The Covid-19 pandemic is without question the defining event of 2020. Right?

After all, it’s a “once in a generation” event that took a human and economic toll that was unimaginable to many just a year ago.

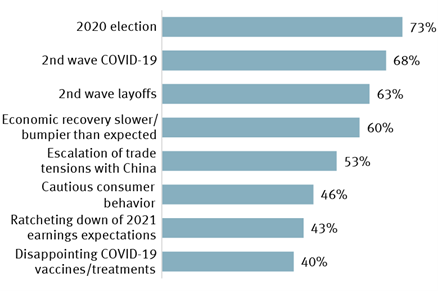

So, you might be surprised to hear that coronavirus is NOT what investors are most afraid of this year.

No, institutional investors are more worried about the upcoming Presidential election in the U.S. than the potential for a second wave of COVID-19.

Said differently, a regularly occurring, once-every-four-years, country-specific event is more concerning to smart investors than a once-in-a-lifetime global pandemic.

If you caught last week’s Presidential Debate, you know why.

To say it was contentious is an understatement. To be worried that the outcome of the election might still be undecided come November 3rd is justified.

Markets despise uncertainty.

Uncertainty leads to volatility.

Volatility can be unnerving.

As we wrote to clients in our most recent quarterly commentary:

“Volatility is not itself a dangerous thing. For long-term investors, volatility creates opportunities. It is what allowed us to buy into stocks at very attractive levels during the depths of the bear market earlier this year. However, volatility becomes dangerous when investors take their eye off long-term goals.”

Here’s our advice to serious investors that want to successfully navigate the volatility that may be with us even after November 3rd.

- Don’t adjust your portfolio based on who you think will win. Historically, the political party in power does not by itself have a meaningful impact on long-term returns. Fidelity has a great article on why the economy and corporate earnings will always be more important drivers of future returns.

- If you have cash to put to work in the markets, don’t let the potential for market volatility keep you on the sidelines. A silver lining of market volatility is that buying stocks at a lower price generally equates to better future return potential. Read more about using a systematic approach to moving off the sidelines so you can potentially take advantage of buying in low.

- Don’t get out of the market just to shield yourself from volatility. This article from DiMeo Schneider & Associates reminds us that “some of the market’s best days happen during periods of heightened uncertainty”. This study by Putnam shows that missing the best 10 days of market performance for the 15-year period ending 12/31/19 would have reduced your total return by nearly 5%.

Serious investors stay focused on the long-term because they have a detailed financial plan that keeps them grounded during periods of market uncertainty.

Are you comfortable with your long-term financial plan? Let’s Talk.