Nearly a year after the start of the global shutdown, we all still crave signs of life before COVID – a return to normalcy.

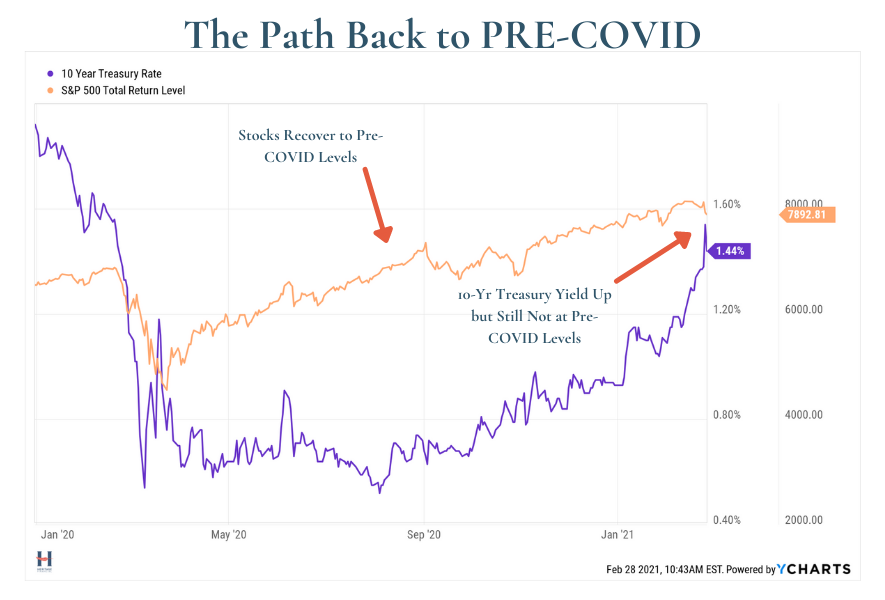

The equity market rally that brought stocks back to pre-COVID levels last August was one of those welcome signs.

Last week, the yield on the 10-year U.S. Treasury Bond made a strong advance back toward pre-COVID levels.

While it fell short, that advance dominated the financial headlines and created notable volatility in the equity markets.

So why was this potential return to normalcy not so welcome?

For fixed income investors, rising rates are problematic. They correspond with falling bond prices. But a challenging bond market is not new. Rates have been so low for so long, even before COVID. Finding attractive return potential in bonds has been a problem for a while. Add to that a rising rate scenario and bond investors have even more challenges to navigate.

For fixed income investors, rising rates are problematic. They correspond with falling bond prices. But a challenging bond market is not new. Rates have been so low for so long, even before COVID. Finding attractive return potential in bonds has been a problem for a while. Add to that a rising rate scenario and bond investors have even more challenges to navigate.

Higher bond yields are not necessarily bad for stocks. If yields are moving higher in anticipation of a better economy, that’s a good thing for stocks. The fact that recent yield increases have been focused in longer-term bonds suggests this is the case. Then why so much volatility in stocks last week?

Markets don’t like uncertainty…

…and right now there is speculation that bond yields may be signaling not just better economic growth, but also a return of inflation.

Last week on our blog, we discussed some early signs that inflation may be making a comeback, and how we are positioning our clients’ portfolios for long-term inflation protection.

But are these early data points just temporary price increases that are to be expected after a year of pent-up consumer demand and supply chain disruptions? Or are they the beginning seedlings of a return of 1970s-like inflation?

At Heritage, we don’t look to predict the direction of interest rate moves. However, we recognize there is a higher risk of inflation in the near-term.

We focus instead on managing this risk through asset allocation.

In our 2021 Outlook, we discuss Opportunities for a Low Interest Rate Environment, noting that “nimbleness and selectivity will be key attributes needed in the quest for fixed income returns this year”.

We adjusted client portfolios earlier this year to address the current low interest rate environment and potential return of inflation. Specifically, we reduced bond allocations and increased exposure to real assets. In addition, we focused our bond investments on flexible strategies with shorter duration.

Wondering how your diversified portfolio will weather a changing interest rate environment? You may be ready to take part in our introductory three-meeting process. It’s not only a chance to hear our thoughts on your current financial plan and investment portfolio, but also to test-drive a relationship with us. Want to learn more? Let’s Talk.