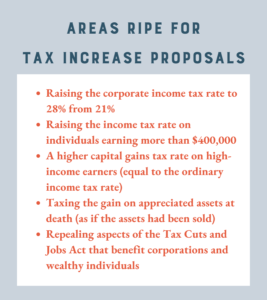

With the passage and signing of ARPA (American Rescue Plan Act), DC is now turning its attention to future spending plans and how to pay for stimulus. Said another way, we are watching closely for what could be an increase in taxes. [Check out our recent discussion on the potential tax changes under a Biden administration here.]

It’s worth noting that the Biden administration remains focused on considering tax increases for those making over $400,000. The 2021 childcare expense deduction changes in the ARPA was an example of this. The credit included a rapid phase out for taxpayers with adjusted gross income over $400,000.

It’s not just high-earning individuals that may see tax increases. The administration is considering corporate tax increases as well.

It’s not just high-earning individuals that may see tax increases. The administration is considering corporate tax increases as well.

Most reporting suggests any tax changes would be effective in 2022. Current dialogue suggests they would not be retroactive for the 2021 tax year. To help pass contentious legislation, a package may contain an infrastructure bill and tax increases together.

There may be some tax relief as well. Specifically, this relief may be targeted at households making $110,000 or less, based on recent comments from the administration.

We expect to see more on the President’s plans (dubbed “Build Back Better”) this Spring.

And, a few reminders…

Last week was busy for the IRS. They issued multiple guidance memos. Here are two of the more important ones.

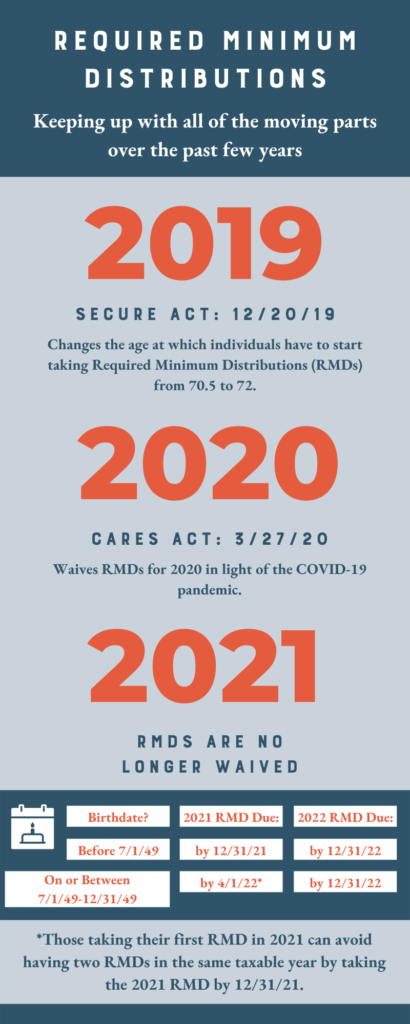

The IRS reminded taxpayers of recent changes to retirement plans. In 2019, the IRS changed the age at which Required Minimum Distributions (RMDs) must start. Then in 2020, they waived RMDs in light of the coronavirus pandemic. RMDs are required once again for 2021. Our overview simplifies all of this recent activity. Check out our infographic to make sure you know what you need to do and when.

The IRS also gave many a welcome gift last week by pushing back the 2021 deadline for filing individual income taxes to May 17th. The extended deadline applies to filing and payment of 2020 federal taxes. It also includes individuals that pay self-employment tax.

The IRS also gave many a welcome gift last week by pushing back the 2021 deadline for filing individual income taxes to May 17th. The extended deadline applies to filing and payment of 2020 federal taxes. It also includes individuals that pay self-employment tax.

The relief doesn’t apply to any estimated tax payments that are due on 4/15.

It’s also important to note that the extension is for federal filing only. Taxpayers should check with their specific state about any similar deadline changes at the state level.

(Note for Massachusetts taxpayers, the State did follow the federal government’s lead, making May 17th the new date for filing.)

The only constant is change

At Heritage, we’ve built a robust Financial Planning Checklist with over 100 monitoring points that track the details of each client’s unique financial plan.

But we’re not just gathering and tracking data. Our Financial Planning team systematically shares critical monitoring points with our Wealth Management Teams to prompt reviews and updates with our clients to make sure nothing gets stale or goes overlooked. With this systematic approach, we can be much more proactive and nimble in spotting opportunities, shifting strategy, and minimizing taxes for our clients as legislation changes.

At Heritage, when we say “Every Detail Matters”, we mean it. If we can help you getter a better handle on all the details of your financial picture, Let’s Talk.