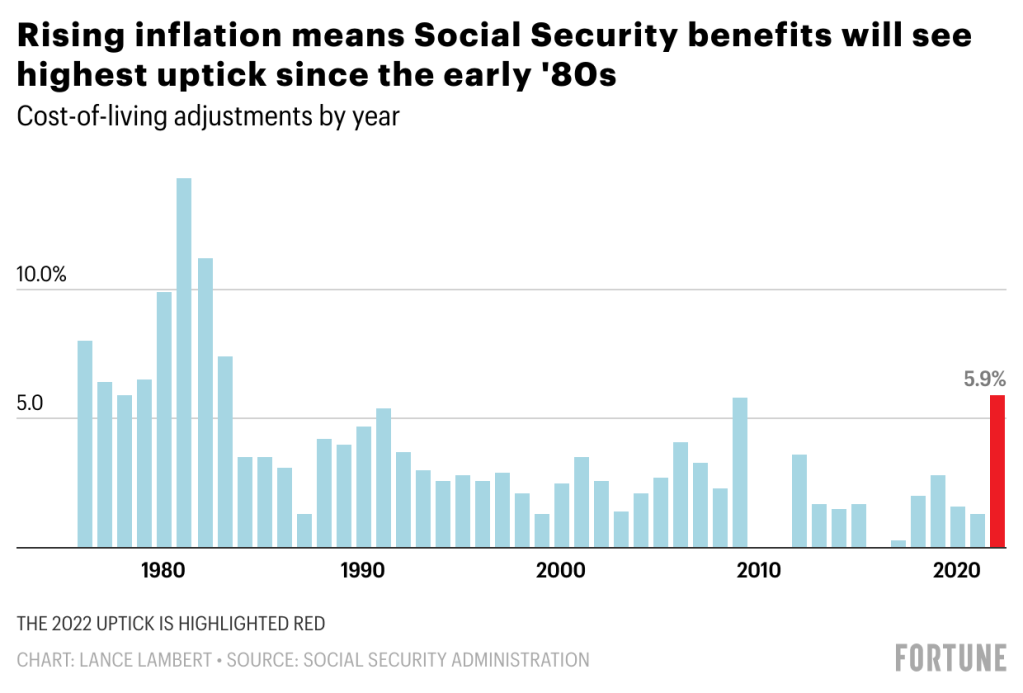

Social Security benefits will be 5.9% higher in 2022. This is the biggest cost of living adjustment (COLA) since 1982.

The good news is, the check in the mail is going to be higher next year.

The good news is, the check in the mail is going to be higher next year.

Is there bad news?

Maybe. Social Security benefits are only going higher because inflation is higher. So while it’s nice to think about getting more in your monthly check, what you spend that check on is likely going to cost more too. It’s best not to think of this as a “raise”.

Along the same lines, Medicare Part B premiums are also expected to see an increase. These premiums are deducted from Social Security payments.

So at best, for those receiving Social Security checks, the increase may end up close to a wash after higher expenses.

For those still paying into the system, there is some bad news. In 2021, the first $142,800 of your annual wages are subject to Social Security taxes. Starting in 2022, you’ll be paying Social Security taxes of 6.2% on the first $147,000 of your employment income.

It all comes back to inflation, which is something we really haven’t had to deal with in the U.S. for a long time. So, it makes sense to ask:

Is Inflation Here to Stay?

This really says it all. We are feeling rising prices everywhere. How long will this last?

This really says it all. We are feeling rising prices everywhere. How long will this last?

The U.S. Federal Reserve Board is tasked with ensuring price stability (keeping inflation in check). The Fed has shared for months their feeling that higher prices are temporary and a result of a reopening economy. On the surface, this makes sense. As the world comes out of the global pandemic, there is pent-up demand being unleased at the same time that supply is slowly coming back on line. More demand than supply equals higher prices.

But there are increasing concerns that higher prices could be around for longer. The Fed has even started to imply that inflation may likely be higher and around longer than they originally anticipated.

How do I protect my money?

At Heritage Financial, we’re watching inflation closely. Our investment team views unexpected inflation as a risk to take seriously. It impacts not just our clients’ investments, but also their long-term financial plans.

It’s impossible to predict exactly how long this higher level of inflation will stick around…and whether it might actually move even higher from here. But there are actions you can take now to position your finances to weather an unexpected environment of higher prices.

Read Four Tools to Protect Against Inflation to learn more.

And mark your calendar to hear thoughts about inflation from our Chief Investment Officer, Bob Weisse and Research Director, Global Public Markets for Fiducient Advisors, Brad Long. They’ll be digging into the impact of inflation, interest rates, new legislation and potentially higher taxes on the current market and economic recovery on Tuesday, November 9th at 11:30 am EST. And don’t worry if you aren’t local to the Boston area. This conversation will be vitrual…all you have to do is register and we’ll send you the link to listen in live. And if you can’t make it live, register anyway and we’ll send you a link to listen to the replay at your convenience.

Register for the 11/9 webinar with Bob and Brad: What’s Next for the Recovery and Bull Market?