While there is no such thing as an average bear market, with history as a guide, our 10-month-old bear market is likely closer to its end than its beginning. Let’s take a look at how bear markets typically unfold.

Index prices can be broken down into two primary components, earnings per share (EPS) and multiples. EPS is the economic value created by businesses and what investors are buying. Multiples are how much an investor is willing to pay for those earnings. Multiples are often driven by sentiment and are one of the first things reflected in prices. Corporate earnings on the other hand are backward-looking. Moreover, the impacts on businesses from higher interest rates and/or slowing demand takes time to appear in financial statements. Therefore, the typical pattern of bear markets is multiples contract first leading the market lower, followed by earnings.

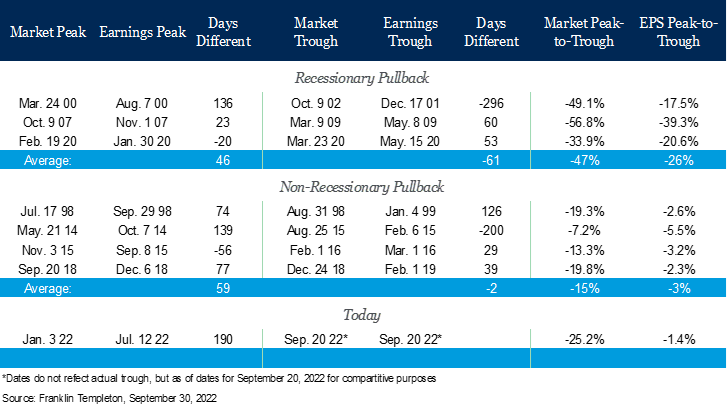

This has certainly been the case in 2022 as multiples account for more than 100% of the pullback as earnings have been positive in 2022. The question remains, what role will earnings play in the market bottoming this time around? As shown below, there is a meaningful difference in the earnings impact in recessionary vs non-recessionary environments. Our expectations remain that if we are not already in a recession, should one take place, it will be a modest and cyclically led recession rather than one driven by structural imbalances like during the Global Financial Crisis or an exogenous factor like COVID-19.

With that in mind, second and third quarter earnings are beginning to reflect this modest economic contraction. In fact, Q2 earnings ex-energy were down -4.0% (up 6.2% with energy) and with 91% of the S&P 500 having reported Q3 earnings as of November 14, 2022, earnings ex-energy were down another -3.2% (up 5.4% with energy).*

Why ex-energy? Russia’s invasion of Ukraine propelled commodity prices up, pushing earnings for the sector up 141% as of November 14, 2022. The boon for energy is unique to the space and is not reflective of the rest of the market. All in, earnings are beginning to reflect the economic reality of a moderating economy in 2022. This is a healthy step forward for a bear market bottom and again suggests we are nearer the end than the beginning.

Finally, what role does the Fed play in all of this? To no surprise, given the Fed focus this year, an important one in our view. History has shown us markets tend to bottom after the Fed is done raising rates. Intuitively this makes sense. If the Fed is raising rates, they are proactively looking to cool economic activity. Yet given their dual mandates of price stability and full employment, the operative word is cool not kill. When the Fed sees modest success in controlling inflation they will stop or pause. However, the full effect of higher rates takes some time to work through into businesses and markets. It is a bit like turning the shower handle to change the temperature: you have to wait a second to see if you got it right. Therefore, businesses are often amidst contraction when the Fed is stepping back. It is certainly conceivable that the market bottoms before the Fed officially stops increasing interest rates as it tapers back from 0.75% moves to 0.50% or less. However, the market is less likely to bottom if the Fed is accelerating or maintaining its hawkish stance.

Our Outlook

The good news for markets is many of these conditions have been met or are near. Multiples, especially those abroad, reflect real pessimism and are priced for dire outcomes. Earnings are beginning to reflect reality and this source of volatility, as we warned in our 2022 outlook, is a healthy step forward to finding a bottom. Finally, the Fed has been on the most aggressive rate path in multiple decades. We, like all investors, do not know precisely when they will stop. However, we know they will stop and when they do it adds greater confidence and markets will once again begin to rise. As we do each year, we will expand upon these views and more in our 2023 outlook which will be released in the coming weeks.

- Perspective can go a long way to successfully navigating periods of volatility. Our Bear Market Field Guide provides some enduring wisdom we can share having invested through bear markets and as students of history.