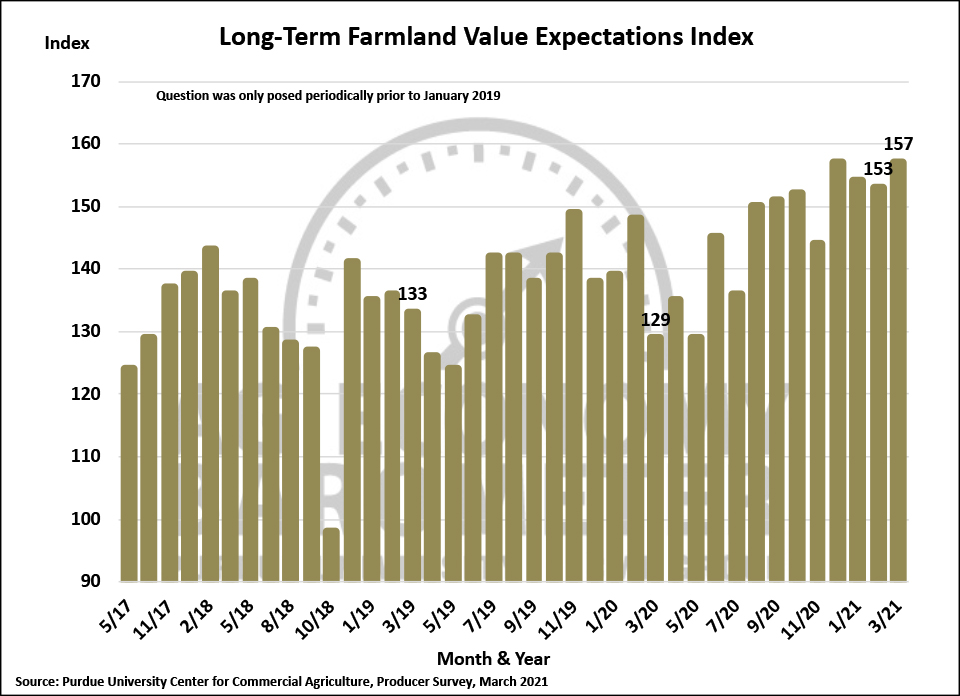

Each month, Purdue University conducts a phone survey of 400 U.S. agricultural producers about the expected future value of farmland. They use this data to compile and monitor the Long-Term Farmland Value Expectations Index (chart below). In March, this index rose back to its highest level on record, indicating a positive long-term outlook for the value of farmland.

At Heritage Financial, our investment offerings go well beyond traditional stocks and bonds. We know that every client’s needs are different. And quite frankly, the investing landscape sometimes requires less traditional options. Today’s environment of very low interest rates and potentially higher near-term inflation encourages looking beyond the traditional asset classes for unique ways to get more return and risk protection for our clients. Farmland is one of those unique opportunities.

At Heritage Financial, our investment offerings go well beyond traditional stocks and bonds. We know that every client’s needs are different. And quite frankly, the investing landscape sometimes requires less traditional options. Today’s environment of very low interest rates and potentially higher near-term inflation encourages looking beyond the traditional asset classes for unique ways to get more return and risk protection for our clients. Farmland is one of those unique opportunities.

A bit about investing in farmland

From an investor’s standpoint, farmland fits into the category of real assets.

When we talk about real assets, most people immediately think about gold and silver. It makes sense. Particularly in times of crisis, there is no shortage of advertisements for investing in gold. But here’s two things to know about investing in these precious metals:

While gold and silver are a nice inflation hedge, inflation is really the only long-term return driver for these assets. Over the long-term, investors in gold or silver should expect returns that are similar to that of cash, plus inflation (minus the cost of investing in it, like fund management or storage fees).

Some might be fine with cash-like returns over the long-term. But gold has historically experienced stock-like volatility. Prudent investors expect high returns (not cash-like returns) for highly volatile assets. In our opinion, gold and silver have historically not provided attractive long-term risk/return trade-offs.

