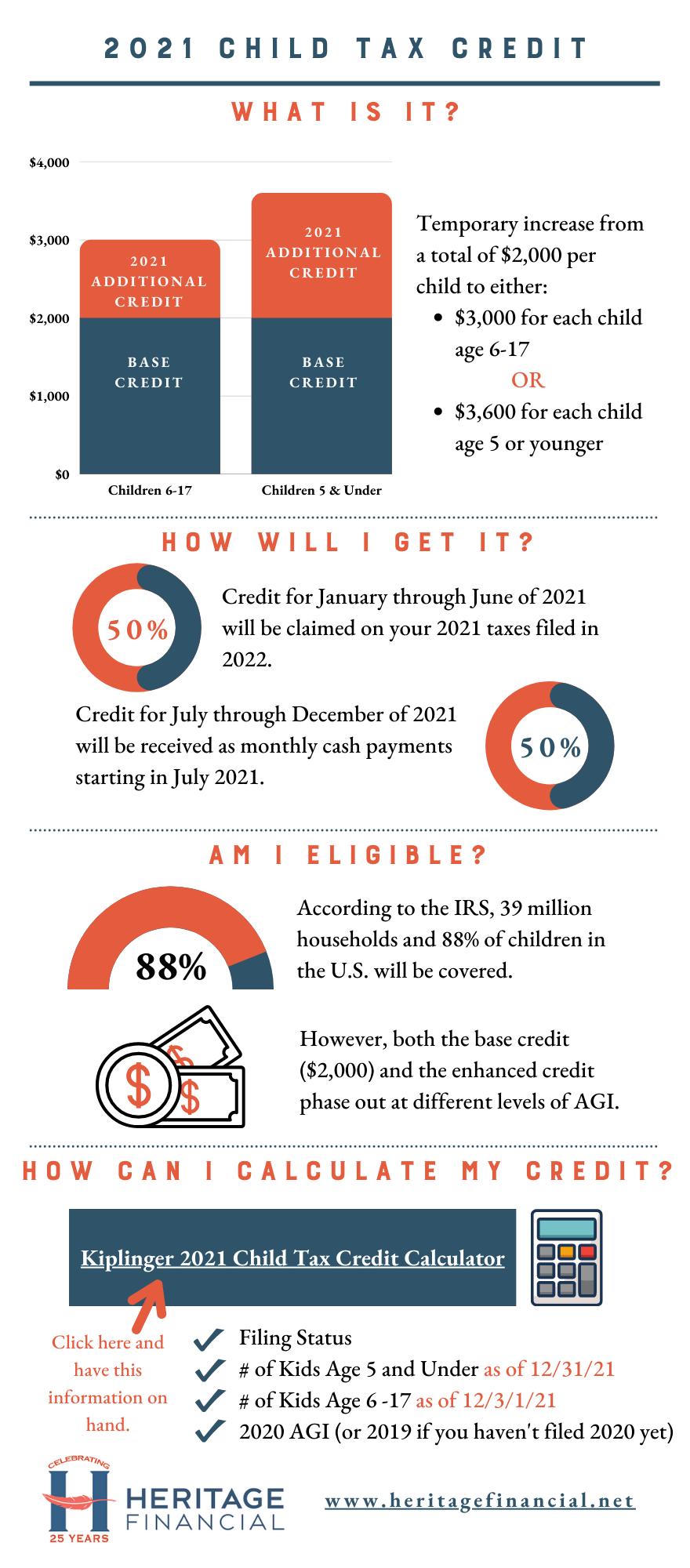

Last week the IRS announced plans to move forward with direct cash payments to taxpayers eligible for the child tax credit. Payments will start in July and run through December of this year.

The IRS estimates that about 39 million households and 88% of children in the U.S. will be eligible for the credit. But there are phaseouts based on income. And if you aren’t phased out, the amount you get depends on your adjusted gross income and the age of your child as of 12/31/2021.

Here’s a quick overview of the credit, how it pays out, who is eligible and how to calculate your monthly payment.

Need help figuring out how new proposed tax laws might impact your long-term financial plan? At Heritage Financial, we have more than 25 years of experience in financial planning and wealth management for serious investors. Based in Westwood, Massachusetts, we have the planning and investment expertise to help you structure a plan for long-term peace of mind. Reach out today to learn more.

And don’t miss these other recent blog posts and resources from Heritage Financial about potential upcoming tax law changes: