Most if not all Americans celebrate Labor Day. Many don’t know that it’s a celebration of the social and economic achievement of workers in the U.S. Rather, the day is more often a marker for the unofficial end to summer.

At Heritage Financial, we believe you can’t celebrate the achievements of labor in the United States without recognizing the more than 30 million private businesses in existence. They are often owner operated and built on blood, sweat, and tears. These business owners are responsible for more than 60% of the job creation in the U.S. And the majority of their personal wealth is illiquid, tied up in their business.

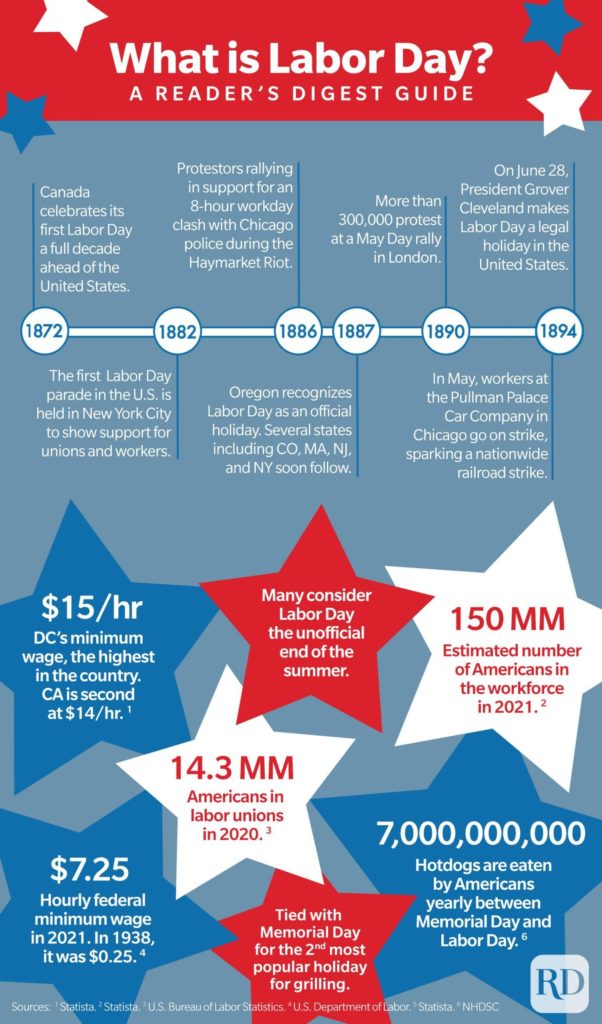

This week we salute all workers in the U.S., with some interesting and fun facts about the history of Labor Day. More importantly, we thought this was an appropriate time to introduce our upcoming series of special blog posts for our business owner clients, friends, and partners. Read more below about the resources we’ll be sharing over the coming weeks.

At Heritage, we work with many business owners

We know first-hand that without a clear exit strategy, many of these owners will have trouble unlocking the wealth in their business when the time comes to transition into retirement.

Over the course of our 25 year history, we’ve acquired significant experience helping business owners save and plan for the future during their working years, and transition to retirement by selling or other means when they are ready.

And we are going to share our insight on this topic over the next several weeks right here on our blog.

Next week, we’ll share what to do if someone has made you an offer to buy your business

We’ll address:

- whether it’s a seller’s or buyer’s market right now

- the four things you should do right away if you get an offer

- five things you need to do if you decide to move forward with a buyer

At Heritage Financial, the mission of our labor is clear:

To make a positive and lasting financial impact on the people in our lives and those we serve.

If you are a business owner, you won’t want to miss the resources we’ll be rolling out. Click here to subscribe to our blog if you aren’t already. And if you have specific questions about planning your exit strategy, contact us directly.