Key Observations

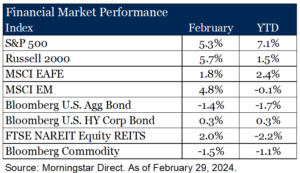

- Most risk assets advanced in February as optimism remains that the no-show recession of 2023 continues to fade further into the rearview mirror. As a result, fixed income investors have also tempered the expectations around rate cuts and longer duration assets underperformed.

- For the first time in 34 years the Japanese index, Nikkei 225, hit a new all-time high. The nearly 3.5-decade comeback is instructive of how to think about risk and valuations.

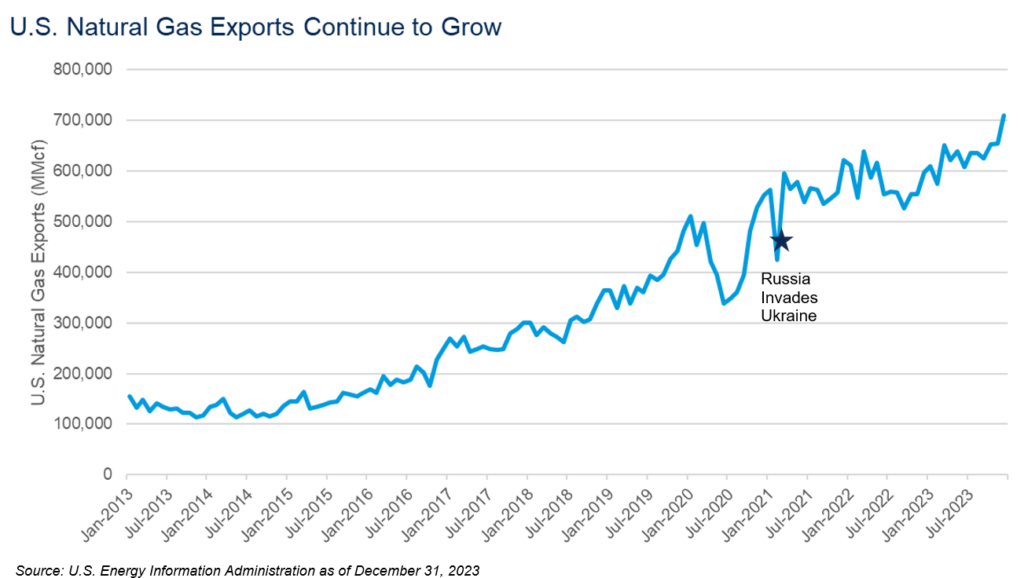

- The Russia/Ukraine conflict entered its third year, and with hindsight, demonstrates two important macro trends of a multi-polar world and some newfound resiliency for Europe as it has waned off its reliance of Russian natural gas.

Market Recap

Stocks advanced in February with indexes like the S&P 500 and the NASDAQ hitting new highs. While a new high for an index is not a new thing, in fact it happens quite regularly and often without material consequence, there was a recent new high that is worth reflecting on. The Japanese equity index (the Nikkei 225) hit a new all-time high for the first time since 1989!1 We’ll do the math for you: that’s 34 years. For some pop culture points of reference, the last time the Nikkei was at these levels Poison’s Every Rose Has Its Thorn was the number one song in the U.S., Nintendo launched the Gameboy and the Berlin Wall fell marking the end of the cold war. Why it took this long to come back is an import investment lesson. In a word, valuation.

Valuation Matters

Japan was the premiant stock market in the late 1980’s. They were known for leading in robotics, gaming, and banking. At the time the top five largest companies in the world by market cap were, you guessed it, all Japanese and the Nikkei quickly raced toward 40,000 with many companies near their peak equity valuation based on this investor exuberance. That’s when financial physics (that is rationale economics, just like gravity, applies to all investments) set in. It is hard for a company trading at lofty valuations to sustain those levels of success and as a result investors sought opportunity elsewhere and Japanese stocks fell precipitously. While Japan’s run up and come back were both extreme, they serve as a valuable lesson all these years later. What you pay for an investment matters. All else equal, it is easier to outrun modest expectations than it is lofty ones.

