There is a great deal of discussion about the likelihood for increased taxes under a Biden administration. View the short video below (less than 2 minutes) to hear Sammy Azzouz, JD, CFP®, President of Heritage Financial, discuss a unique strategy that utilizes your required minimum distribution to make a charitable donation and reduce taxable income.

A few points on qualified charitable distributions (QCD):

• They count towards satisfying your required minimum distribution. While required minimum distributions were waived in 2020 due to the coronavirus pandemic, they are once again required in 2021.

• The strategy may also lower your overall adjusted gross income and Medicare premiums, depending on your income.

• Using a QCD may be an effective tax strategy for individuals who are not able to itemize their deductions.

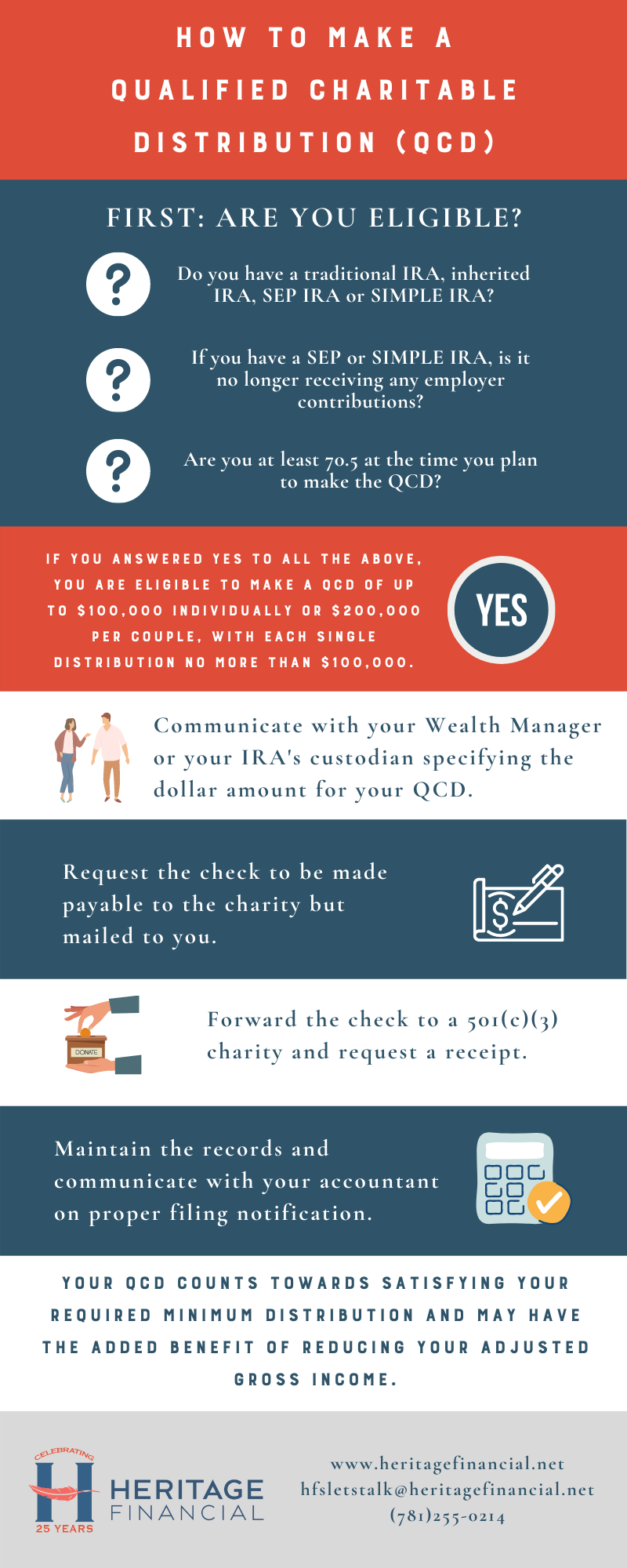

Not everyone is eligible for the QCD. You must be over 70.5 years old. You also must have a traditional IRA, inherited IRA, or a SEP or SIMPLE IRA that is no longer receiving employer contributions.

In addition, charitable gifts from your IRA cannot exceed $100,000 for individuals. Couples can gift up to $200,000, but each individual gift can be no more than $100,000.

Making a charitable donation from an IRA through a Qualified Charitable Distribution is easy but should be coordinated with your accountant. Read our infographic below for more information.

At Heritage Financial, we understand that making an impact is often an important wealth management goal. Over the last four years, we’ve helped our clients facilitate over $1 million in qualified charitable distributions. We coordinate closely with our clients’ accountants, estate planners, insurance professionals and other key advisors to deliver meticulous planning, investments and detailed wealth management. Interested in learning more? Let’s Talk.