A Look Back:

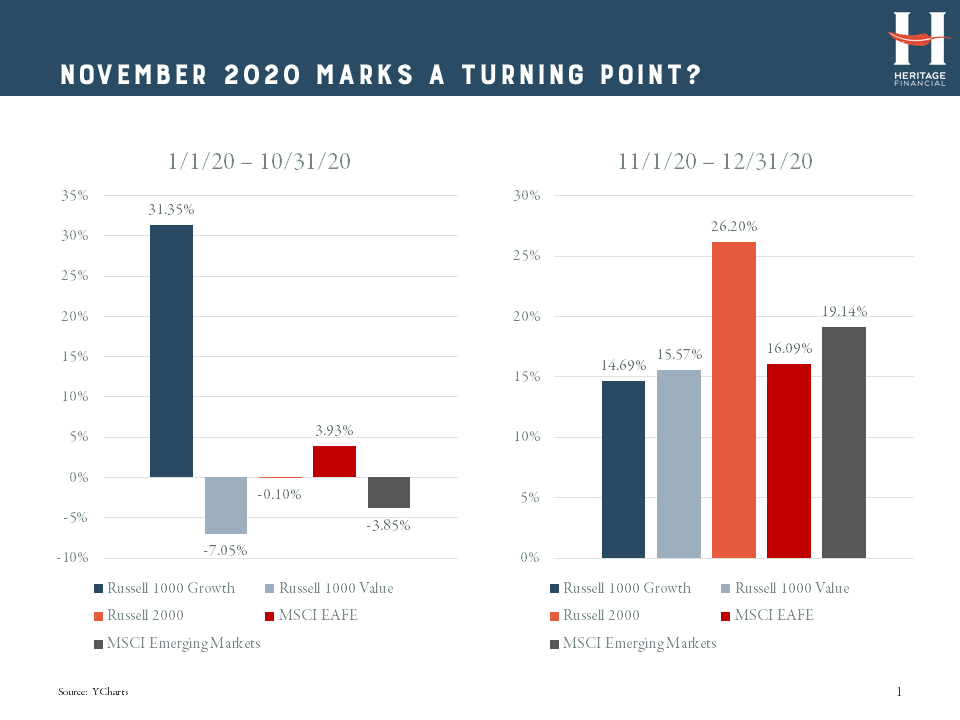

For equity investors, the fourth quarter of 2020 will be remembered as a turning point in the global market recovery.

2020 was a remarkable year for stocks. After hitting new highs early in the year, market prices fell dramatically in the face of a global pandemic, then started a strong recovery just a month or so later. While news of more potential economic lockdowns and a second strain of the virus were in the headlines as the year came to a close, stocks still posted double-digit gains for the year.

For diversified investors, however, it was the fourth quarter of 2020 that was the most exciting.

Prior to then, it was pretty much just U.S. large cap growth stocks that were seeing sustained gains. But news of several effective vaccines in early November opened the door for stocks of companies that were still being impacted by the pandemic (airlines, travel, restaurants) to also begin participating in the rally more consistently.

Prior to then, it was pretty much just U.S. large cap growth stocks that were seeing sustained gains. But news of several effective vaccines in early November opened the door for stocks of companies that were still being impacted by the pandemic (airlines, travel, restaurants) to also begin participating in the rally more consistently.

Moving Forward:

If we believe that we are closer to the end of the pandemic than the beginning of it (which we do), then it is realistic to anticipate a continuation of the type of market rally we saw in the fourth quarter – one that is broad in nature, including stocks across market caps, styles and geographies.

Remember, value stocks and small cap stocks typically do well early in an economic recovery.

Does this mean U.S. large cap growth stocks are done with their run? Not so fast. While the tailwinds that have been in place for stay-at-home stocks like Netflix, Google, Facebook and Microsoft may not be as strong as the economy opens up more going forward, it is difficult to argue against the strong presence these companies have in our day-to-day lives, pandemic or not.

But it does favor the outlook that the rally will likely be much broader in scope going forward.

At Heritage, we believe that global diversification is key for long-term investors. The good news is that international stocks are cheaper than U.S. stocks and, particularly in light of the strong run in U.S. tech stocks over the past year, value stocks are less expensive than growth. We believe it’s a good time to have diversified exposure to caps, styles and geographies right now.

As has been the case for a while now, fixed income returns are tough to come by. Rates are low and more likely to go higher than lower (and when rates rise, bond prices fall). And the return potential that typically comes with narrowing credit spreads after an economic shock is, for the most part, already behind us. With rates where they are, there is little incentive to invest in longer maturity bonds – investors simply aren’t being compensated for that risk.

We continue to position our clients in:

• Globally diversified equity portfolios, with an emphasis on value and small cap in anticipation of a continued broadening of the economic recovery.

• Shorter-term, high quality fixed income in structured product sectors where yields are more generous relative to similar risk profile U.S. treasuries.

• Alternative investment opportunities including reinsurance, infrastructure, private credit and, for qualified investors, private equity and real estate.

Wondering if your portfolio is positioned to best take advantage of the next phase of this market and economic recovery? Let’s Talk.

At Heritage, providing an initial assessment of your portfolio is an important step in our 3-Meeting Process that we complete with any interested and qualified potential client BEFORE you sign on with us. It’s how you can test drive our services, and how we make sure that we will be a good fit for you and your long-term goals.

Interested in learning more about our 3-Meeting Process? Click here to get started.