You hear it every day if you are paying attention to the news. Your neighbors and coworkers are likely talking about it (over Zoom, of course). And, if you are being honest with yourself, you probably believe it’s true.

The Stock Market Is on Fire!

(Yes, even despite this recent volatility.)

We are witnessing what is being called the quickest bear market recovery in history. But are things really true if they are only partly true? The reality is that:

- SOME stocks are on fire.

- SOME stocks are continuously hitting new highs.

- The “average stock” is not.

And let’s be clear…that means MOST stocks are not.

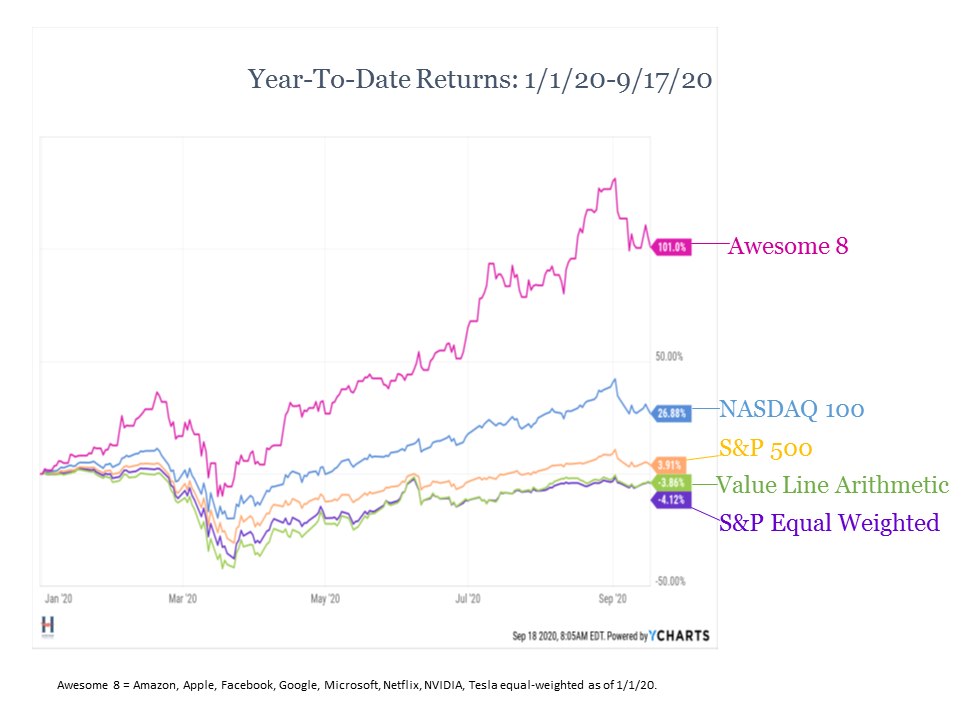

We picked this chart (adapted from BCA Research) as our “Chart of the Month” because it says a lot in just one glance.

We picked this chart (adapted from BCA Research) as our “Chart of the Month” because it says a lot in just one glance.

- Stocks are indeed well off the lows they hit in the depths of the COVID-19 pandemic. Yes, this is great news.

- However, even just within the U.S. large cap stock universe, different indexes tell a contrasting story about how robust the price recovery has been. This requires caution.

- There is a small handful of stocks (the “Awesome 8” in this chart) that have performed much better than the “average” stock, represented by the equal-weighted S&P 500 Index and the Value Line Geometric Index. This is where the full truth comes out.

Why does the truth matter?

Because when we don’t have the full truth, we sometimes make decisions that we otherwise wouldn’t. Here’s the top mistakes we see investors make in these situations:

1. Get frustrated. You hear all this great news, look at your own portfolio’s returns, and get frustrated that your returns aren’t as great as what you are hearing about.

2. Chase returns. You start looking into what changes you can make to your investments to get the same great returns you keep hearing about.

3. Go all in. You start to concentrate your portfolio in the stocks, industries, or sectors that are the source of these great returns.

Here’s a headline that you’ll want to pay attention to:

When a lot of money starts chasing the same ideas, it’s typically a good sign that those ideas are not going to be good for much longer.

So, if you’ve felt tempted to do any of the above, we suggest you follow the plan that serious investors take.

- Revisit your long-term financial plan to confirm your goals and time horizon. If nothing has changed with your plan, don’t make changes to your investments.

- Take advantage of diversification. It’s a free tool for managing risk and it’s a winning strategy over the long-term.

- Make sure you are working with a fiduciary. At Heritage, we have a fiduciary responsibility to act in your best interest. Our globally diversified portfolios are evidence of that commitment.

Have additional questions about this topic? Want to know more about working with an independent fiduciary like Heritage Financial? Let’s Talk.