The January 2021 reading of the Producer Price Index (PPI) saw its largest monthly increase since early 2009. Producer prices represent the cost of goods or services that will ultimately be bought by consumers. So, it makes sense that we will be feeling those higher costs soon.

Most experts expect inflation to make a comeback at some point this year. In our 2021 Outlook, we note that:

…the impact of pandemic-induced stimulus and ongoing measures to alleviate the economic burdens on households…may cause inflation to rise in 2021.

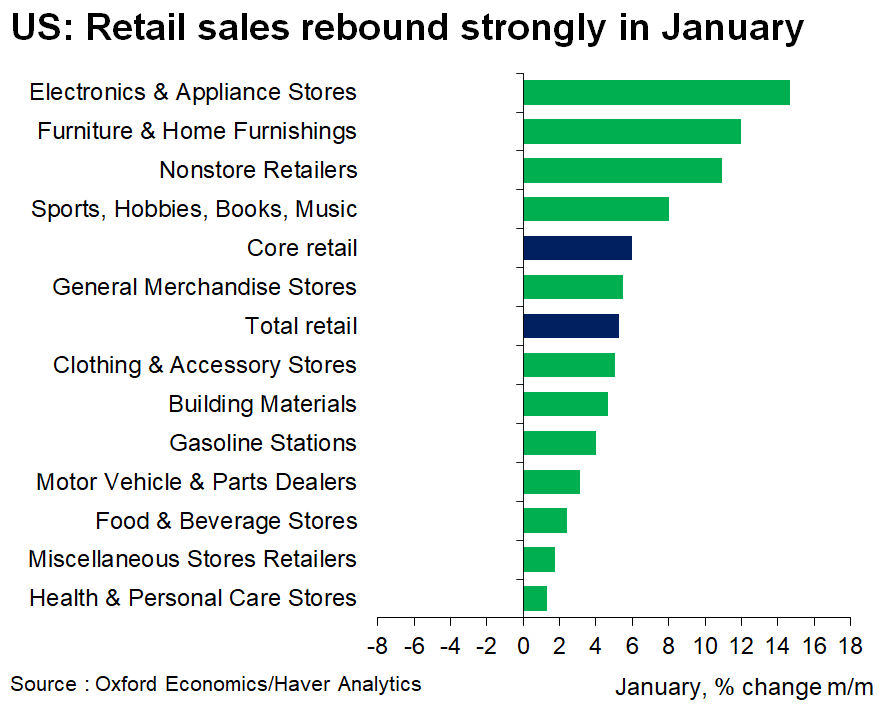

After all, the government has already spent more than $3 trillion to battle the impact of COVID-19 on the economy. Much stronger than expected retail sales in January hint at the level of pent-up demand that could drive prices higher going forward.

For investors looking to insulate their portfolios from inflation risk, the key questions are:

For investors looking to insulate their portfolios from inflation risk, the key questions are:

When will inflation truly take hold?

How bad might it get?

The reality is that inflation is very difficult to predict. Remember all the stimulus during The Great Recession? Everyone expected inflation to make a strong comeback after that. But it never materialized.

Is this time different?

You can spend time debating that question. But we think time is better spent on the things you can control. The simple truth is that investors can be prepared for expected or unexpected inflation by simply committing to a diversified portfolio that includes a strategic allocation to alternative investments.

Why Alternatives?

Stocks and bonds typically outpace inflation over the long term, but there have been short-term periods when this has not been the case. Alternatives have a low correlation to stocks and bonds, meaning that they do not move in the same way. If/when an inflation surprise unnerves the stock market or sends bond rates higher (and bond prices lower), this diversification will help your portfolio.

What Type of Alternatives?

Private real assets like real estate, infrastructure, farmland, and timberland generate strong returns when inflation is above the 2% target level cited by the Fed as a monitoring point. Research from Versus Capital shows that private real estate and timberland tend to do particularly well during higher inflationary periods. And data going back to the 1970s shows that private farmland generated an 11% average annual premium over the inflation rate from 1970 – 1979, which was a high-inflation period.

Inflation is likely to make a return. How strong it will be and when it will show up are more difficult questions. To prepare our clients for that potential risk, we rely on long-term strategic asset allocation tools, including an allocation to real assets.

Want to talk about whether your portfolio is positioned for a potential return of inflation? Let’s talk.