Today’s housing market is absolutely a “seller’s market”. Demand is strong. Supply is weak. So the seller has all of the leverage.

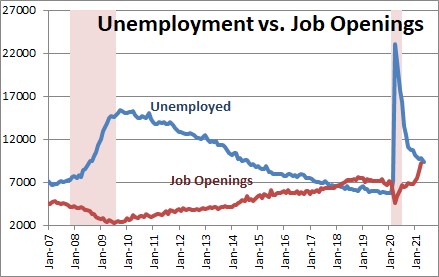

Our chart of the month shows a completely different supply and demand story in the job market.

Supply is abundant

The April Job Opening and Labor Turnover Survey (JOLTS) released in June came in at its highest reading since the start of the survey back in December 2000. There are currently 9.28 million job openings in the U.S. That’s 1 million more than just last month, and 4.7 million more than last year at this time. Clearly, the economy is reopening.

But demand is weak

The latest unemployment reading came in at 9.31 million. With so much unemployment, you would think demand for jobs would be high.

What the chart above shows, amazingly, is that there are just about enough jobs open for every person that is unemployed. But these jobs are still unfilled.

There are ample theories about how we can still have such a large number of unemployed when there are so many jobs open. Lingering COVID fears. Lack of child-care keeping parents at home. Continued unemployment benefits. And a mismatch of job requirements with the skills of the unemployed. All of these are likely playing a role to some extent.

But with so many jobs open, those that are in the workforce have the leverage. If they aren’t happy with their current situation, it’s easy to pick up and go find a job elsewhere. The Bureau of Labor Statistics (BLS) also tracks quit rates – how many people have quit their job during the month. This is also at a high since the BLS started tracking it. And it’s proof of the leverage that employees have over employers in the current market.

Sellers having leverage over buyers in the housing market has led to higher prices. Employees having leverage over employers in the job market is leading to higher wages.

Higher wages are good, right?

For employees, of course. But there are broader implications.

Wages are a cost for businesses. If costs go up, profitability declines, unless those cost increases are pushed through to the consumer, which means higher prices for goods and services.

Higher wages and higher costs for goods and services is why there is so much discussion these days about inflation.

As we recently wrote to our clients in our Second Quarter Investment Commentary:

“Our team views unexpected inflation as a risk to take seriously.”

There are many factors that point to current inflation forces being temporary. Pandemic-related unemployment benefits are suspended now for about half the states in the U.S. They are expected to be fully suspended by September. Hopefully, schools will be back to normal by then, leaving parents able to return to work.

But while it’s easy for businesses to lower the price of their goods and services at some point in the future, it’s harder to decrease wages across the board. So we have to be prepared that some prices increases may be with us for a while.

At Heritage, we’ve positioned our clients’ portfolios for the risk of unexpected inflation. Read our special Update on Inflation to learn about the four key tools we are using to protect our clients’ long-term financial plans against the erosion of purchasing power that comes with inflationary periods.