Everyone is talking about the likelihood of inflation. We first started to hear concerns when the U.S. Federal Reserve Board (“the Fed”) responded to last year’s pandemic recession by lowering rates and injecting liquidity into the economy. To be fair, it was the same concern that was raised the last time the Fed lowered rates after the Great Recession. But inflation never materialized once the economy recovered.

Is there reason to be worried this time?

What happens with inflation and, subsequently, interest rates and market returns, could impact your overall financial plan. And so, it’s worthy of a deep dive. Below, we outline what’s currently happening with consumer prices, the forces at play that are causing concern, and whether those concerns are warranted. Most importantly, we share four tools we are using to address inflation concerns in our clients’ portfolios.

First, What’s Really Happening?

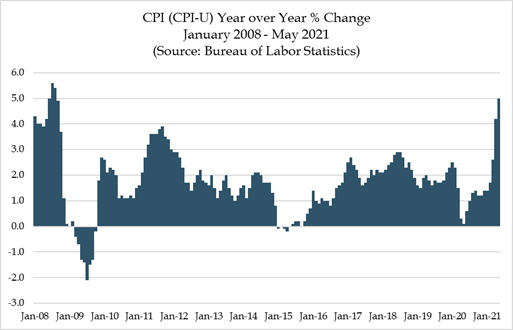

Let’s look at the numbers. The year-over-year change in the Consumer Price Index (CPI) was 4.2% in April. The CPI measures the price of a basket of consumer goods monthly and is the most widely cited benchmark for inflation. This 4.2% increase over last year’s prices was the largest jump in inflation since September of 2008, so stock and bond markets took notice.

What we saw from the detail of the April report on CPI was that energy (+25% year-over-year) and used automobiles (+21% year-over-year) were some of the biggest drivers of rising prices. In May, the year-over-year reading was even higher, at 5%.

What we saw from the detail of the April report on CPI was that energy (+25% year-over-year) and used automobiles (+21% year-over-year) were some of the biggest drivers of rising prices. In May, the year-over-year reading was even higher, at 5%.

Rising Prices Are Bad, Right?

Surely, we would all prefer to pay less for things, not more. As value investors, we certainly agree with that statement! But while the magnitude of the April and May CPI figures seem concerning, it helps to put some context to the numbers.

While we all want to forget much of last year, it’s important to remember that prices for many products and services were depressed at this time last year (excluding toilet paper, of course). We were just a few months into the pandemic. World economies had shut down. Demand had fallen off a cliff for most things except Netflix.

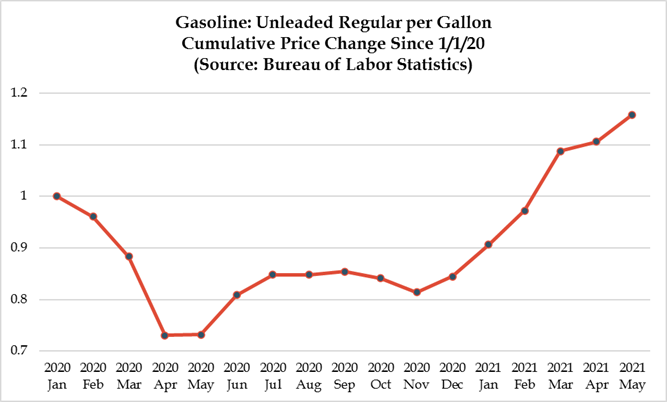

Remember how we all suddenly stopped driving? Gasoline prices fell in response to sudden and dramatic lower demand. One year later, the global economy is well on its way to reopening. Demand is once again rising, and prices for things like gasoline have increased. So yes, gas prices are up meaningfully since this time last year. But that 12-month price change is more of a story about what was happening to prices last year than this year.

The bottom line is that the current strength of inflation is being driven – in part – by the reality of artificially low prices that we were experiencing last year at this time.

The bottom line is that the current strength of inflation is being driven – in part – by the reality of artificially low prices that we were experiencing last year at this time.

