As children grow into adulthood, many parents still want to provide support—whether to help them get established, ease a financial burden, or simply give them a meaningful boost. Gifting to adult children doesn’t have to be grand or complicated. Even modest gifts, offered intentionally, can strengthen their financial footing and show them you’re cheering them on.

Here are several ways to gift to your adult children, both financially and through practical, heartfelt support.

One-Time Financial Gifts

Small, well-timed gifts can make a big difference in your child’s daily life. Covering a car repair, helping with moving costs, or purchasing professional attire for a job interview may seem small, but reliable transportation and a strong first impression can make a big difference in their ability to secure work and build financial independence.

Annual Financial Gifts

If you’d like to gift regularly, the annual gift tax exclusion makes it easy to share your wealth in a tax-efficient way.

For 2025 and 2026, the annual gift tax exclusion is $19,000 per recipient. You can give this amount to as many individuals as you’d like without filing a gift tax return or using any of your lifetime exemption. Married couples may gift up to $38,000 per recipient per year. These annual gifts can help adult children with important milestones or long-term goals, such as:

- Contributions to a 529 college savings plan

- Funding a Roth IRA

- Paying down student loans or credit card debt

- Helping with a wedding, first home purchase, or new business venture

Some gifts—such as tuition paid directly to a school or medical bills paid directly to a provider—can be given in unlimited amounts without using the annual exclusion at all.

Ongoing Financial Support

If you’d like your gift to be felt more consistently throughout the year, you might consider covering smaller recurring expenses such as:

- A portion of their phone bill

- Car insurance

- A subscription or service they depend on

These ongoing gifts can create breathing room in your child’s budget, helping them focus on saving, career development, or managing household expenses.

Gifts That Encourage Healthy Financial Habits

Some of the most powerful gifts are those that reinforce good financial habits and long-term stability.

- Match their savings. Help your child open a savings account by making the first deposit or offering to match their contributions. Matching can also be used to motivate progress on credit card or other debt repayment.

- Fund or match contributions to an IRA. If your child is freelancing or doesn’t have access to an employer retirement plan, an IRA—particularly a Roth IRA—can help them start saving for the long term.

- Gift shares of stock. Giving stock in a company they care about—such as a tech, entertainment, or socially responsible firm—can spark interest in investing and teach valuable lessons about long-term growth.

- Gift appreciated assets. Gifting appreciated assets to adult children who may be in a lower tax bracket can be an effective way to transfer wealth and potentially reduce capital gains taxes.

Non-Financial Gifts With Lasting Value

Gifting doesn’t always involve money. Some of the most meaningful gifts you can offer your adult children come from your time, your experience, and your preparation.

- Offer practical support. Reviewing a résumé, making introductions for networking, or assisting with a job search can be just as valuable as financial help. Providing childcare or pet-sitting can also help your child save money on essential expenses.

- Share your knowledge. Many young adults haven’t had formal financial education. Helping them create a budget, understand credit, or learn investing basics can provide lifelong benefits.

- Organize and document your financial world. Preparing a document that outlines essential information your family will need upon your passing can spare your loved ones anxiety, confusion, and potential conflict during an already difficult time. This document should include:

- Who to contact: Your financial planner, accountant, attorney, employer, banker, and other key advisors.

- What you own: Insurance policies, collectibles, jewelry, mortgages, loans, and other assets and obligations.

- Where things are: A list of financial items is only helpful if your children know it exists and where the items within it are located. They don’t need to know the details today—only how to access them when the time comes.

Taking the time to organize this information is a profound act of care and one of the most meaningful non-financial gifts you can provide.

Planning Your Gifting Strategy

Every family’s situation is unique. Your Wealth Manager can help you determine how gifting fits within your broader financial plan—how much you can comfortably give, which gifting strategies are most tax-efficient, and how to support your adult children without compromising your own financial security.

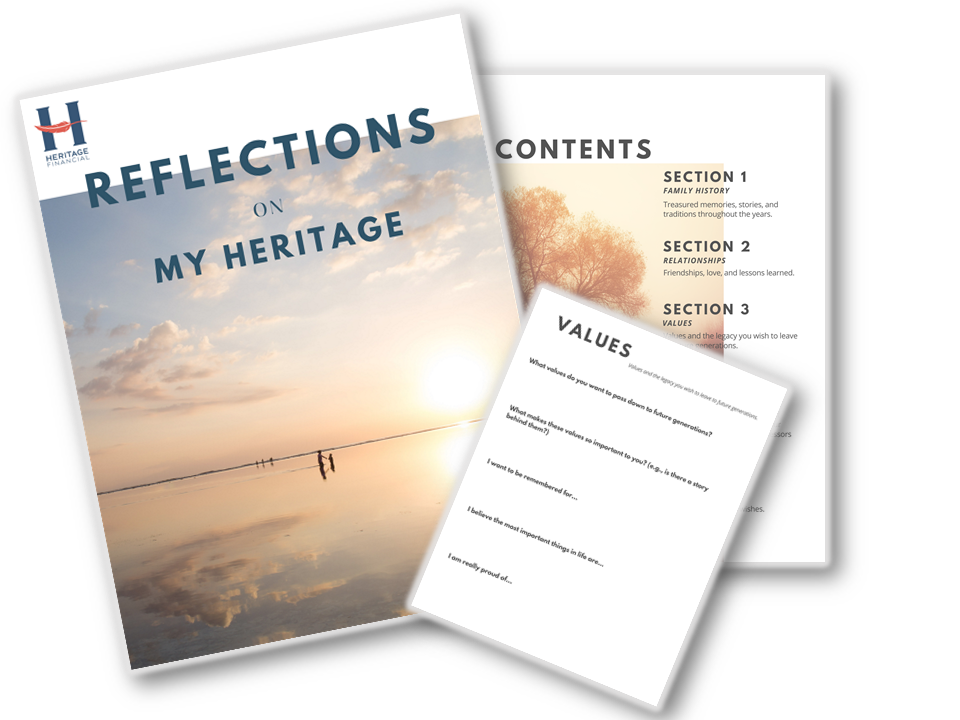

Reflections On My Heritage is a resource to help share treasured memories, pass on important family values, and provide important information to family members during times of transition.

Click the image to download a copy or send an email to heritage@heritagefinancial.net to request a hard copy.