This week we’re sharing a graphic about Earth Overshoot Day. Have you heard about it?

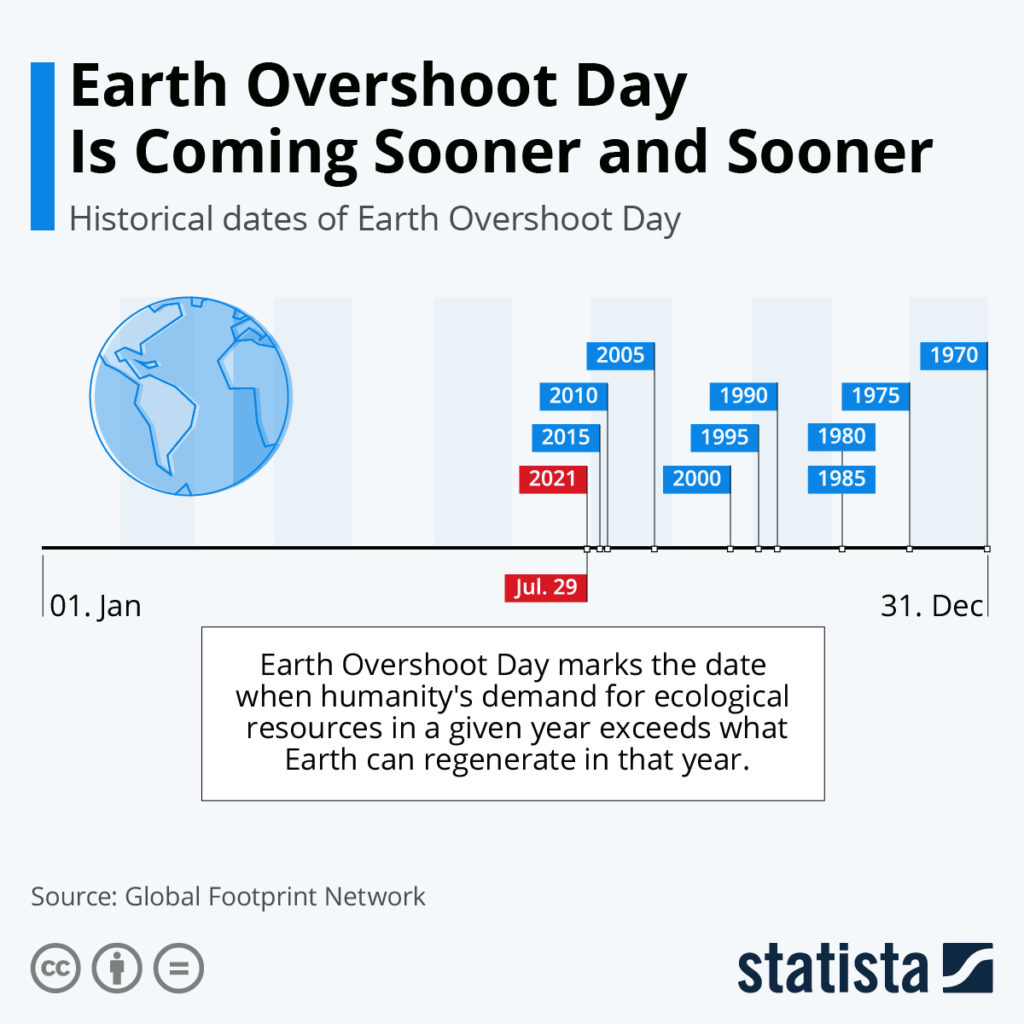

Like Earth Day, it’s a day to raise awareness about protecting the environment. Unlike Earth Day, which falls on April 22nd each year, Earth Overshoot Day falls on a different day each year. That’s because it marks the day each year when our collective demand for resources from the planet exceeds what the earth can regenerate in a year. And that bogey changes from year to year. It happens earlier and earlier.

Like Earth Day, it’s a day to raise awareness about protecting the environment. Unlike Earth Day, which falls on April 22nd each year, Earth Overshoot Day falls on a different day each year. That’s because it marks the day each year when our collective demand for resources from the planet exceeds what the earth can regenerate in a year. And that bogey changes from year to year. It happens earlier and earlier.

In 2021, Earth Overshoot Day fell on July 29th. Just 20 years ago, the day was marked in late September. Back in 1970, we made it all the way to December 30th before marking the day.

#MoveTheDate

It’s not a surprise that humans all over the world are making small changes to prevent Earth Overshoot Day from happening earlier and earlier each year. One of the changes that’s becoming more and more mainstream is pursuing sustainability through personal investments.

Investment portfolios that are managed with some level of environmental or social impact strategies now represent more than 30% of all professionally managed investments in the U.S.

And it’s not just large institutions that are driving this trend. Many individual investors are shifting their investment approach to incorporate sustainability in their portfolios.

It’s Becoming More Mainstream…But There Are Potential Pitfalls

Sustainability investing is a way to make an impact on the future of our planet. But if you aren’t strategic about how you approach it, you could be putting the success of your financial plan at risk by earning lower returns than what you need or exposing yourself to more investment risk.

It’s important to understand the tradeoffs that come with sustainability investing, so you can build a values-based portfolio that (1) makes an impact and (2) meets the needs of your financial plan.

Earlier this year Heritage Financial hosted a Sustainability Investing Webinar featuring Dimensional Fund Advisors’ Isabelle Williams. Isabelle highlighted three key tradeoffs that are important for investors to consider when incorporating sustainability strategies in their investment portfolio. Watch the short video below to learn those three key considerations. (Approximate viewing time: 1 minute, 30 seconds.)

Heritage Financial worked closely with Dimensional Fund Advisors and other sustainability investing leaders to create sustainable investment solutions that recognize and address these potential pitfalls. Our solutions cover both stock and bond investments, allowing us to work with a variety of individual investors that want to take a more sustainable approach to investing for their financial future.

Want to Incorporate Sustainability in Your Investments?

Already working with us? Reach out to your Wealth Management Team to learn more about how to incorporate sustainability in your overall plan.

If you don’t work with us yet, contact us to discuss our sustainability investing options and learn more about taking us for a test-drive to see if we would be a good fit for your financial goals.

Click here to access the full replay of our Understanding Sustainable Investing webinar.