A Look Back

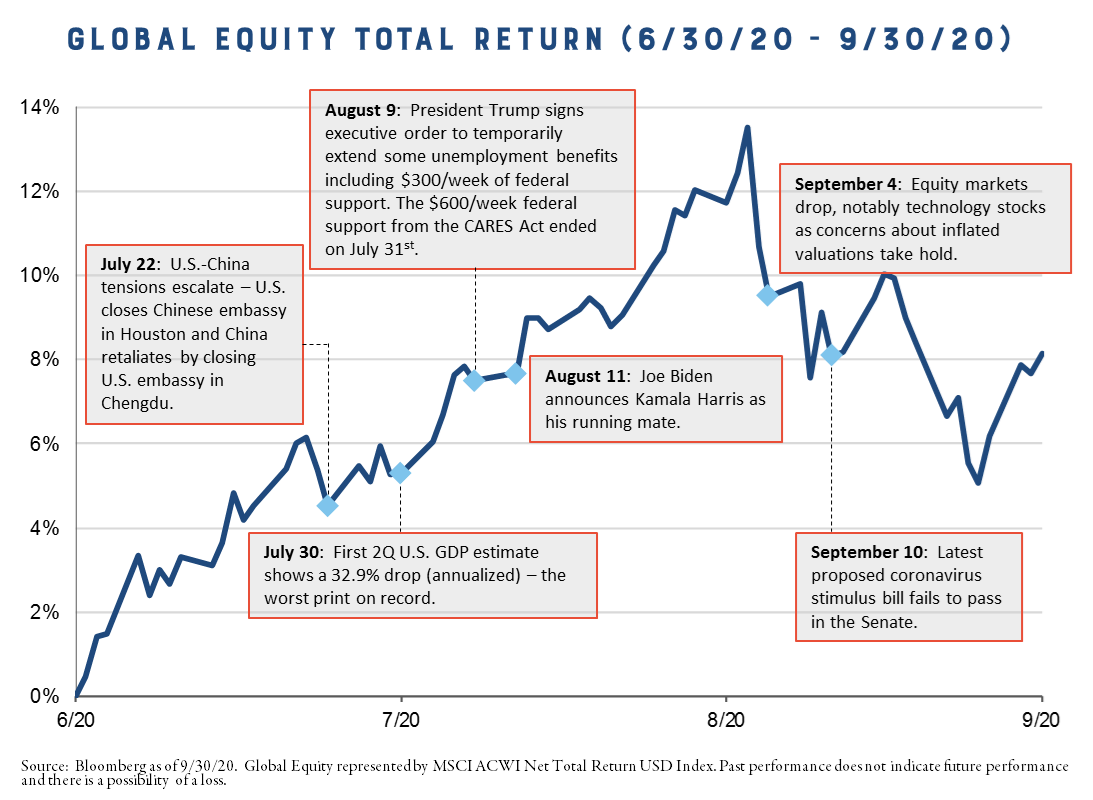

- Second quarter GDP as reported by the Bureau of Economic Analysis came in at a painful (but expected) -32.9% advanced annualized estimate. While it’s an extremely bad report, it was expected, and most economists anticipate that economic activity will rebound now that we know more about the virus and that full lockdowns have been lifted.

- Stocks were up for the quarter, but expectations for another round of fiscal stimulus appeared to fade quickly in September, which led to increased equity market volatility.

- U.S. stocks (8.9% return for the S&P 500) continued to outperform developed non-U.S. stocks (4.8% return for the MSCI EAFE). Within the U.S., growth stocks once again outperformed value stocks, and large caps performed better than small caps. Emerging market stocks finally gave U.S. large cap growth some competition, with the MSCI EM Index returning 9.6% for the quarter.

- The U.S. Federal Reserve announced a new inflation targeting policy that will, effectively, keep rates lower for longer. The U.S. yield curve moved very little during the third quarter. Fixed income returns were largely flat except for high yield bonds.

Moving Forward:

- Current estimates for 3Q GDP growth are around 30% annualized, with the first estimate of the reading due out in October.

