Last fall, one of my social outlets was joining a few friends to sit around a firepit and talk about what my kids would call “boring stuff”. We have different backgrounds and work in different fields, so I enjoyed hearing diverse perspectives.

One night we talked about solar panels.

The case I heard for them was:

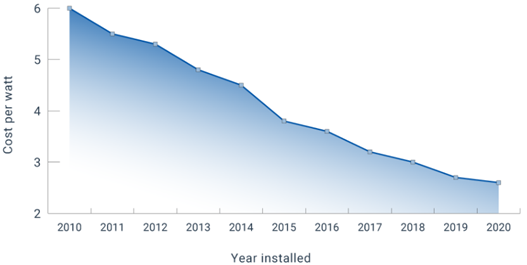

- Costs have come down dramatically over the last ten years.

- Federal tax incentives are strong.

- Massachusetts has one of the best incentive programs in the country.

- The earth only has about 50 to 100 years of fossil fuels left.

I have heard some of these points before, but hearing it all strung together resonated with me. With this catalyst I did some research.

Costs have come down.

In addition to a reduction in component costs, panel efficiency has increased.

The federal solar tax credit is currently 26%.

This is not a deduction but rather a credit, meaning 26% of the cost to install the system is a direct offset to your tax liability.

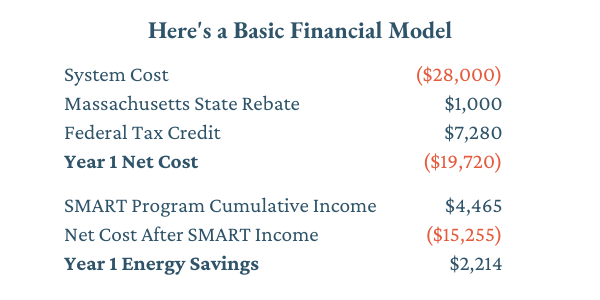

The state of Massachusetts has two incentives.

The first is a rebate of $1,000 or 15% of the project costs, whichever is less.

The second is the Solar Massachusetts Renewable Target (SMART) Program. Through the SMART program customers receive quarterly payments based on the amount of energy their system produces for 10 years. For example, a system that produces 9,000 kilowatt hours (kWh) per year at a SMART rate of $.08 would receive $720 per year with payments ending after 10 years.

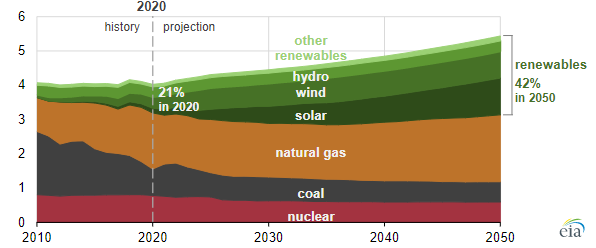

Regarding climate change, there are two definitive truths.

Fossil fuels are a finite resource. Whether we have enough to last my children’s lives or my future grandchildren’s lives, the point is we will run out if we do not shift to other forms of energy generation.

Burning fossil fuels and emitting greenhouse gases is damaging to the environment. It is having consequences today and those will only grow in the future if we do not change. Solar power is expected to be one of the growing sources of power generation to reduce our consumption of fossil fuels.

So, are solar panels a good investment?

Being an investment guy, I answered this question by creating a basic financial model, calculating the breakeven point and return on my investment over time, and compared that to other investments I could make (e.g., stocks, bonds). Here’s a look at that analysis.

Important disclosure about my assumptions for this model:

Important disclosure about my assumptions for this model:

Model assumptions: System: 10,000 kW system, 90% production yield (9,000 kWh year 1) and .67% annual system degradation. Electric rate: $.246 electric rate with an annual 2% increase. SMART program: $.083 credit taxed at 30% and a 3% discount rate for SMART program income in years 2 through 10. $4,465 is the after-tax present value of SMART plan income received in years one through ten. The modelling above is based on an Eversource customer in eastern Massachusetts. Within Massachusetts, the SMART program only applies to customers of Eversource, National Grid and Unitil and the incentive rate varies per utility. Residents who have local municipal utility providers may be still eligible for incentive programs.

