This seems to be the newest question on investors’ minds. There are many factors to consider, including things like jobs and inflation – both of which can impact consumer spending. The Fed is also a key player here, considering the role they have in interest rate policy. Here’s how we are thinking about recession chances.

Let’s Start With Jobs

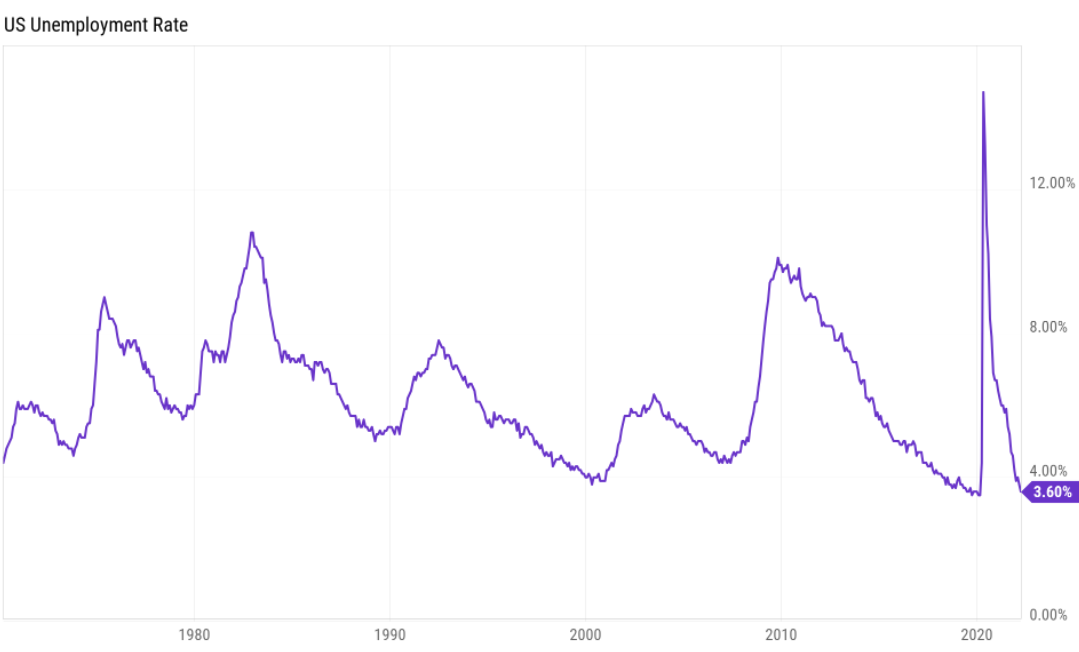

Last week we received the March jobs report which showed the unemployment level dropping to 3.6% from 3.8% in February. This is a new low since COVID started and brings us close to the pre-COVID low of 3.5%. Below is a chart of unemployment over the last 50 years. As you can see, a 3.6% level is a healthy employment market. We’ve only been at this level or lower for nine months in the last 50 years. The lowest level was 3.5% in January and February of 2020.

