The invasion of Ukraine by Russia in late February is adding fuel to already burning fires of inflation and volatility in markets. Below we lay out what’s unfolding under the surface, and discuss three strategies we’re using to navigate this environment.

Believe it or not, there was positive macroeconomic news in February:

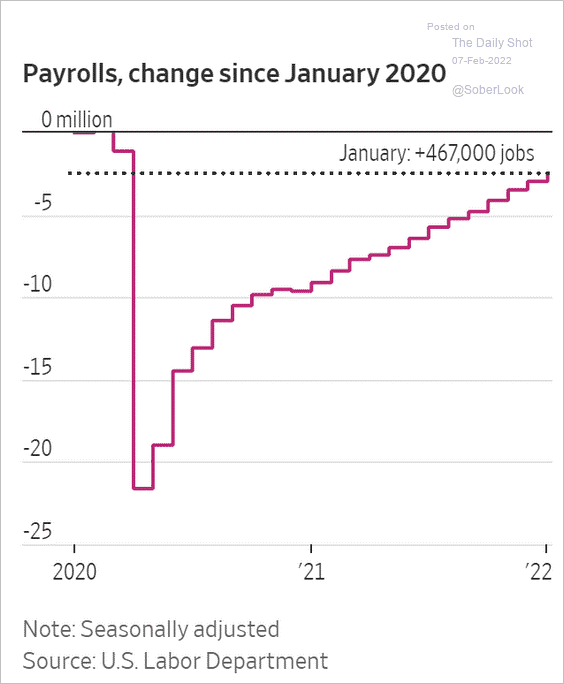

- The job market showed strength, gaining 467,000 jobs in January, more than three times the forecast of 150,000. The bulk of these gains came from the services sector, which added 440,000 new jobs. These positive trends were amplified by upward revisions for previous months’ numbers, too.

- Strength in consumer spending was another positive factor, as retail sales grew 3.8% in January. Given the central role of consumers in the economy, this strength bodes well for continued recovery.

- Further evidence of economic strength was provided by the S&P 500 showing 30.7% earnings growth for the fourth quarter of 2021.

Of course, concerns about inflation and the invasion of Ukraine by Russia led markets broadly lower for the month.

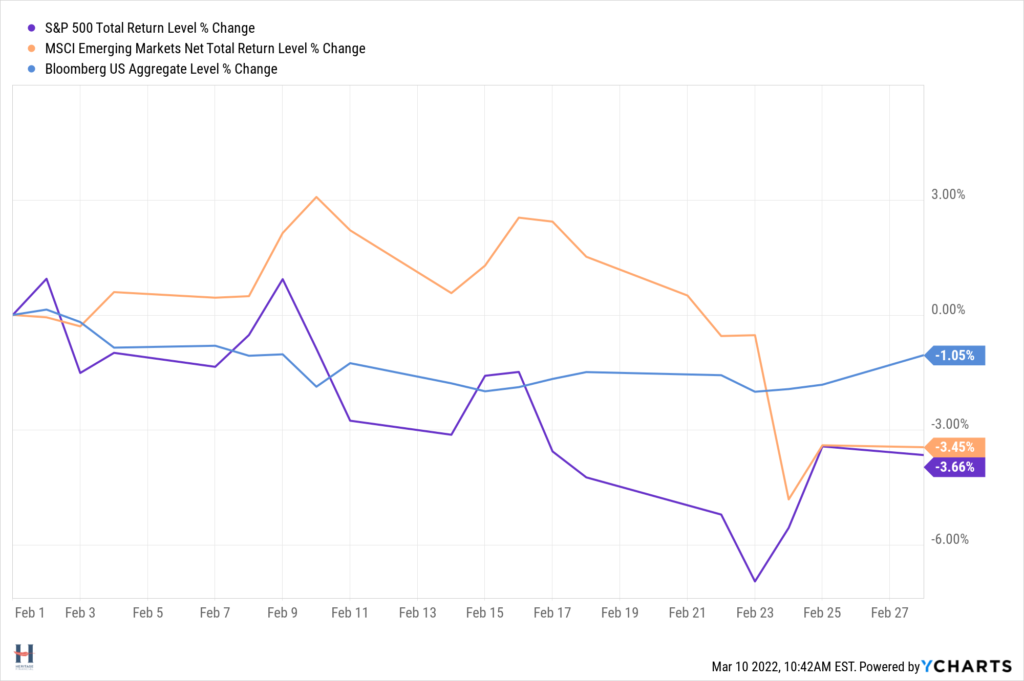

- Equity markets were broadly negative, with the S&P 500 and MSCI Emerging Markets index each down about 3% in February, while the small-cap Russell 2000 gained 1.1%.

- Fixed income markets were lower in the first half of the month as interest rates rose, recovering some ground later; the Bloomberg U.S. Aggregate index fell 1.1% in February.

Economic sanctions on Russia continue to pressure commodity prices and inflation globally.

