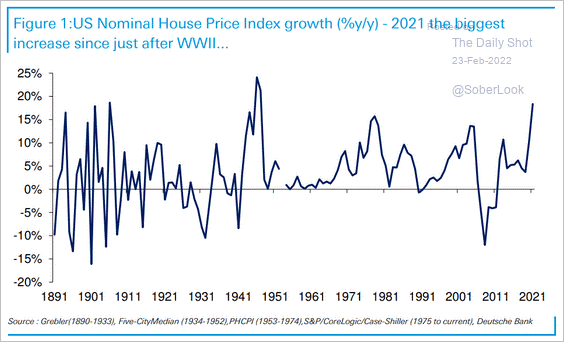

In 2021, home prices in the U.S. increased more than at any other time since World War II. That’s according to Deutsche Bank Research.

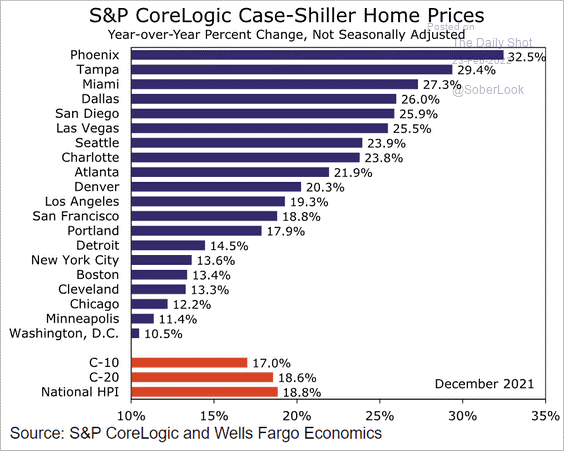

Major cities across the U.S. saw double-digit price increases ranging from 10-32%. While at the lower end of that range, Boston’s 13.4% increase was an all-time high.

Strong increases in real estate prices are good news for homeowners on the surface. But the reality is that you can’t really do much with those lofty gains unless you sell. And part of the reason prices are so high is because inventory is so low. Which begs the question, if you sell, where will you go?

Another reason to be wary of this seemingly good news is the stealth tax that may be due on the sale of your primary residence. Let’s say you can find somewhere else to live and you’re ready to lock in the current price of your house. Now you need to understand if you’ll be paying a tax on the gain that you are likely to have when you sell.

What’s So Stealth About This Capital Gain Tax?

Most people have sold real estate before and not had to worry about paying a tax on any realized gain. That’s because there’s an exemption on capital gains realized for the sale of a primary residence. Single filers can exempt $250,000 in gains, while those married and filing jointly can exempt as much as $500,000.

But that exemption was established in 1998. And the $250,000/$500,000 limits haven’t changed in more than 20 years. In contrast, house prices certainly have changed, particularly over the last two years.

What this means is that many more people are now faced with paying a capital gains tax if they sell their primary residence.

Thinking of Selling? Here’s What You Need to Know About This Tax

During our recent webinar, Stealth Taxes May Cost You At Tax Time, Heritage Director of Financial Planning, Ed Jastrem, CFP, addressed several stealth taxes. Listen to the 6 minute video below to hear his advice for how long-time homeowners with significant gains that are looking to sell should approach the process so as to manage their exposure to this tax.

As Ed mentions in the video, having a robust financial plan and detailed planning discussions with your financial advisor can highlight ways to minimize a potential gain when selling your primary residence. If you’re looking for guidance in this area, let’s talk.

More Resources for Taxpayers

Check out the full replay of our Stealth Taxes May Cost You At Tax Time webinar for tips specific to business owners and high income earners.

And, here are some additional resources:

Will my Beneficiaries Have to Pay Taxes on my Life Insurance Policy?

Qualified Charitable Contributions to Reduce Taxes on Required Minimum Distributions

Important Dates and Tax Figures for 2022