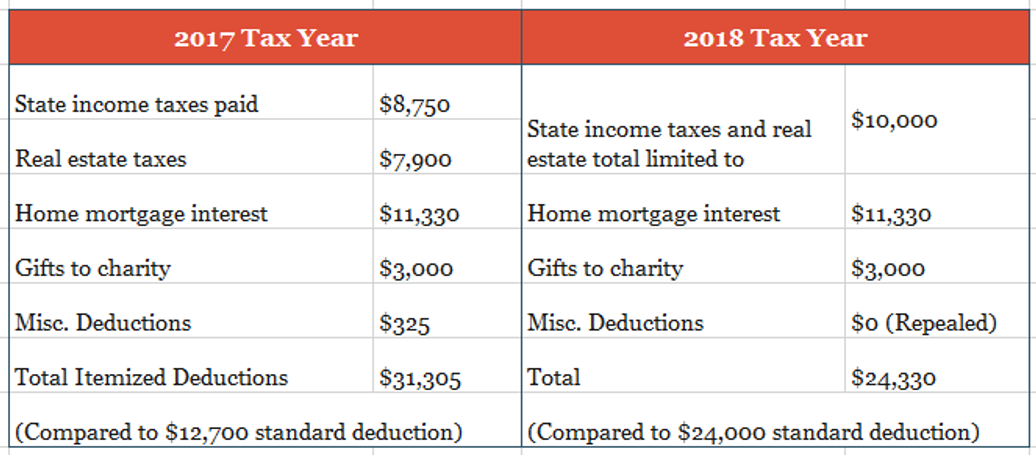

The itemized deduction for charitable contributions may have less income tax-saving benefit for some taxpayers starting with the 2018 tax year. This is due to a substantial increase in the standard deduction and the elimination or reduction of other itemized deductions. The new law increases the standard deduction to $24,000 for married couples and to $12,000 for single persons, up from $12,700 and $6,350 respectively. The deduction for state and local income tax and property tax is capped at $10,000 total. Furthermore, miscellaneous itemized deductions, such as tax preparation expenses and investment advisory fees, are repealed. The potential impact to the value of the charitable deduction can be illustrated by example:

In the illustration above a couple that donates $3,000 to charity in 2017 received the full tax benefit from the deduction. The same donation in 2018 however only contributes to a $330 net deduction above the standard deduction amount. In other words, you will not receive a deduction for the full value of the charitable gift unless your other cumulative itemized deductions exceed the (new) standard deduction amount.

NEXT STEPS

If the new tax law may reduce the tax-savings of your charitable contributions, you may consider changing your giving strategy. There are a few methods that could be useful in different situations:

1. One option could be to delay donations and bunch them into a future year for a larger deduction. In this case, you may alternate using the standard deduction and itemizing every other year.

2. Alternatively, one could advance a larger tax deduction into the current year – but distribute the funds to charities over time – using a Donor Advised Fund.

3. One may be able to coordinate these strategies with other life events, to try to plan for the best outcomes. For example, plan to make a larger charitable donation in the same year one receives a bonus or realizes a gain from a property sale. Offsetting taxable income with strategic deductions can make good planning sense even if the new tax law is not specifically impacting your situation.

4. Individuals age 70 ½ and older have another option using money in an IRA. Under the Qualified Charitable Distribution (QCD) rules, one can make a tax-free gift directly to a charity from an IRA, instead of taking a taxable withdrawal from the IRA to fund the gift.

While we aim to help make tax-smart giving decisions with our clients, one should engage in charitable giving to support a cause or interest that has meaning to you and not necessarily because of economic motivators. There are many ways one can give, not only financially but also through volunteering time and sharing knowledge. We enjoy discussing these goals and however we might help you achieve them.