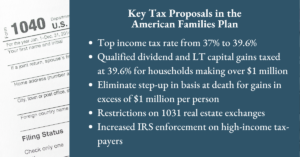

The President formally introduced the American Families Plan to Congress and the public on April 28th. The plan summarizes a host of policy initiatives and tax reform goals.

We expect that debate and compromise may lead to modifications of the proposal. In fact, the notes released by the White House already deviate from some expectations. For example, the President did not address decreasing the estate and gift tax exemption. Rather, his tax reform goals at this time are mainly focused on the treatment of investment income and gains. Here’s the most notable tax reform proposals.

Let’s dig into the two most impactful proposals

Equalize the Tax Rate Paid on Investments and Wages

The proposed plan aims to increase the dividend and long-term capital gains tax rate to 39.6%. This would align these rates with the top income tax rate prior to the Tax Cuts and Jobs Act. With the net investment income tax of 3.8%, the tax rate on gains could be as high as 43.4%. Individuals in states like New York and California could see a rate of more than 50% on gains when considering both state and federal taxes. For now, the proposal would only impact households making $1 million or more per year.

Today, ordinary income tax rates apply to short-term capital gains. But qualified dividends and long-term capital gains are taxed at preferential rates of 0%, 15% or 20% based on overall income. So this proposal is a notable change.

Tax Unrealized Gains at Death

Current tax law grants a step-up in basis to fair market value on assets in an estate at the time of death. This allows heirs to sell inherited assets without realizing any capital gains. The President proposed eliminating the step-up in basis. This would lead to gains being taxed at death as if gains were realized.

Like the investment income tax rate proposal, the step-up proposal carries a threshold before application. The plan would allow a step-up for gains up to $1 million per person and include protection for the continued operation of family-owned businesses and farms.

What Should You Do?

Should you act now to realize gains on appreciated securities? Although history suggests otherwise, it is always possible legislation could be retroactive to the start of the year, in which case a preemptive move now would be ineffective. It is also possible legislation does not pass at all.

The reasonable approach, for those with both high incomes and highly appreciated investments, appears to be careful preparation. At Heritage Financial, we’re beginning to review a number of things for our clients, including:

Current unrealized gains, both short and long-term

Current unrealized gains, both short and long-term

Any carryover capital losses from the prior tax year that might offset some of today’s gains if realized

Full utilization of tax-advantaged investment accounts and employer benefits

Charitable giving strategies

Whether gifting appreciated assets to family members now is an option

If large anticipated taxable payments can be spread out over multiple years to keep income under $1 million

Whether tools like margin borrowing or a home equity line of credit can help provide flexibility for the timing of cash flow needs to minimize taking portfolio gains

Need some help?

We are closely monitoring legislative movements, but starting to think ahead about the pros and cons of various tax planning strategies and collaborating with our clients and their other trusted advisors. If you are worried about the impact of these potential tax law changes and need an opinion, you can learn more about this topic in our blog post titled Minimizing Income Taxes Under President Biden’s Proposed Tax Plan. Or just reach out to us. We would be happy to share our thoughts.