The daily price movement of Bitcoin is now quoted almost as widely as the Dow, S&P, and the NASDAQ. While there are more than 1,000 cryptocurrencies available, Bitcoin is the best known. In many ways, Bitcoin is to cryptocurrency what Kleenex is to facial tissues.

Everyone is talking about Bitcoin. But here are three things you might not know about it and other cryptocurrencies.

It’s considered a good gauge for speculation

Professional money managers are keeping an eye on what’s happening with the price of Bitcoin, but maybe not for the reason you think. At some firms, tracking the price of Bitcoin is viewed as a way to gauge current market sentiment…specifically, how much speculation exists in the current environment and how that might impact the prices of traditional investments.

Is the price activity of Bitcoin and other cryptocurrencies a decent gauge for the degree of speculation in the market?

According to Google, the definition of “speculation” is the forming of a theory without firm evidence. As it turns out, Bitcoin has no basis for intrinsic value. That is, it has no underlying assets, earnings, or revenue to justify its price. Yet we often see the price move up or down by 20% or more in just a day…based on perceived value. Sounds like a textbook definition of speculation.

But if you need more proof, you only need to look as far as the launch of the latest cryptocurrency, the $cat. It was launched by Carole Baskin of the popular Tiger King TV series and it’s a way for fans of the show to buy merchandise from the Big Cat Rescue animal sanctuary in Tampa, FL. So the cryptocurrency space now has an option for both dog (Dogecoin) and cat lovers.

Perhaps that’s enough said.

Bitcoin is considered “property” for tax purposes

The IRS considers Bitcoin and other cryptocurrencies as property, not currency. In short, that means you pay capital gains on any realized price appreciation of Bitcoin just like you would a stock. Since most people are buying cryptocurrencies as investments, this makes sense.

But what about the tax implications of using Bitcoin as currency…to actually purchase a good or service? This is where Bitcoin feels a lot different than legal tender. Since Bitcoin is property, using it as tender for a purchase also results in realizing a gain or a loss. But receiving Bitcoin as payment is considered income and subject to income taxes.

There are quite a few tax implications that holders of cryptocurrencies should be aware of. If you are a serious crypto investor, you can get a good overview of those implications here. And you may want to review the potential changes that are coming to income and capital gains tax rates that we wrote about in our recent blog titled “Are My Taxes Going Up?“.

Many likely don’t know that simply mining Bitcoin creates a taxable event. But Bitcoin mining is anything but simple so we won’t get into the tax implications of that in this discussion. That said, there is an aspect of Bitcoin mining that the average investor might be more concerned with. That brings us to the third thing about investing in Bitcoin that you might not know.

