How to Financially Care for You, Your Kids, and Your Parents

As a parent, you have one of the most important jobs in the world—raising and encouraging the next generation. Parents in their 40s and 50s may find that they’re sandwiched between raising their kids and caring for older loved ones. This is the “sandwich generation”. If you are in it, you may be feeling the pressure of being stuck in the middle. In fact, a recent study suggests that almost half (47 percent) of adults are part of the sandwich generation.

You may feel compelled to provide care for your aging parents in addition to raising children. Maybe you don’t mind the added responsibility. But the financial planning needs of people in this position can be tremendous:

- Saving for college

- Preparing for your own retirement

- Covering your parents’ costs

Depending on how much care your kids or parents require, your income stream could be affected. That’s why protecting your own financial standings should remain top of mind. Finding that balance is, of course, easier said than done. Here are a few ways to ease the financial toll of the sandwich generation.

Tip #1: Build Your Support Network

Sometimes, people feel like they need to shoulder all the responsibility in caring for their elderly parents. You may be the oldest sibling in your family. Maybe you are considered the most responsible. Perhaps you simply live closest to Mom and Dad. But if you find that the caretaking is becoming too much for one person, it may be time to have a transparent and honest conversation with your siblings or other family members. They may not know just how much added responsibility you’ve taken on, and they may be just as eager to help.

Family members aside, it can also be beneficial to gather a team of financial professionals. Your financial advisor, for example, can help keep your financial priorities top of mind while also helping you develop a game plan for managing your caretaker responsibilities. Other professionals you may want to engage with include accountants, estate planning attorneys, insurance agents, and college planning professionals.

Tip #2: Keep Your Savings Goals in Mind

Remember, you cannot help others financially or otherwise if your own financial standing is in jeopardy. Trying to put a kid through college while caring for aging parents can drain your savings quickly if you aren’t careful. That’s why making your own financial goals a priority, though not easy, is important.

In fact, staying focused on your long-term financial goals (such as retirement) actually protects your own kids. Emptying your retirement accounts early or neglecting to save enough for retirement could leave you in a bad spot later in life. In turn, your children may find themselves providing for you financially while they’re raising kids of their own. Remembering to prioritize your long-term goals now can help set you, your children, and your grandchildren up for a less stressful financial future.

Tip #3: Create Boundaries for Your Children

If your kids are college-age or older, you may be able to set financial limitations with them. This won’t be easy, but it may be necessary in certain circumstances. If they don’t already work, encourage them to find a part-time job. And if they’re already earning an income, help them develop a budget and become as self-sufficient as possible. You may even find that, when presented with the opportunity, your kids are able to rise to the challenge and learn good money habits from being less financially dependent on their parents.

If your kids are younger, start working with them to understand the importance of saving versus spending. That way, when they’re old enough to start earning money of their own, they’ll be well prepared to work toward financial independence from you.

Tip #4: Consider a Long-Term Care Policy

A long-term care insurance policy can cover a number of expenses that are not typically covered by health insurance. These could include assistance with activities of daily living (ADLs), such as bathing, dressing, and eating. Care may be provided wherever your parents are living, whether at home or in a nursing or adult day care facility.

A long-term care policy is typically bought when individuals are in their 50s or 60s, as a policy can’t be obtained once a person has been diagnosed with certain debilitating conditions or diseases. Depending on your parents’ health, you may still have time to purchase a policy. If not, you may want to look into obtaining a policy for you and your spouse if you’re concerned about your own future care needs.

In addition to traditional long-term care policies, certain hybrid policies blend life insurance with long-term care insurance. Also, some life insurance policies may allow for accelerated benefits for the chronically ill, effectively accessing the death benefit before death to pay for care.

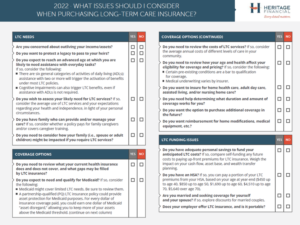

There are many issues to consider when purchasing a long-term care insurance policy. Coverage options, tax implications, and how to pay for it are all important considerations. Check out our comprehensive checklist of Long-Term Care Considerations to get an idea of what you need to think about.

What to do if you are feeling the stress

Protecting yourself, your parents, and your kids requires careful strategizing, discipline, and planning. It’s a balancing act, but it’s one you don’t have to perform alone. Boston-based Heritage Financial can help. With an initial discovery call, we can begin to assess where you are at and what your most pressing concerns are, and discuss a strategy for reviewing how to best prioritize your financial goals. And we can help you navigate the myriad of considerations you’ll want to think about before purchasing any type of insurance coverage. If you are ready to get some help from our highly credentialed wealth management teams, Let’s Talk.