Your mindset when you wake up sets the tone for your entire day.

The same logic applies to the calendar year. In that spirit, we recommend taking these three easy steps to start your year off on the right foot financially. [And read all the way to the end for a bonus step that might help you find free money!]

Check Your Free Credit Report

You are entitled to receive a free copy of your credit report annually from each of the three major credit reporting agencies. After answering a few questions online, you can receive a digital copy instantly to download or print. If you can’t (or don’t want to) complete the request online, you can mail a short form to request a copy of your report in the mail.

Your credit report doesn’t contain your credit score, but it does include a lot of valuable information on your history and current use of debt. Mistakes are common, due to a combination of the high volume of data handled by the credit agencies, human error, and inadequate communication from lenders. In just a few minutes you can check to see if open account balances are correct, if you have any accounts with negative information, and that the most recent account is authentic. Errors can be addressed by writing to the credit bureau, with instructions on how to file a dispute included in your report.

Create/Update Your Annual Budget

80% of American’s go through the practice of creating a budget. The beginning of the year is a great time to update that. But since the beginning of the year is a great time to do a lot of housekeeping items, the budget update can get overlooked.

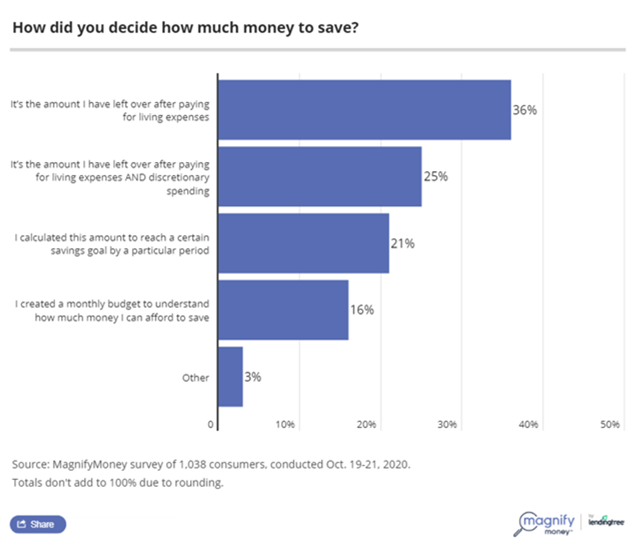

Budgeting is not only important for keeping expenses in check, but also for keeping savings on track. According to MagnifyMoney’s survey of 1,038 consumers, most people decide how much to save based on how much they spend, either on living expenses or living expenses plus discretionary spending.

Without a budget, those expense items can change dramatically from month-to-month, leaving little discipline to the saving strategy. Now is a great time to update your budget, and include a monthly savings goal.

Without a budget, those expense items can change dramatically from month-to-month, leaving little discipline to the saving strategy. Now is a great time to update your budget, and include a monthly savings goal.

Organize Your Tax Return Information

Banks, brokerages, and employers have already started distributing 2020 tax-year information. If you haven’t already, establish a folder to collect your tax information all in one place. Records for other activities, such as charitable contributions, medical expenses, or quarterly estimates, should also be organized. Let your tax preparer know sooner rather than later if your circumstances (for example, address, marital status, or employment) changed materially in 2020 (or expect to in 2021).

If you let out a heavy sigh at the thought of tackling your budget, wrap the budgeting process in with the tax return prep process. Nobody’s going to make you update your budget, but the government will make you file your taxes. Take the opportunity while you are getting organized for tax purposes to spend those few extra hours knocking out your budget.

Bonus Tip: Find Unclaimed Property

States hold billions in unclaimed property. Examples include dividends, insurance proceeds, and refunds from utility overpayments. Most claims are small but often easy and free to receive. Avoid any commercial sites that offer to find property for you – these are most likely collecting your personal information and charging an unnecessary fee. Stick to www.unclaimed.org, which can point you directly to your state’s official resource. For Massachusetts, the website www.findmassmoney.com offers an easy tool to search and submit claims.

At Heritage Financial, we take the lead role in helping our clients coordinate their finances, including working with their other professional advisors. We ask questions that most others don’t, and we do a significant amount of work digging into and organizing your financial picture before you even become a client.

Looking to start the year off right with detailed financial planning and meticulous wealth management? Let’s Talk.