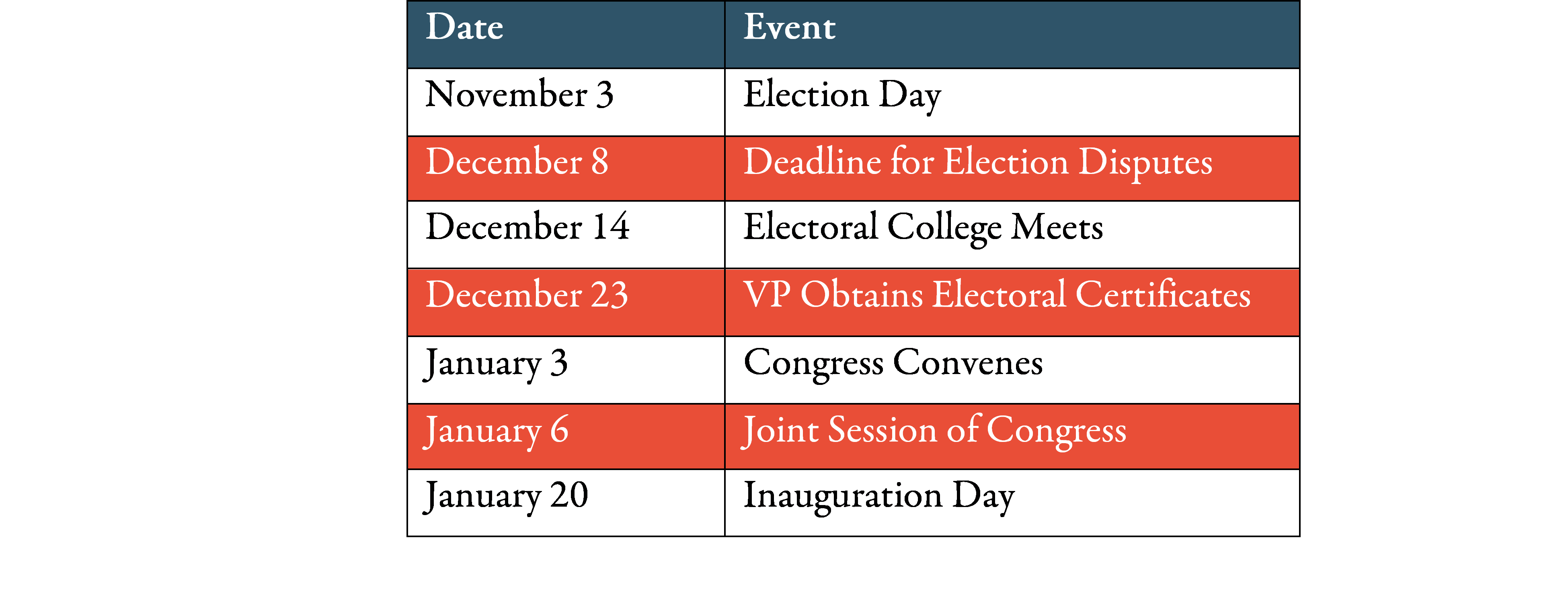

- The U.S. election continues to dominate investor conversations as the expectation that neither candidate will concede a close race sets in. While November 3rd is Election Day, the deadline for election disputes is December 8th. Volatility in stock markets can be expected to persist for as long as uncertainty does.

The economic outlook will remain murky given uncertainty around the virus, additional fiscal stimulus, and U.S. politics.

The economic outlook will remain murky given uncertainty around the virus, additional fiscal stimulus, and U.S. politics.

There are two things that serious investors have in their favor when navigating uncertainty like this:

1. A detailed, long-term financial plan

2. A candid relationship with their wealth manager

…both of which act as guardrails to keep you on track when uncertainty creates too much volatility.

At Heritage, these keys are built into our three-meeting process with prospective clients. We put together a financial plan for you and give you an opportunity to road-test working with us before you even hire us. Why? Because planning and rapport matter, in good times and bad, but particularly during uncertain times.

Curious to learn more about taking a test-drive with us? Let’s talk.