Is the U.S. in a Recession?

It depends on who you ask. Yes, even the experts can’t agree on the answer to this question. It’s just another sign of the times we are living in today.

At Heritage, our team believes the U.S. is more likely than not in a recession. But we encourage our clients not to get caught up in concerning themselves or debating others on this point. The truth is that knowing for sure where the economy is in the cycle provides context. But it probably doesn’t matter much more than that in terms of your investments and your financial plan.

Here is the reality for long-term investors:

- The economy and markets are related, but not directly overlapping.

- Markets peak before economic output does (on average, 7 months before) and bottom before economic troughs (on average, 4 months before).

- Economic data, like GDP, is slow to be released and backward looking, making it less useful for investing purposes.

- Given all this, even if anyone could time recessions for investing purposes, they would be timing the wrong thing.

Are All Recessions the Same?

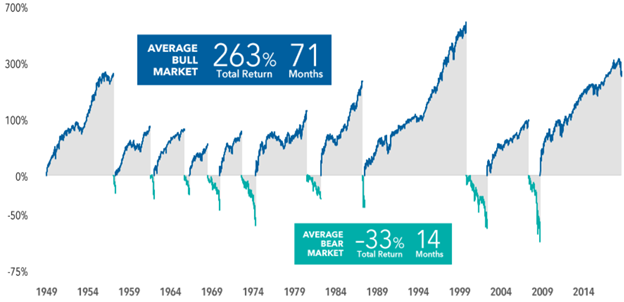

We have been conditioned to think of recessions as large, protracted events that have an extreme effect on the market. That’s probably because the last three recessions (COVID, Global Financial Crisis, and Tech Bubble) were extreme. From an investing perspective, the S&P 500 was down 49% during the tech bubble and 57% during the Global Financial Crisis. However, these recessions were impacted by other exogenous factors like high leverage, overburdened consumers, bank failures, etc. Such external inputs are not as obvious today or may not even exist. In contrast to the last three recession and bear market scenarios, the potential for a 1980’s Fed driven type recession in which markets declines are less severe – say in the 20% – 30% range – seems more likely. And, remember, at it’s low point in mid June, the S&P 500 was already down more than 23%.

Simply put, we shouldn’t jump to the conclusion that a current day recession has to go hand-in-hand with an investing environment that looks like the global financial crisis.

If We Are in a Recession, Now What?

Markets are forward looking. So what should long-term investors focus on if we are indeed in a recession today? In our opinion, the big takeaways are to stay invested and stay diversified.

Since 1990, stocks have outperformed bonds by more than 30% on average in the 12 months following a recession bottom. Small cap stocks tend to outperform large cap stocks in these periods, and emerging market stocks have done better than developed market stocks. And 75% of the time international stocks have earned more than U.S. stocks, though factors like valuations, the strength of the dollar, and commodity cycles are also a consideration. [Source: Fiducient Advisors]

Remember, recessions are a regular and healthy part of markets and the economy. In these times, volatility is high. Your best course of action is to stay disciplined, focused on the long-term, and seek only to make changes if your true underlying circumstances compel you to do so, not because the market is uncomfortable.

For more on how to recession-proof your finances:

- Check out these ideas from Heritage President, Sammy Azzouz, JD, CFP

- Join us to hear our Investment Team’s outlook for the rest of 2022 on September 13, 2022. You can register for the webinar here.

In closing, we think these wise words from our partners at Fiducient Advisors sum it up perfectly:

“Recessions and the bear markets that often accompany them are points in time. Bull markets and the wealth gained from them happen over time.”