- Source: YCharts

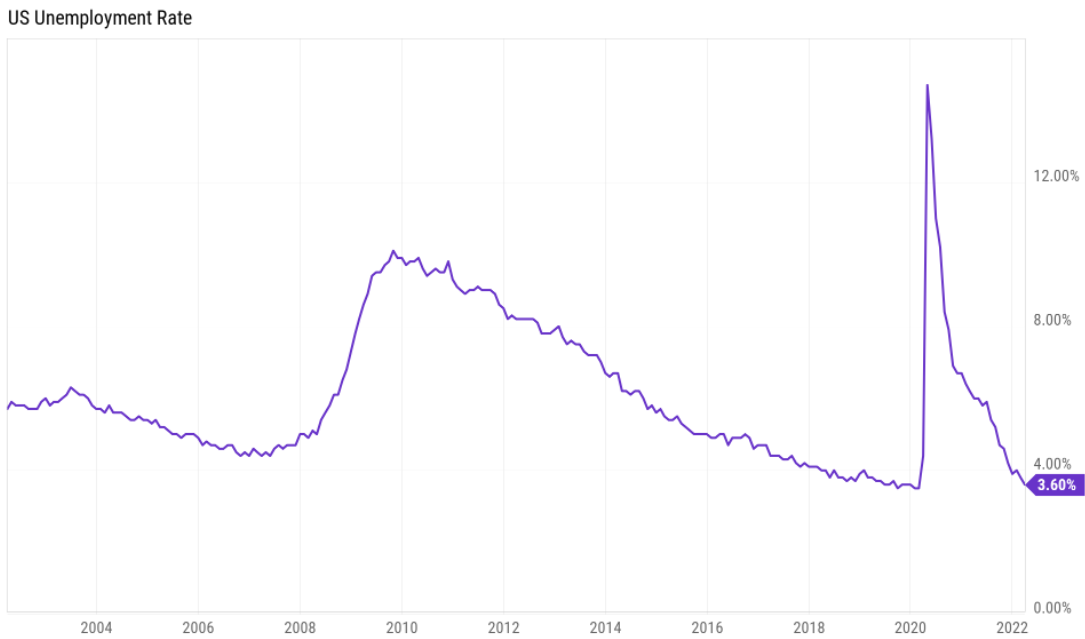

Below is the same data set, with a focus on the last 20 years. The pre-global financial crisis (GFC) unemployment rate was 4.4% in March 2007. Unemployment spiked during the GFC and didn’t get back down to 4.4% until March 2017, exactly 10 years later. The current recovery has been much quicker. (Note: the U.S. stock market rallied 40% from March 2017 until COVID started in 2020).

- Source: YCharts

A Word on Inflation

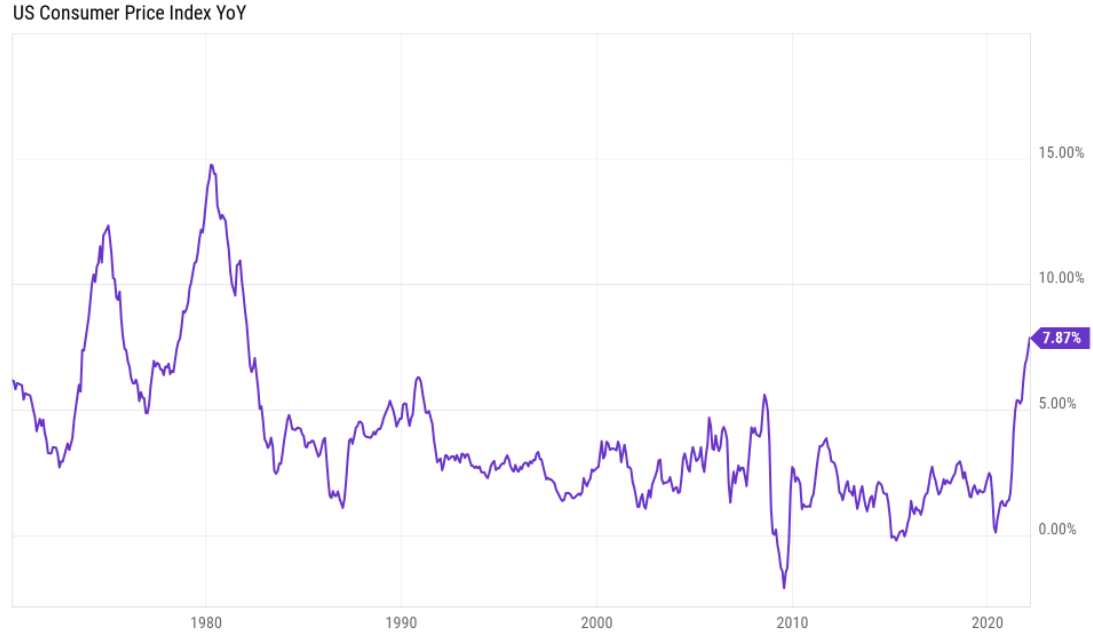

Moving on from employment, below is a chart of inflation as measured by the consumer price index (CPI). The most recent reading was on March 15th and came in at a 7.87% annual rate. This is the highest level since 1982.

- Source: YCharts

What the Fed Might Do

The Federal Reserve, led by Jerome Powell, controls monetary policy, mainly through the fed funds rate. A low rate promotes economic growth, allowing people and companies to borrow money cheaply. A higher rate slows down the economy and should put downward pressure on inflation.

