen on average about three times a year.

If nothing has changed with respect to your long-term plan, the best course of action is to simply turn off the TV and stay the course.

Do You Think the Price You Pay Matters?

We are all a bit price sensitive these days as we see the cost of things from groceries to cars on the rise. The truth is that for most of us, price does matter. All else equal, we’d rather pay less.

According to Wes Crill, Head of Investment Strategies at Dimensional Fund Advisors, there is good news for long-term investors like Heritage Financial that care about what they pay for stocks. In a recent Financial Times article, Wes stated:

According to Wes Crill, Head of Investment Strategies at Dimensional Fund Advisors, there is good news for long-term investors like Heritage Financial that care about what they pay for stocks. In a recent Financial Times article, Wes stated:

“As long as you believe how much you pay for an investment has an effect on return, then the expected (value) premium is always there.”

Said a different way, value investing is a strategy that should pay off in the long-term.

In the article, Wes also comments on the dramatic outperformance of small cap value relative to large cap growth over the six months ending March 31, 2021. Turns out the 63% six-month outperformance of small cap value was the largest on record since 1943.

We’ve talked a lot about the likelihood that value stocks and small cap stocks typically outperform at the beginning of an economic cycle. This time is no different. The similarities between 1943 and 2021 will be of interest to history buffs. In both periods, war time optimism was the driver of small cap value outperformance.

- 1943 and optimism related to Allies gaining an upper hand in World War II

- 2021 and the world gaining an upper hand in the war against COVID-19

You can read the full article via this link on DFA’s website.

What Should Investors Expect for the Second Half of 2021?

Heritage Financial has just published our Mid-Year Outlook. You can access it here. We’re reviewing the current state of the markets with respect to economic growth, monetary and fiscal policy, and inflation. And we’re updating our outlook for several investing themes we identified at the beginning of this year, including:

- Investing in the Wake of the Pandemic

- Opportunities in a Low Interest Rate Environment

- The Case for Global Equity Exposure

- The Opportunity in Real Assets

Read our full 2021 Mid-Year Outlook to get a feel for how your portfolio is positioned relative to the themes that are currently moving the markets.

If you aren’t currently a client of Heritage Financial, we can still help. Remember that a full assessment of your current investment portfolio is part of our signature Three-Meeting Process that we undertake with qualified prospective clients. This process is complimentary. It gives both parties a chance to see what it’s like working together and assess whether we would be a good fit. Learn more about that process here. And if you are interested in getting the process started, contact us.