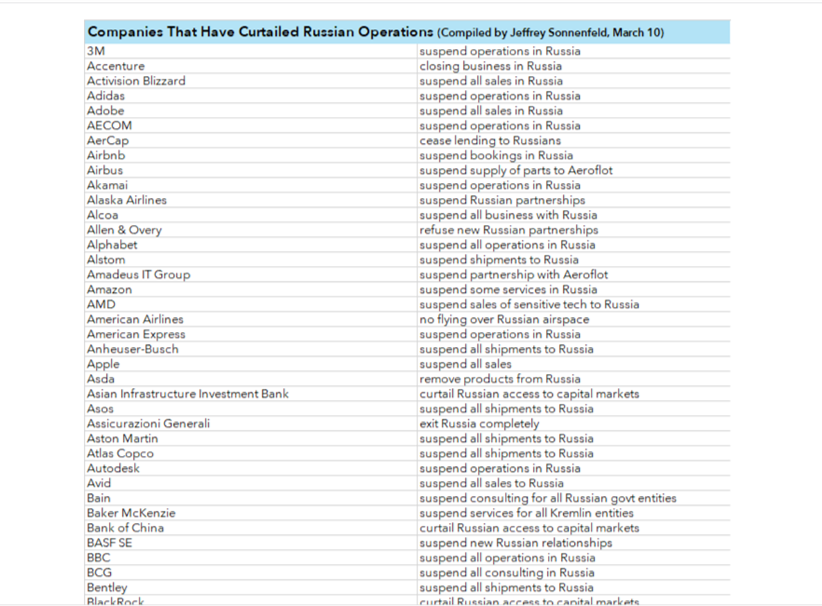

- More than 300 private companies have initiated sanctions on Russia since the invasion.

- Crude prices added to recent gains driven by uncertainty regarding sanctions on Russia, a major crude exporter. This pushed oil above $100/barrel, the highest level seen since 2014.

- Inflation came in at a 7.9% year-over-year pace for the month of February.

- Energy and real assets benefited from this acceleration in the prices of oil and other commodities.

- Further prospects of high inflation will be a factor in the Fed’s rate decision this week and in coming months, especially given uncertainty regarding Russia, elevated market volatility, and recent trends in commodity prices.

Source: Yale School of Management. For full list, see link in text.

As 2022 evolves, we believe the themes of inflation and market volatility will remain at the forefront.

In our view, investors would benefit by focusing on these key takeaways:

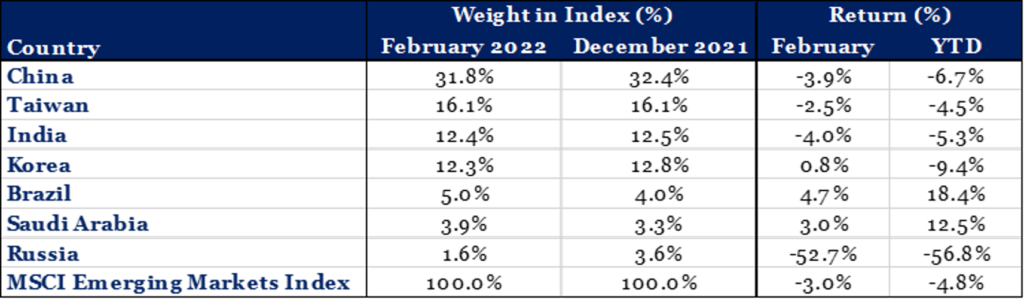

- Diversification: Although Russia is a major commodity supplier to the rest of the world, particularly Europe, its role in a globally diversified portfolio is muted. The drawdown in Russian equities led to a halving in its size in the MSCI Emerging Markets index. Additionally, index providers such as MSCI began discussing the removal of Russian equities from indices, given ongoing market closures that made them entirely illiquid.

Source: FactSet, Morningstar; as of 2/28/22

- Inflation protection: February’s inflation reading doesn’t account for the current level of oil prices. If those prices are sustained, it’s likely inflation climbs still higher from here before peaking. It’s important to have an inflation protection strategy in your portfolio. At Heritage, we’re using four distinct tools to address higher inflation. You can read more about our strategy in our blog post titled Four Tools to Protect Against Inflation.

- Have a plan: In our recent blog post, How Will the Russian Invasion of Ukraine Impact my Investments?, we detailed what we believe to be a prudent plan for navigating current geopolitical events and overall market volatility. It’s a plan that we’ve used successfully in past volatile markets. You can read more about it here.

We continue to adhere to the themes we discussed in our 2022 Outlook, namely, preparing for volatility and inflation, as well as policy makers walking a tightrope amidst an evolving landscape. Investing for the long-term in a volatile environment remains key, and our 10-year outlook and capital markets assumptions remain consistent with those outlined at the outset of this year.

If you think you could benefit from the strategies we are using with our clients, let’s talk.