A Look Back:

The first quarter of 2021 witnessed Part II of the reopening trade in stocks. As a recap, Part I happened during the fourth quarter of 2020, when small cap, value, and international stocks finally started to perform on par with – and even a bit better than – growth stocks. This was significant because for years, growth stocks were stealing the spotlight and leaving globally diversified investors feeling left out.

What unfolded during Part II? Growth stocks significantly underperformed, while value stocks in particular posted strong returns. The reason for growth’s difficult quarter? Rising interest rates.

By the end of the first quarter, the yield on the 10-year U.S. Treasury bond had essentially increased back to the level it was in January of 2020, before the pandemic sent rates plummeting. As the global economy continues to move back towards pre-pandemic conditions, it makes sense that rates would do the same. But this unnerved equity market investors – particularly growth investors. Why?

Because investors buy growth stocks for their FUTURE return potential. And the current value of future growth is lower when rates are higher. The rise in rates, despite being (at this point) a return to pre-pandemic levels, led investors to question whether many growth stocks were worth their current prices.

Moving Forward:

So what do higher rates mean for stock and bond markets going forward?

At a high level, we expect:

Bond markets will remain challenging given low yields and the likelihood for rates to continue moving higher. This can be managed using more dynamic bond strategies that access less interest rate sensitive areas of the bond markets.

Equity markets should continue to benefit from the reopening trade, with returns being much less biased. This is positive for globally diversified investors.

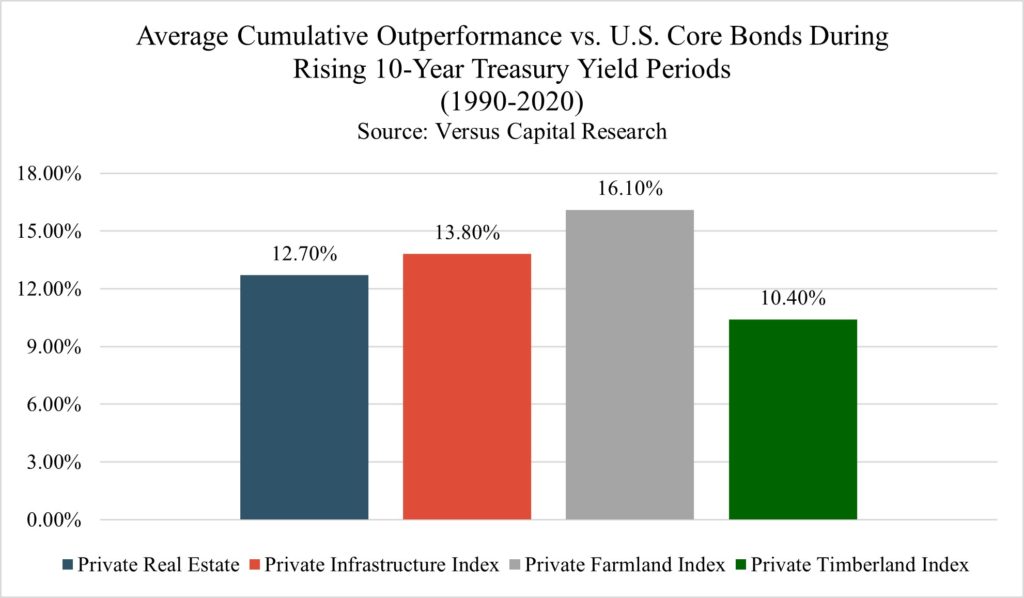

Real assets, including real estate, infrastructure, farmland, and timber are likely to benefit from the continued global recovery, low but rising interest rates and the potential for pockets of inflation. In early 2021, we shifted client assets away from bonds and into stocks and real assets.

Professional investment management is more than just diversification.

Professional investment management is more than just diversification.

At Heritage, we believe one of the most important thing we do is strike a balance between keeping you on track long-term, and taking advantage of what’s happening now. Because we know it’s what’s happening now that keeps you up at night or causes you to make a knee-jerk reaction that could upset your long-term plan.

If you’re curious about what it would be like to work with us, hear first hand from our President, Sammy Azzouz.