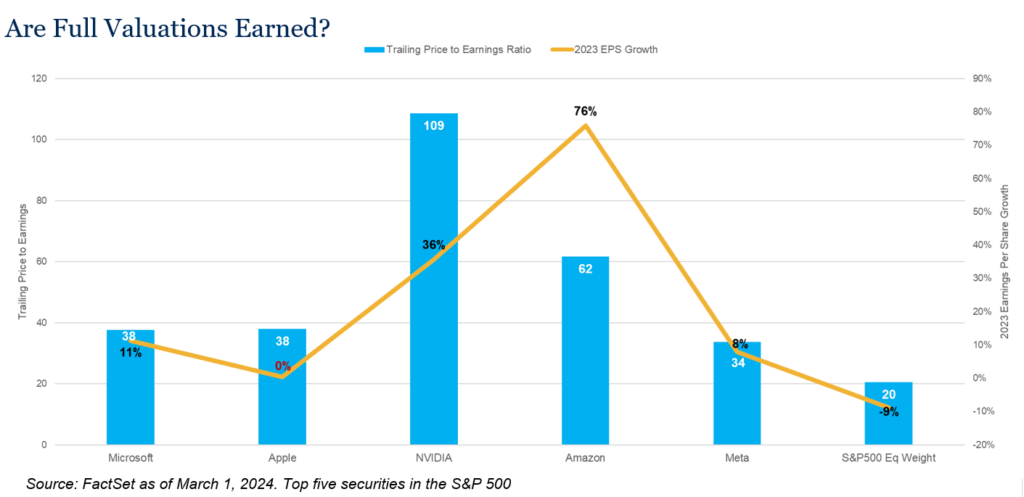

As we look to markets today, there are some similarities and some key differences that we can apply. First, the U.S. today like 1980’s Japan exhibits similar levels of stock market preeminence. Today, the top five stocks globally are all based in the U.S., all of which are technology or technology related stocks, and whose collective market cap is larger than the bottom 383 companies in the S&P 500 combined2. This level of dominance naturally begs the questions, “does gravity still apply?”. Our answer is a resounding “yes”, but at periods of time certain stocks can feel weightless. As you can see in the following exhibit, the current top five stocks in the U.S. trade at full valuations but have arrived there deservedly so. The equal weight S&P 500 index EPS contracted at -9% in 2023. The top five U.S. stocks grew EPS on average by 52%. Full valuations begin to make more sense in that context. I.e. gravity still applies. Yet the trillion-dollar (pardon the market cap pun) question remains, how sustainable are these levels of returns and success? Stay tuned for a future posts where we’ll explore another natural world analogy to describe markets, which is seasonality. History has taught us about the seasons of companies out-earning their economic or societal benefit and the consequences to price as a result.

Today, the top five stocks globally are all based in the U.S., all of which are technology or technology related stocks, and whose collective market cap is larger than the bottom 383 companies in the S&P 500 combined2. This level of dominance naturally begs the questions, “does gravity still apply?”. Our answer is a resounding “yes”, but at periods of time certain stocks can feel weightless. As you can see in the following exhibit, the current top five stocks in the U.S. trade at full valuations but have arrived there deservedly so. The equal weight S&P 500 index EPS contracted at -9% in 2023. The top five U.S. stocks grew EPS on average by 52%. Full valuations begin to make more sense in that context. I.e. gravity still applies. Yet the trillion-dollar (pardon the market cap pun) question remains, how sustainable are these levels of returns and success? Stay tuned for a future posts where we’ll explore another natural world analogy to describe markets, which is seasonality. History has taught us about the seasons of companies out-earning their economic or societal benefit and the consequences to price as a result.

Source: FactSet. Current is the S&P 500 as of March 1, 2024

Russian Hindsight

As of February 24, Russia’s invasion of Ukraine has now entered its third year. What was originally deemed a forgone conclusion of military victory and devastating economic sanctions for the Kremlin has turned out to be anything but. Such events have a mercurial way of teaching us humility. However, now with hindsight we can see a number of important macro trends.

First, Russia’s economy was bailed out from the lifelines it threw to the east, namely to China and India. The walls that continue to build in this multi-polar world may continue to instruct policy, geopolitical tension and inflation as near- or friend-shoring continues, and the flow of global goods is impeded. This reconciles well with our 2024 theme of “the messy middle” in which it is our expectation that inflation will remain subdued, but will have fits-and-starts feeding both investor anxiety and Fed watcher trepidation.

Second, just as Russia avoided the cost of economic decline, so did Europe. With time as an ally, the U.S has emerged as the EU’s largest natural gas supplier in 2023. U.S. natural gas exports are now at all-time high and have increased 30% since Russia invaded Ukraine. Much of that incremental growth headed to Europe. This has created both opportunity here in the U.S. and greater stability for Europe.

Outlook

Our investment themes that we outlined heading into 2024 remain in the wake of upward market performance in February: the “messy middle” inflation range of 2-5%, preparing not predicting recession, and concentrated consequences. We believe a thoughtful portfolio construction framework rooted in valuation helps avoid some of the extremes we noted above and keeps our sights on our long-term objectives.

1.Source: Morningstar

2.Source: FactSet as of March 1, 2024

March Market Update & A Primer on Private Equity vs. Venture Capital