The Internal Revenue Service announced annual inflation changes to tax brackets, annual exclusions for gift and estate taxes, FSA limits, and more for 2023. The announced adjustments will be welcomed by most American’s who are feeling the harsh effects of record inflation. We’ve provided a few highlights of the release below. More detail on all the IRS tax inflation adjustments for 2023 can be found at www.irs.gov.

- The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from 2022. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

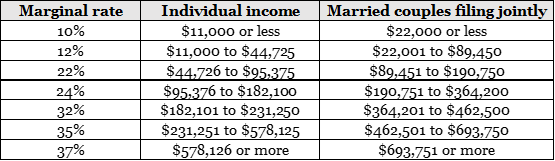

- Tax rates remain unchanged, however, the income limit for each tax bracket has changed, meaning your top tax rate may have decreased.

- The annual exclusion for gifts increases to $17,000 for calendar year 2023, up from $16,000 for 2022.

- Employee salary reduction contributions to health flexible spending arrangements increases to $3,050. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $610, an increase of $40 from taxable years beginning in 2022.

- Estates of decedents who die during 2023 have a basic exclusion amount of $12,920,000, up from a total of $12,060,000 for estates of decedents who died in 2022.

With the estate tax exemption level at an all-time high and the likelihood that it will be cut dramatically in 2026 to approximately $6.4 million ($12.8 million per couple), there’s an immense planning opportunity for wealthy couples that have or can be reasonably expected to have assets in the range of at least $15 million or more. Heritage Financial Founder and CEO, Chuck Bean, shared this opportunity on Forbes.com

Retirees receiving Social Security are in for an added bonus, last week the Social Security Administration announced an 8.7% cost of living adjustment (COLA) – the largest increase in 40 years. Additionally, the Social Security wage base increased for 2023 to $160,200, up from $147,000 in 2022. This means those currently employed will pay Social Security taxes on more of their earnings to help pay for the increase in retiree benefits.

If you are nearing Social Security age, here’s a resource to help you review your options.

Keeping up with the constant tax changes can be difficult and time consuming. It’s never too early to start tax planning so you can keep as much of your hard earned dollars as possible.

- We’ve consolidated all the important dates and financial figures individuals and business owners need to know for 2023.