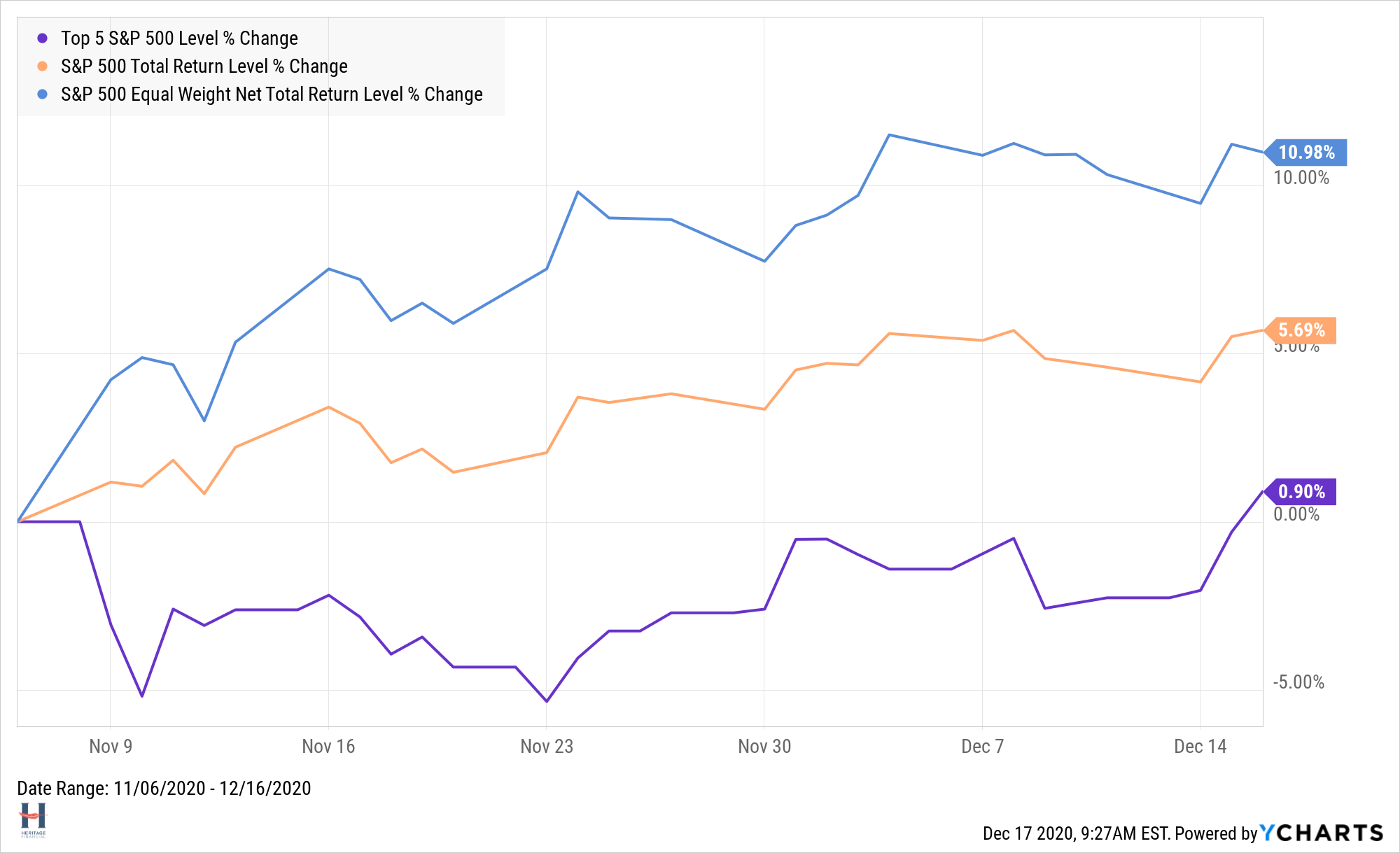

On 11/9 the first significant news about a soon-available coronavirus vaccine hit the headlines. Since that time, we’ve seen stellar performance from equity markets, but a dramatic shift in the driver of stock market returns.

No longer is Big Tech the only winner. (In the above chart, Top 5 S&P 500 includes Apple, Microsoft, Amazon, Facebook and Google.) As we mentioned in our 9/22/20 blog post titled “The Lie Staring Us Right In The Face”, it was pretty much the largest tech stocks that were performing well, while the average stock was struggling.

No longer is Big Tech the only winner. (In the above chart, Top 5 S&P 500 includes Apple, Microsoft, Amazon, Facebook and Google.) As we mentioned in our 9/22/20 blog post titled “The Lie Staring Us Right In The Face”, it was pretty much the largest tech stocks that were performing well, while the average stock was struggling.

But all of that has changed.

Since November 9th, Big Tech has underperformed the average stock. And the Equal-Weighted S&P 500 has outperformed the traditional market cap weighted version of the benchmark. The “average” stock is doing better than Amazon and Facebook.

What does this tell us about market returns in 2021? Nothing is for certain, but a few things are clearer now:

Those large tech stocks are not the only game in town.

It seems that way. After all, what else do we have to do but stay at home and use our computers to search for stuff to buy online? But if you have built your nest egg around big tech, now’s the time to realize that it’s not a sound long-term strategy on its own.

Previously ignored value and small cap stocks will have their day in the sun…

…once the global economy resembles something close to normal. Don’t ignore this sneak peek of the future that the market is sharing with us. There is a well-documented history of value and small cap stocks outperforming over the long-term in both U.S. and international markets. Serious investors will want to have an allocation to these segments of the market.

Diversified investors will eventually be rewarded.

That hasn’t been the case for the past several years, as U.S. large cap growth stocks have outperformed every other segment of the market even before the start of the pandemic. But changes in leadership – which areas are performing best – are a common result of a change in cycle. And the pandemic changed the economic cycle (from expansion to recession) and the market cycle (from bull to bear and now back to bull again).

We will likely look back at some point and see that the pandemic was also the catalyst that shifted the growth/value cycle, the small cap/large cap cycle and even the domestic/international cycle.

Yes, change is (very likely) coming.

Think you need to review your overall portfolio diversification in the face of this shifting landscape? Let’s Talk.