At Heritage Financial, our Investment Team feels the U.S. is likely already in a recession or will be entering one soon. With that in mind, our financial planning and investment teams have gathered several tips to help you recession proof your finances.

Let’s start with three tips from Sammy Azzouz, President at Heritage Financial. Sammy shared several recession-proofing tips in this blog post. Here are our favorites:

1. Maintain Emergency Reserves

A rainy-day fund protects you from going into debt or selling long-term investments at a loss to cover emergency expenses. The Certified Financial Planner Board of Standards recommends maintaining three to six months of living expenses in cash. Target a larger cushion if your income is volatile, if you have less job security, if you are in a non-essential service industry that may take a hit if people stop spending, or if you have larger financial obligations.

2. Establish Lines of Credit

Beyond your rainy-day fund, having lines of credit to tap into for emergencies is a great way to recession proof your finances. One of the most common sources of credit lines available to individuals is a home equity line of credit (HELOC), which allows you to borrow against your home equity. If you have meaningful equity in your home and good credit, you can possibly get a line of credit worth as much as 85% of your equity.

Learn more about how HELOCs work. And if you already have a line but your home equity has increased given higher home prices, take the time to reapply for a new HELOC and increase your emergency borrowing power.

3. Review Monthly Expenses

We’ve all been feeling the pain of inflation. Have you revisited your budget to account for today’s higher costs? All smart investors should track their spending, re-evaluate and cut the easy things out, and some people have more work to do than others. If you don’t have a rainy day fund established, are worried about job security or loss of income, review your monthly expenses and adjust unnecessary spending. Save those dollars today so you are better prepared to handle change.

If you don’t have a budget, or haven’t reviewed your budget in a while, our budget worksheet can help you.

How will a recession impact my investments?

How to best recession proof your portfolio has a lot to do with what stage of life you are in.

If you are saving your money for the future, we consider you an Accumulator.

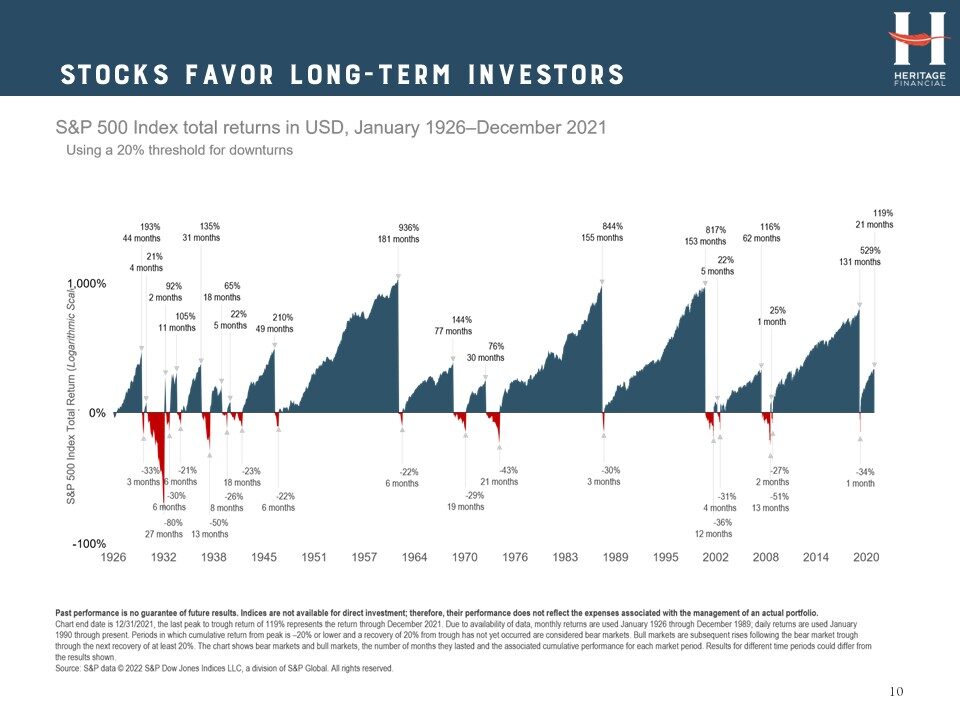

Looking at S&P 500 Index returns back to 1926 stocks favor long-term investors. There are stretches of bull and bear markets, but in the long-term stocks are a good investment if there is time on your side.

We all know we should buy low and sell high, that sounds great but it’s harder to execute. So while we do not recommend trying to time the markets, if you have extra cash we recommend investing it during downturns when you can buy quality stocks at a discount. Who doesn’t love a sale?! While it may not be a smooth ride in the near-term, long-term historical trends tell us you’ll be glad you did.

If you are living off your investments and the money you’ve saved throughout the years, we consider you a Spender.

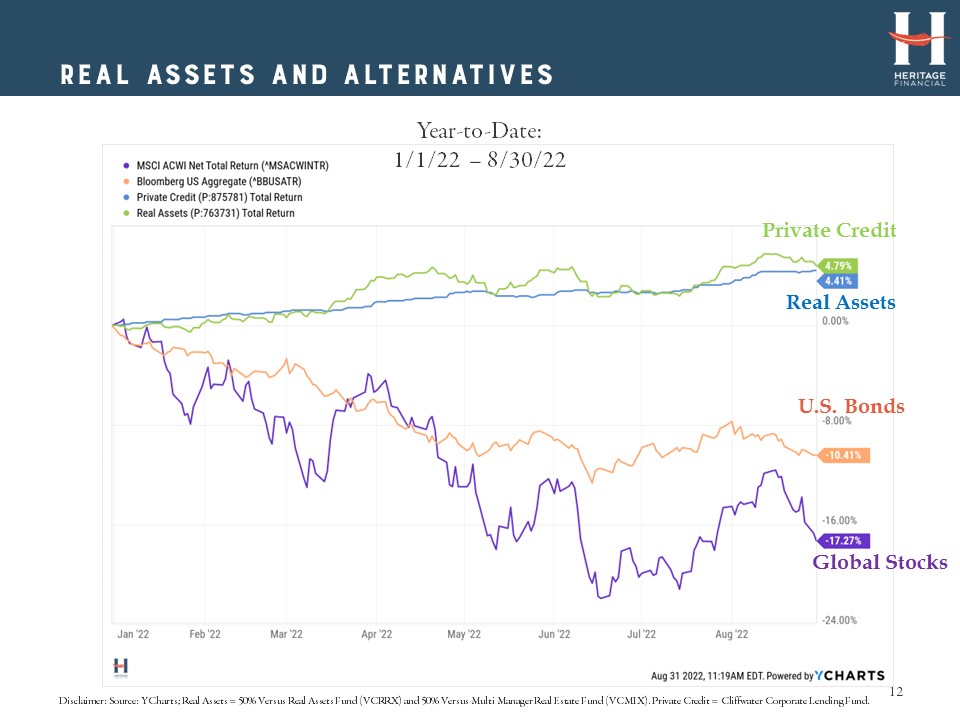

It’s imperative to be sure your investments are diversified across assets classes such as bonds, equities, private credit, and real assets. Diversity among investments and an appropriate asset allocation for your age, risk tolerance, and needs can make your portfolio less sensitive to changes in interest rates and help you stomach the inevitable volatility that markets bring.

You can’t consistently time or predict market downturns and recessions. Take some time to review your finances and make sure you are prepared for the next one.

For additional tips on how to recession-proof your finances and to learn what we are doing in client portfolios:

- Listen in to the Wealthy Behavior September Market Update: A New Direction podcast.

- Watch the replay of our webinar, The Outlook Has Changed.