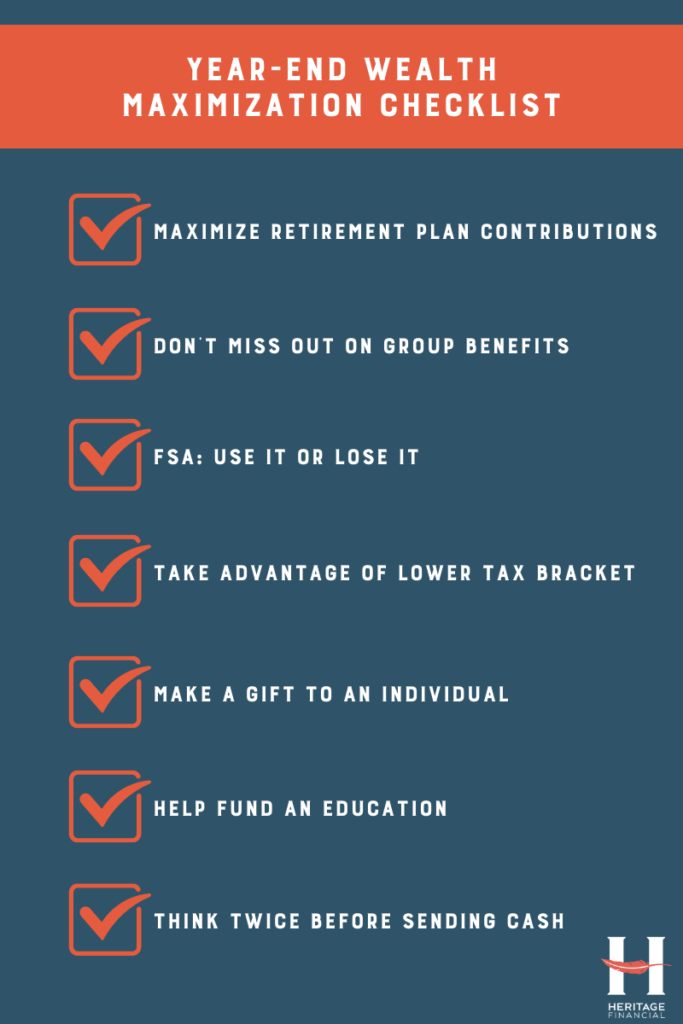

With less than two months to go until the end of 2021, here are seven strategies you can use to maximize your wealth as the calendar year comes to a close.

Maximize Retirement Plan Contributions

Maximize Retirement Plan Contributions

There’s still time to max out contributions to 401(k), 403(b) or other tax-deferred savings plan. The 2021 limit on employee elective contributions to 401(k), 403(b) and 457 plans is $19,500. If you are age 50 or older this year, you can make an additional catch-up contribution to most plans of $6,500 to reach $26,000 total. If you changed jobs during the year, make sure you coordinate the total contributions to not over or under contribute.

Make Sure You Aren’t Missing Out on Group Benefits

Many employees have an open-enrollment period for group benefits at year-end. While the focus tends to be on health insurance options, other benefits such as disability insurance, life insurance, and discount or wellness programs shouldn’t be overlooked. Higher earners should pay particular attention to available pre-tax benefit plans such as Flexible Spending Accounts or Health Savings Accounts.

Use It or Lose It

If you use your employer’s Flexible Spending Account, you may need to use up any remaining balance by year-end or risk losing what you saved. Some employers extend a grace period for submitting expenses. Others may allow you to rollover some of your account balance. Know the rules that apply to your plan, so you don’t lose what you saved.

Take Advantage of a Lower Income Year

If you find yourself in a lower tax bracket for 2021, consider taking advantage of strategies to benefit from your circumstances. There may be an opportunity to realize some long-term capital gains with zero tax liability. Converting an IRA to a Roth IRA or withdrawing earnings from a tax-deferred account may also be effective ways to manage income taxes if you expect to be in a higher bracket in the future.

Consider Gifts to Individuals

You can gift up to $15,000 a year to as many people as you choose ($30,000 if you and your spouse both make the gift) without any gift tax consequences. You can also make payments of tuition or medical costs on behalf of another person if the payment is made directly to the billing institution. Taking advantage of gifting opportunities reduces the size of your taxable estate. With the possibility of the federal estate exemption reverting to a lower figure, gifting assets now could lead to estate tax savings in the future.

Help Fund an Education

529 Savings Plans offer a tax-favored way to invest in education. If you are funding 529 savings plans for children, grandchildren or others, those contributions count as gifts toward your $15,000 or joint $30,000 annual exclusion per recipient. There is also a special strategy called “superfunding” that allows up to 5 times the annual gift exclusion for contributions into 529 plans without using any of your lifetime gift or estate tax exclusion. Wondering how this works? Ask us here.

Think Twice Before Sending Cash

Sometimes there are more tax-efficient ways to give to charity than cash. Giving gifts of appreciated stock, using a Donor Advised Fund, or making a Qualified Charitable Distribution from an IRA are all strategies that allow you to share your wealth while benefitting from tax-savings at the same time. Completing charitable gifts before calendar year-end may require paperwork and communication with your tax advisor. If you have questions, we can help.

There are many strategies for serious investors to maximize their wealth.

Don’t worry. You don’t need to be an expert.

You just need to have an expert on your team.

If you are a client of Heritage Financial, we’ve got you covered. We will be reviewing these options with you as the year comes to a close. Just make sure to update us on any changes to your professional relationships (accountants, estate attorneys, insurance professionals). You’ll also want to share your most recent tax returns with us.

If you aren’t a client of Heritage Financial yet but wondering how you might maximize your wealth by using some of these strategies, let’s talk.