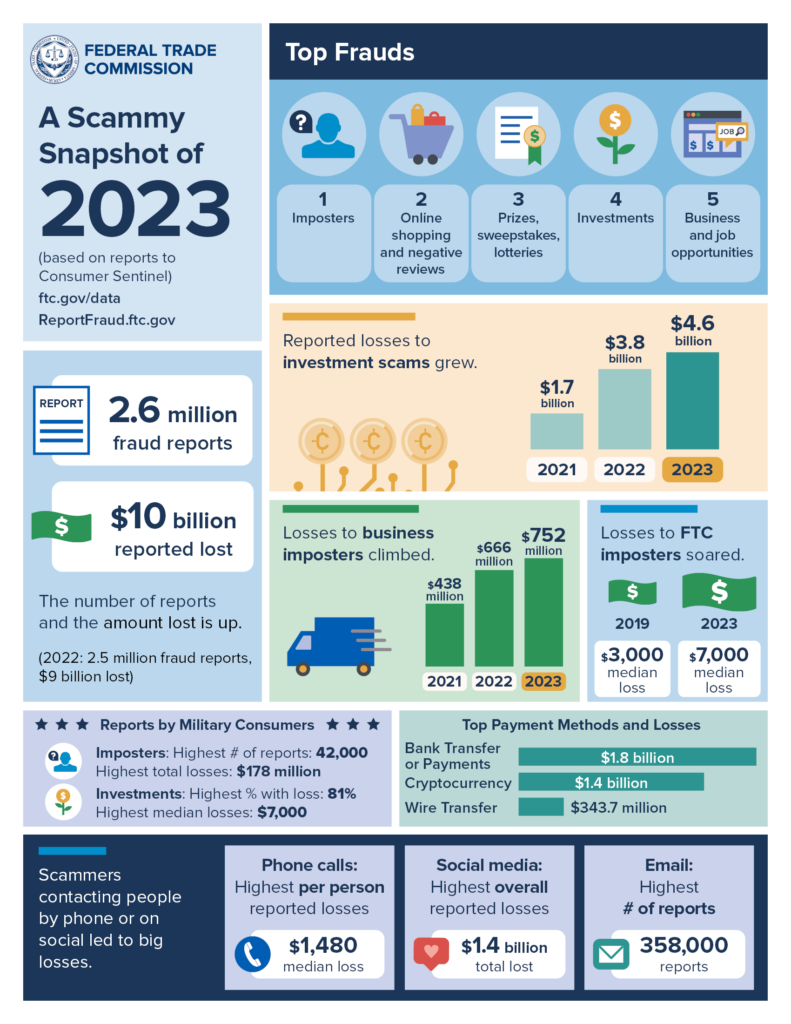

More than $10 billion was reported lost to fraud and scams in 2023. This marks a record high and a 14% increase over reported losses in 2022.1

Of the various types of fraud, imposter scams remained the top reported fraud category. Imposter scams include people pretending to be your bank’s fraud department, the government, a relative in distress, a well-known business, or a technical support expert. And consumers reported losing more than $4.6 billion to investment scams—more than any other category.

Fraudulent activities are becoming increasingly prevalent—one in four people reported losing money to scams in 20231. If you become a victim, here are steps you should take.

- Call your Heritage Wealth Manager and Schwab Fraud immediately at (1-877-862-6352) so that they can watch for suspicious activity and collaborate with you on other steps to take

- Change all passwords (i.e., email, sites with personal information)

- Use strong and unique passwords with a combination of numbers, symbols and upper-and lower-case letters for each website

- Consider using a password management system like Keeper or 1Password.

- Enable 2-factor authentication on accounts, if available.

- Freeze credit with all 3 credit bureaus.

- Equifax: #1-800-685-1111

- Experian: #1-888-397-3742

- TransUnion: #1-888-909-8872

- Consider Norton 360/Lifelock, or a similar identity theft prevention service

- Contact Bank/Credit card companies for new account numbers and to lock current credit cards

As fraudulent activities become more sophisticated and costly, it’s imperative to remain vigilant and use proactive strategies to safeguard your financial well-being. Here are some tips to help lower your risk of becoming a victim of fraud.

1. As Nationwide Fraud Losses Top $10 Billion in 2023, FTC Steps Up Efforts to Protect the Public