Why do we prefer farmland over gold or silver?

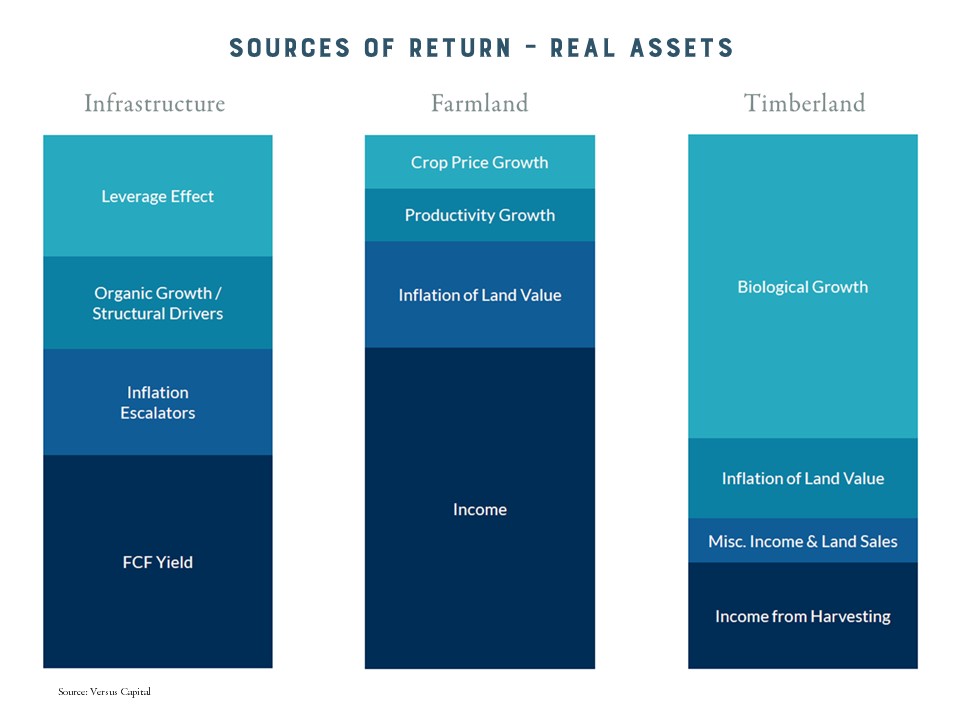

Farmland is also a good inflation hedge, as the value of land typically increases alongside inflation. However, an asset like farmland has several other sources of return potential.

Farmland can increase in value for a number of reasons besides inflation. If the price of crops grown on the farmland increases, the land becomes more valuable. When farmers can make the land more productive, it’s value increases. And most importantly, investors in land are paid income (rent or mortgage income) in addition to any capital appreciation over time.

Because farmland has multiple sources of return potential, it’s also less volatile over time. When it comes to investing in real assets, we believe farmland, timberland, and infrastructure represent a better risk/return trade-off than precious metals like gold and silver.

Because farmland has multiple sources of return potential, it’s also less volatile over time. When it comes to investing in real assets, we believe farmland, timberland, and infrastructure represent a better risk/return trade-off than precious metals like gold and silver.

How do we invest in farmland for our clients?

The Investment Team at Heritage Financial conducts due diligence on a variety of investment vehicles for potential use in our client portfolios. Today, our portfolios include exchange-traded funds, mutual funds, interval funds, and/or private investment vehicles, depending on each client’s specific situation.

Our job is to find the best investment opportunities, no matter the vehicle. And our due diligence includes an analysis of fees to make sure that costs are reasonable relative to the access and liquidity provided by each type of vehicle.

Our current allocation to farmland is part of a broader position in real assets. In fact, earlier this year we adjusted client portfolios to shift assets away from bonds and into stocks and real assets based on our outlook for various asset classes as the economic recovery continues.

We believe real assets are an important part of a diversified portfolio for long-term investors in the current environment. To learn more about our views on this topic, read our 2021 Outlook and our investment process, or reach out to talk to one of our advisors.