Prices Rising: A Variety of Causes

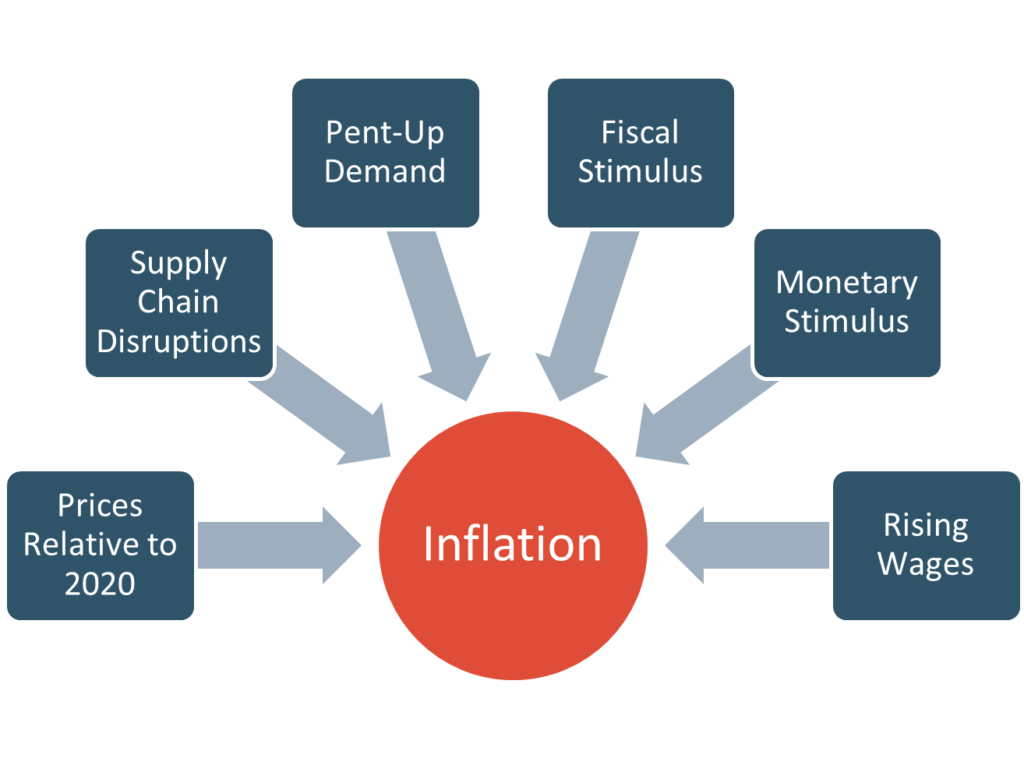

To be fair though, last year’s collapse in demand doesn’t explain all the price increases we are seeing now. Disruptions in the supply of goods has also been a problem. The recent Colonial Pipeline hack which disrupted the supply of gasoline along the East Coast for many weeks is a prime example. The shortage of lumber in the midst of the current pandemic-driven housing boom is another.

In addition to last year’s depressed prices and pandemic-related supply chain disruptions, there are other potential causes of higher prices over the last few months, including:

Pent-up demand:

Pent-up demand:

With the economy reopening, pent-up demand for goods and services is being unleashed, and that may push prices higher, temporarily, for some products and services.

Fiscal and monetary stimulus programs:

Total government stimulus provided throughout the pandemic and extending into this year has totaled more than $5 trillion. More money in the system and low overall interest rates can stimulate spending and lead to higher prices.

Higher wages:

Many business owners have had to offer incentives in the form of bonuses and higher wages to re-staff as businesses re-open. As businesses see their costs (e.g., wages) go up, they are compelled to protect profitability by raising prices of their products.

Let’s Cut to the Chase: Is Inflation Going to Be a Problem?

Now that we are seeing pockets of higher prices, the key question is whether it is temporary – just a side effect of the post-pandemic reopening – or here to stay.

The Fed has made its position clear. It believes current inflation readings represent “transitory” price increases that will moderate as the reopening economy finds its footing. While that would be a welcome outcome, it’s certainly not a given. And until we know for sure what the outcome will be, we can expect stock and bond markets to be temperamental around any surprise readings of economic data or guidance from the Fed about rate hikes or “tapering” (i.e., the removal of money from the economy resulting from the Fed buying fewer fixed income securities).

We Need to be Prepared Either Way:

The Fed might be right. Technology, an aging population, and continued globalization are all forces that have and will likely continue to keep inflation in check to some extent. But they also could be wrong. The prospect of higher prices can very easily encourage people to spend now (versus later) to avoid future higher prices. This behavior could easily push prices higher, supporting more near-term inflation.

Our team views unexpected inflation as a risk to take seriously.

We do not expect to see a return of 1970s style inflation. While demand-based price increases may be temporary, there are pockets of inflation that are likely to be more permanent. For example, it’s hard to pull back on wage increases. As a result, we are using four distinct tools to proactively position client portfolios to better weather an environment of elevated inflation.

Real Assets

Real Assets

Our clients’ portfolios include a dedicated position to real assets. This includes things like real estate, infrastructure, farmland, and timberland. Real assets increase in value when inflation and interest rates are rising.

Duration

Duration is a measure of interest rate sensitivity. As rates go up, bond prices go down. Rising inflation will often drive higher interest rates and, therefore, lower bond prices. We’ve reduced the interest rate sensitivity in our clients’ portfolios by maintaining a shorter duration in our bond investments. We’ve also allocated dollars to fixed income managers that use a dynamic approach that includes more flexibility to invest beyond traditional U.S. government and corporate bond markets.

Asset Allocation

We’ve made proactive adjustments to our clients’ stock/bond mix in recognition of current market risks. Earlier this year, we reduced our clients’ exposure to bonds in favor of stocks in anticipation of rising interest rates.

Diversification

A tried and true tool that is often underrated, diversification will always be key to managing risks. We’ve seen growth and value stocks react differently to inflation news. And we understand that inflation may unfold in different ways across different countries. As a result, we remain allocated across growth, value, U.S., and non-U.S. markets, as well as across the size spectrum, to minimize volatility around the impact of inflation uncertainty on stocks.

Only time will tell…

…if inflation is ready to make a comeback after roughly 30 years of laying low. While we can’t know for sure what time will bring, our job as stewards of our clients’ long-term financial plans is to balance potential risks with the pursuit of returns that will help meet their goals.

To learn more, review our investment process and subscribe to our blog.