Should you own international stocks?

Serious investors will always have an allocation to stocks of companies outside of the U.S. After all, the U.S. represents less than 25% of total world GDP. And nearly 80% of the publicly traded companies in the world are foreign companies. Even accounting for size, U.S. companies make up just over half of the market cap of public companies.

But beyond this basic argument for diversification, there’s something that that makes international stocks pretty attractive at this point in time. And it has everything to do with the TYPE of companies that can be found in non-U.S. markets.

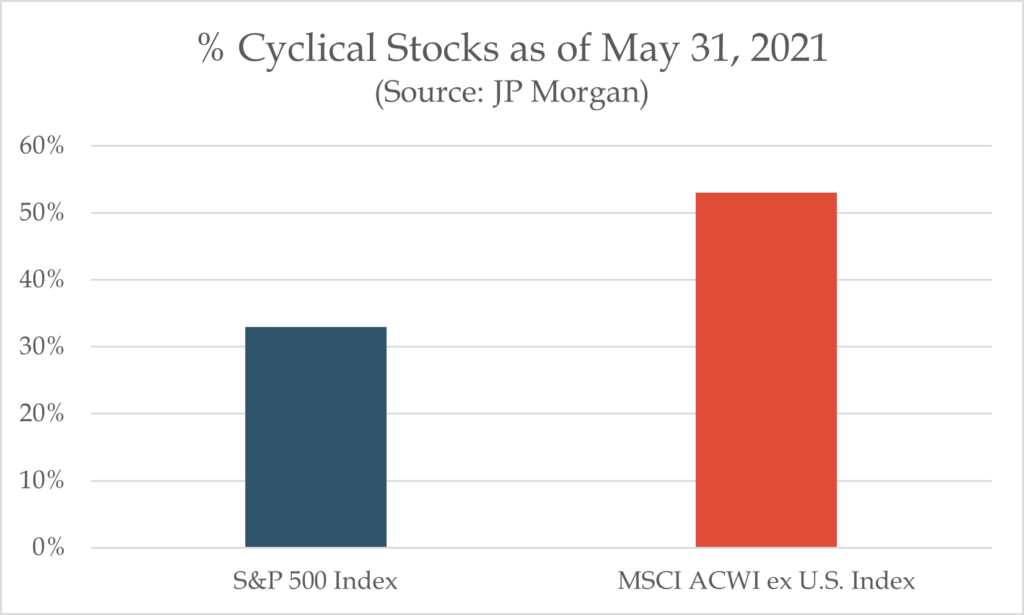

More than half of the stocks in the MSCI All Country World excluding U.S. benchmark are considered cyclical stocks. That compares to less than 35% of stocks in the S&P 500 Index.

More than half of the stocks in the MSCI All Country World excluding U.S. benchmark are considered cyclical stocks. That compares to less than 35% of stocks in the S&P 500 Index.

Why does this matter?

Cyclical stocks generally follow the economic cycle, and so they tend to perform well during an economic recovery. Industrial stocks like airlines and automakers that benefit from expanding demand are good examples. So are financial stocks, as interest rates generally rise during an expansion. (That hasn’t really happened yet – read more about what’s next with interest rates here.)

But wait, hasn’t the recovery already unfolded?

The global recovery from COVID has been uneven. While the U.S. has had several quarters of positive GDP, both Europe and Japan saw GDP contractions in the first quarter of 2021.

This could be related to vaccination rates. Less than 20% of the total population of Japan is fully vaccinated. Across Europe, the countries of France, Germany, Italy, and Spain have vaccinated roughly 35-45% of their populations, with much of that progress happening only during the last few months. In contrast, the U.S. vaccination rate is nearly 50% according to the CDC.

Market returns also reflect the slower recovery outside of the U.S. While the S&P 500 was up more than 15% year-to-date through June, the MSCI EAFE index was up just under 9% (Source: YCharts).

Let’s be clear – a 9% return for stocks over a six month time period is above what any long-term investor should get used to. It’s really the relative difference that’s telling a story here. And that story is that investors have thus far been less confident of the recovery outside of the U.S.

That’s likely to change, and with more economically sensitive companies in foreign markets, you can see how that relative difference in returns could compress pretty easily over the coming months.

But there’s more

Yes, the composition of the equity markets outside of the U.S. is favorable for an unfolding economic recovery. And yes, rising vaccinations rates particularly in Europe are triggering a broader reopening. Just last month Europe announced that it’s once again open for business from a tourism standpoint (here’s a guide to what’s open where in Europe).

But if you are like us and you like to get a good deal, the price of international stocks is just another reason that this area of the market is attractive for long-term investors. According to JP Morgan, international stocks are about 25% cheaper than U.S. stocks.

Being Selective is Still Important

Investing in foreign markets is different than investing domestically. History has shown that international markets are just less efficient when compared to the U.S. market. And that simply means there is more chance for reward (returns well above the benchmark) and risk (returns well below that of the benchmark) when investing in international stocks.

How do we account for that?

- Respect the golden rule of diversification. Clients of Heritage have an allocation to international stocks when appropriate for their investment objective and financial plan.

- Adjust as needed. We allow latitude to adjust our overall allocation to international stocks over time based on shifts in our long-term investment outlook or near-term risks and opportunities.

- Work with active managers. At Heritage, we believe that the less efficient the market, the more active we want to be in our investment approach.

At Heritage Financial, we have more than 25 years experience building diversified portfolios for serious investors. As a wealth manager based in Westwood, MA, our mission is to make a difference in the lives of those we work with. If you want to learn more about how we can help you build a financial plan to meet your long-term goals, contact us here. You can learn more about our investment process here.

And if you liked this post, here are a few more that you might want to read:

An Investment Guy’s Review of Solar Panels