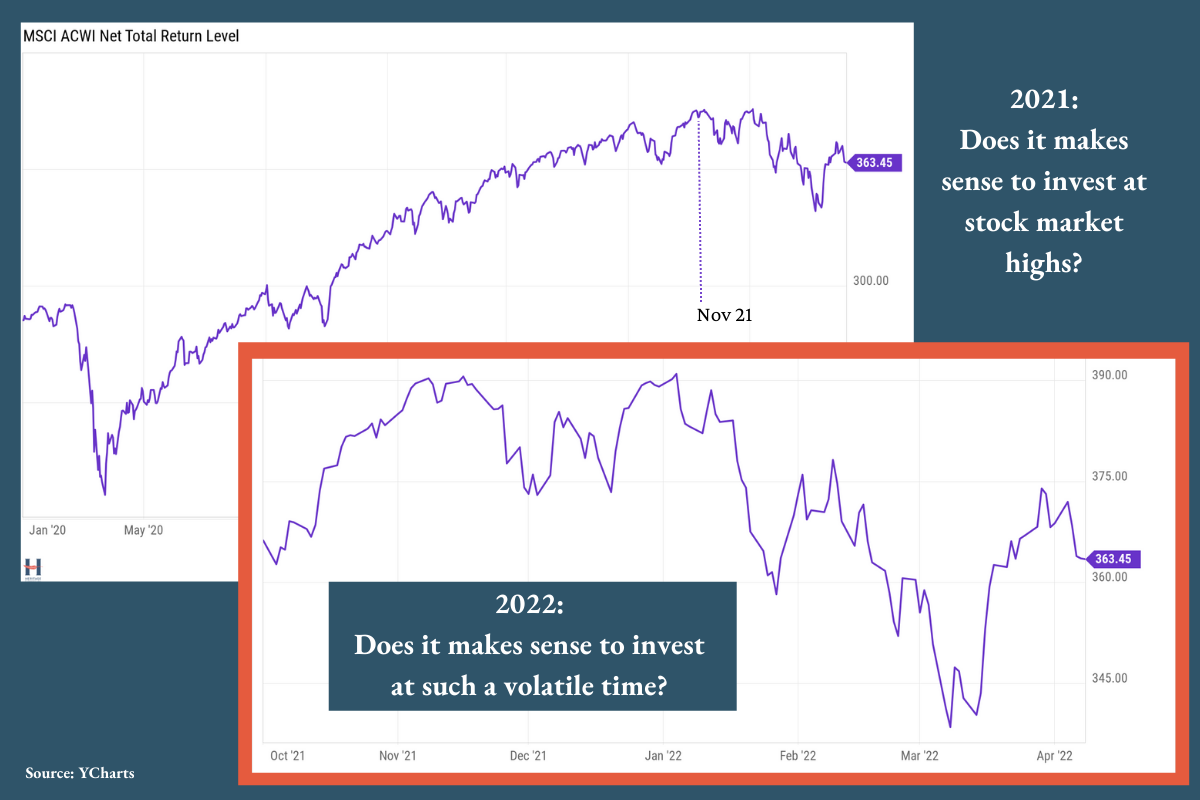

In late 2021, investors wondered if it made sense to put money to work in the stock market given that prices were at all time highs. Isn’t “buying high” a sure way to lose money?

Fast forward a few months, markets are down about 7% from those all-time highs, and some are questioning if it makes sense to be buying stocks now in the midst of all this volatility.

Should you avoid investing in stocks at market highs? What about during periods of volatility?

In our latest episode of Wealthy Behavior: Talking Money and Wealth with Heritage Financial, podcast host and President of Heritage, Sammy Azzouz, talks to Apollo Lupescu, PhD and Vice President at Dimensional Fund Advisors to help answer the question:

WHEN IS THE RIGHT TIME TO INVEST IN STOCKS?

Listen to the latest episode of Wealthy Behavior to learn:

- What typically happens next after stock markets hit an all-time high (you might be surprised),

- Whether dollar-cost averaging is better than investing all at once,

- The strategy that works better than trying to determine the right time to invest (if you are a Heritage client, you’re familiar with this strategy), and more.

Remember to subscribe so you don’t miss any new episodes, and catch up on these past episodes:

Minimizing Personal Risk and Liability to Protect Your Wealth