Just over a year after the global economy closed for business, countries are in various stages of reopening. News headlines cite more openings than closings. More and more people are getting vaccinated and feeling comfortable being out and about.

Cushman and Wakefield, a commercial real estate company, has an interesting interactive global map that measures just how “open” various countries are in terms of entertainment, construction, manufacturing, and schools, among other things. They estimate that the U.S. is about 65% open, while countries like Finland, Russia and China are roughly 90-95% open. In contrast, Germany, Canada and Mexico are more like 50-55% open.

There is still work to be done in terms of getting back to normal. Here’s our thoughts on taking full advantage of the reopening process.

For Your Wealth

If you listen to business news, you’ve heard about the reopening trade. It’s simply the recent rotation of investor dollars into stocks of companies that stand to benefit most from a full reopening of the global economy.

Think of it this way – while names like Netflix and Facebook were beneficiaries of us staying at home, stocks in sectors like transportation and travel will be significant beneficiaries of us all getting out of the house again.

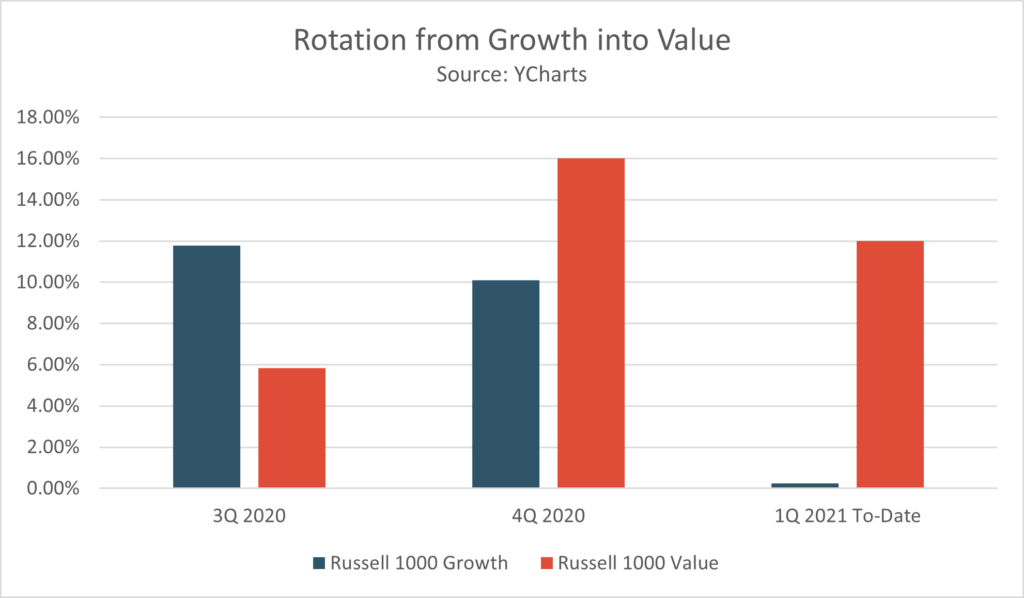

Look no further than the relative performance of growth and value stocks over the last several quarters to find evidence of the reopening trade. There has been a clear rotation, with growth stocks taking a backseat to value during the 1st quarter of 2021.

At Heritage, global diversification is a key aspect of our investment philosophy. And we believe the continued reopening of the global economy will serve diversified investors well, in contrast to the last several years where equity market returns were heavily driven by U.S. large cap growth stocks. See our 2021 Outlook for more on our thoughts about where to invest this year as the global economy continues to reopen.

At Heritage, global diversification is a key aspect of our investment philosophy. And we believe the continued reopening of the global economy will serve diversified investors well, in contrast to the last several years where equity market returns were heavily driven by U.S. large cap growth stocks. See our 2021 Outlook for more on our thoughts about where to invest this year as the global economy continues to reopen.

For Your Health

For those in the Northeast, the continued reopening is timed nicely with the gradual loosening of winter’s grip. There’s been enough spring teaser days that we want the nicer weather just as much as we want to see life go back to normal.

Our Office Manager, Lindsay Greene, has these thoughts to share about how to take full advantage of reopening this spring:

“During this past year, I have personally learned how beneficial it is for your mind and body to get outdoors and move. Simple things like parking further away and taking the stairs can add more movement to your day no matter the weather. But now that the weather is improving, there’s nothing I love more than taking a walk at lunch. It energizes me for the rest of the day, and sometimes I even get a bit of Vitamin D too!”

Lindsay shares some popular hiking and walking trails near Boston, including:

The 2.5-mile Emerald Necklace beginning at The Boston Common and Public Garden.

The 5-mile Battle Road Trail full of historical markers and a tavern to quench your thirst.

Trails in the Blue Hills that get you a bird’s eye view of the entire Boston metropolitan area.

No matter how you look at it, the world is reopening again. This isn’t just good news for the markets. It’s good news for our souls. And it’s prompted us to start planning some long-overdue events for later this year. Details coming soon. In the meantime, from all of us at Heritage, Happy Spring!