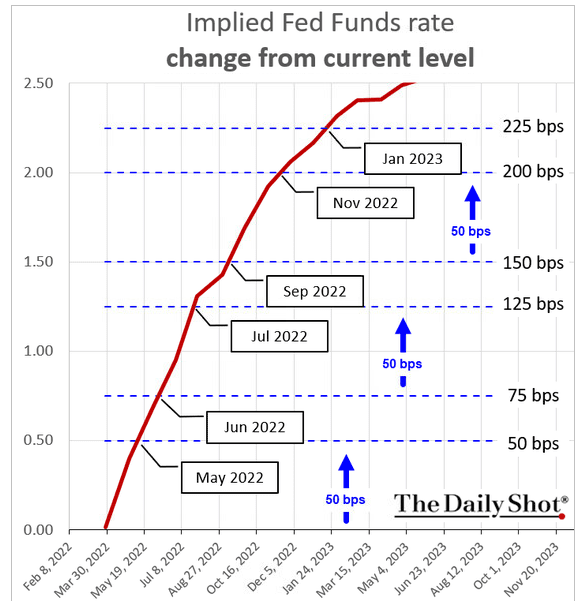

The Federal Reserve Act mandates that the Federal Reserve conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” We have a pretty clear setup now for an increase in the fed funds rate with employment being strong, inflation high (not stable prices), and the fed funds rate well below long-term averages. Below is a chart of market expectations for changes in the fed funds rate from current levels.

What does all of this mean?

You may have heard the term “soft landing”. The Federal Reserve is tasked with normalizing rates, slowing inflation all while maintaining a healthy economy and jobs market. If they are able to do this (a soft landing), we’ll see healthy economic growth. If they overshoot, we’ll head into recession. Either way, we should expect to see volatility as markets sort this out.

What are we doing?

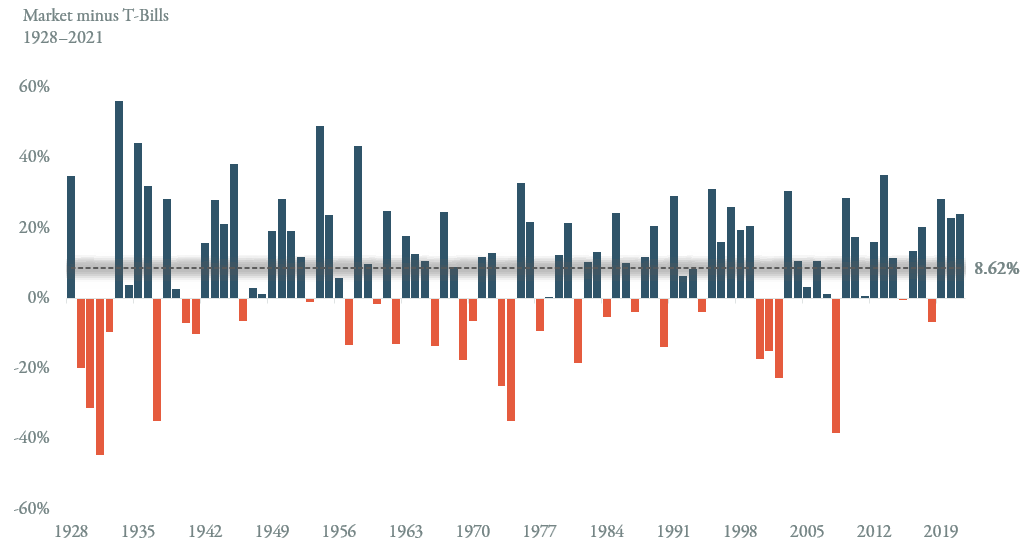

Stating it simply, we are keeping our client portfolios diversified because no one knows the future and because history shows us that stocks win over the long term. Below is a chart of the stock market premium (return of the stock market above or below cash) annually since 1928 (Source: Dimensional Fund Advisors).

Hear More Expert Insight

Later this week I’m hosting Schwab’s Chief Global Investment Strategist, Jeffrey Kleintop, to talk about interest rates, the Fed, chances for a recession, and what this all means for investors. It’s not too late to register to join us live this Thursday (4/7) at 11:30 AM EDT. If you can’t join us live, we’re happy to send you the recording so be sure to register even if you are busy this Thursday.