Bitcoin Has a Carbon Footprint

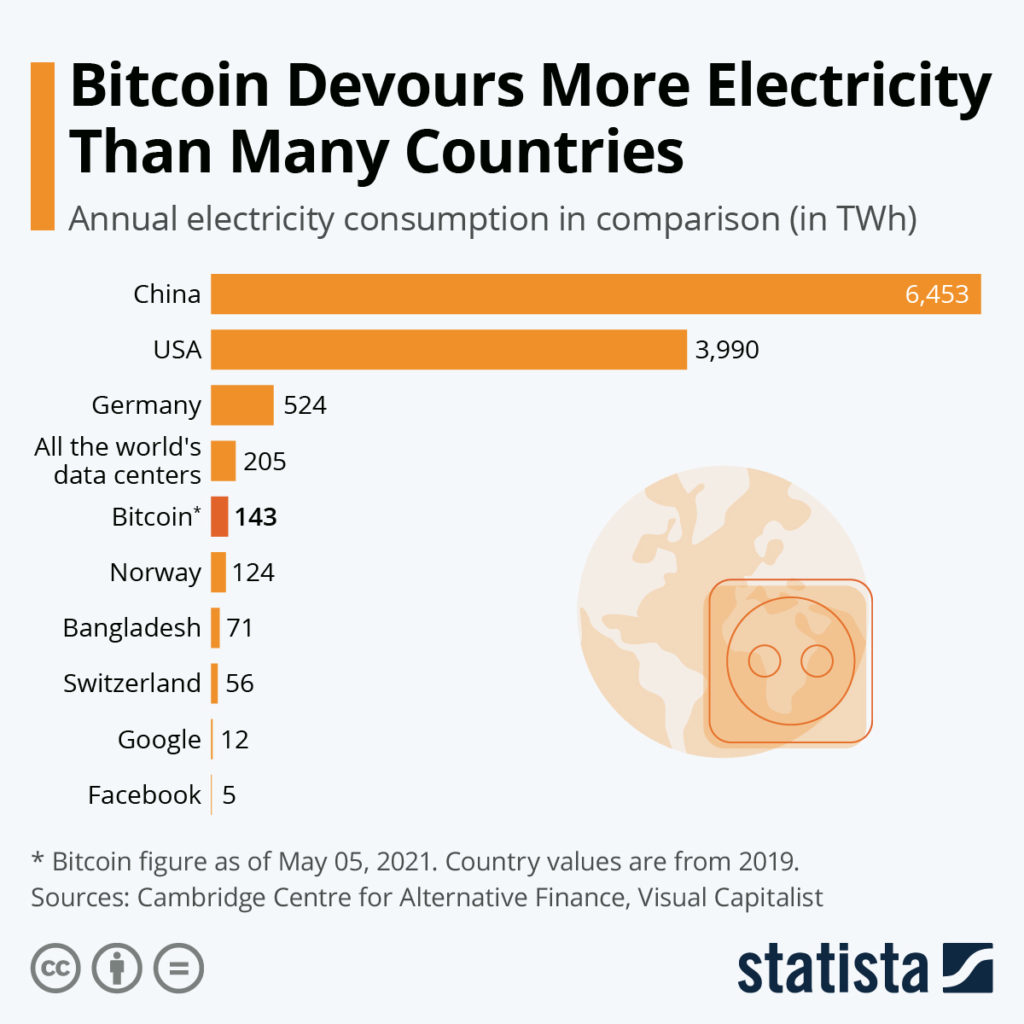

Cambridge University researchers say that mining for Bitcoin consumes more electricity than the entire annual energy consumption of the Netherlands.

Cambridge University researchers say that mining for Bitcoin consumes more electricity than the entire annual energy consumption of the Netherlands.

What does electricity have to do with cryptocurrency?

There is a limited supply of Bitcoin, and not all available Bitcoin is currently in circulation. It takes complex mathematical computations – ones that require the power of multiple computers – to unlock the availability of new coins. It takes similar computations to complete Bitcoin transactions. Essentially, computers and mathematical equations are the oversight and security mechanisms for Bitcoin. And the computer power behind ensuring this security for new coins, transactions, and Bitcoin storage is immense. While renewable resources may be fueling some of that power, many believe that fossil fuels support the bulk of mining activity.

Should that influence your decision to invest in Bitcoin or other digital currencies? It might if you are someone that is pursuing a sustainable investing strategy that aligns your investments with your overall social or environmental values.

At Heritage Financial, we understand that many of our clients want to better understand sustainable investing options. To help with that, we are hosting an educational webinar on the topic next month. Learn more about our webinar, Understanding Sustainable Investing, and register to join us on June 2 at 2 pm EDT to learn about how you can have a good investment experience while you invest in companies engaged in more sustainable business practices.

What to do with what you know about crypto

With respect to cryptocurrencies, there are plenty of considerations that will influence whether or not an investment makes sense. We think this discussion from Schwab is the best overview of the cryptocurrency opportunity that we’ve seen for serious investors:

Bitcoin: Does it Have a Place in Your Portfolio

For those less serious investors, we’ll leave you with this excerpt about Dogecoin from a May 6, 2021 Fortune article:

Dogecoin buyers are hanging their hopes on Saturday night. Well, Saturday Night Live, to be exact. Elon Musk, the chief executive of Tesla, SpaceX, and, sometimes, jokingly, Dogecoin, is set to appear on NBC’s comedy sketch show this weekend. Cryptocurrency enthusiasts and speculators are waiting with bated breath for the episode; they expect the on-and-off-again world’s richest man to mention the so-called meme-coin on air, potentially causing its price to move. That could mean lots of pain—or euphoria—for investors, and likely heaps of both, depending on which side of the trade one falls.

And we now know how that ended. Buckle up.