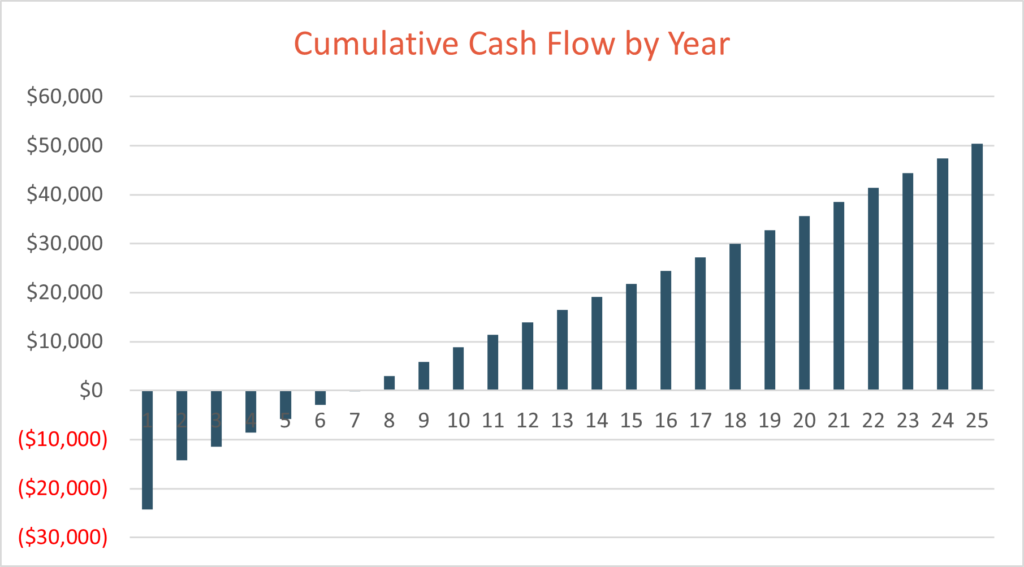

Approximately 46% of the system is paid for by tax credits, rebates and incentives. In this example, the net system cost is $15,255 and that offsets annual electric costs starting at $2,214 in year 1. The breakeven is around seven years.

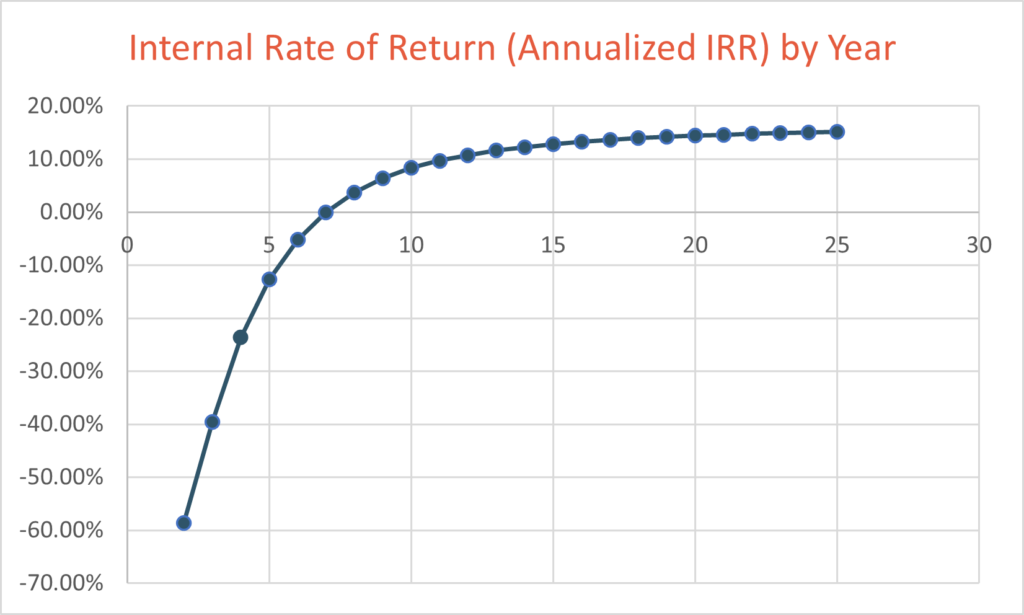

In the chart above, you can see with solar panels, time is your friend. The longer you are in the house owning the system, the better your return will be. Most quality solar panels are guaranteed to produce around 90% of their original production value for 25 years.

In the chart above, you can see with solar panels, time is your friend. The longer you are in the house owning the system, the better your return will be. Most quality solar panels are guaranteed to produce around 90% of their original production value for 25 years.

When compared to traditional stock and bond investments, the return starts to look attractive around year 10 and beyond. In year 10 the annualized return is 8% and it increases each year. Unlike most investment returns, this is tax free. You do not get taxed on not having an electric bill!

Are solar panels right for you?

There are many considerations, but the big three are:

Do you plan on staying in your home for at least seven years, and ideally 10 years or more?

Do you have a roof where you are comfortable putting panels that gets good sun exposure?

Is your roof in good condition?

If you would like to learn more about solar, here are some suggested steps:

- Check your house on Google Project Sunroof to get a sense of how viable your roof is for solar panels.

- Get at least three quotes from reputable solar installers. Ask your friends and neighbors for recommendations and read reviews of installers on sites like https://www.solarreviews.com/. Your choice of an installer is critical to your experience. If you need a nudge on the environmental side, or are just curious and enjoy data, you can see an estimate of your household carbon footprint using the carbon footprint calculator provided by the EPA.

And lastly, if you have a broader interest in investing in a way that promotes your environmental values while still maintaining attention to risk management and return objectives in your portfolio, you can watch a replay of our Sustainable Investing webinar that we hosted last month or reach out to us directly to learn more.