Over the next two decades, an estimated $84 trillion in wealth will move from Baby Boomers and Generation X to their heirs and charities1. Of that amount, more than $72 trillion will go directly to beneficiaries1. While this unprecedented shift presents opportunities, it also highlights risks.

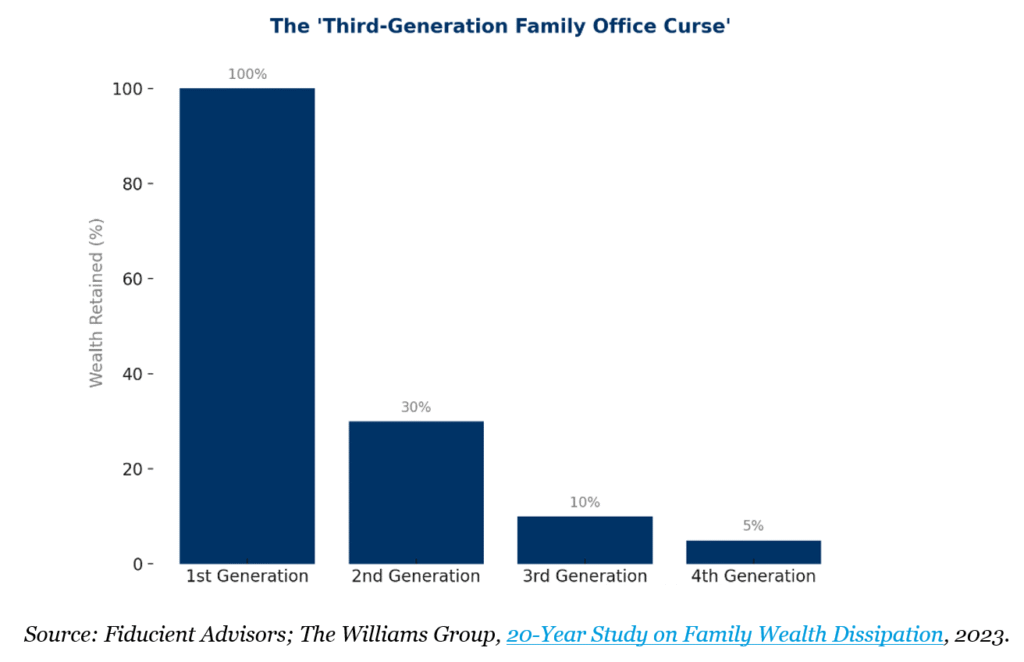

Research shows that 70% of family wealth is lost by the second generation, and 90% by the third2. The cause is rarely poor investment strategies alone. Instead, the erosion of wealth often comes from a lack of preparation, financial literacy, and communication within families.

As fiduciary advisors, we know that preserving wealth is not simply about portfolio management. It also requires multi-generational wealth management that includes education, dialogue, and tailored guidance for every member of the family.

Family Conversations that Matter

Education is most powerful when paired with family dialogue. That is why we facilitate family meetings that bring generations together to discuss wealth, values, and goals. These conversations are often where the most meaningful progress occurs.

We believe a well-run family meeting creates a forum to:

- Introduce younger members to the family’s mission and legacy

- Share stories that highlight how the family built its wealth and why stewardship matters

- Allow heirs to ask questions in a supportive, structured setting

Depending on the family’s needs, these meetings can also include philanthropy discussions, governance frameworks, or multi-generational planning exercises. Importantly, meetings are tailored to the family and coordinated with their other professional advisors, helping to ensure alignment with the broader investment and estate plan.

Tailored Guidance for Heirs

Every generation approaches money differently. Millennials and Gen Z, for example, often value impact investing, financial independence and sustainable strategies, while Baby Boomers may focus more on retirement income and estate planning.

That is why we believe one-size-fits-all approaches rarely work. For heirs ready to take on more responsibility, we provide personalized coaching that meets them where they are through our Heritage Generations Group offering. This includes an ongoing relationship with a dedicated advisor who will meet with them on a regular basis to provide guidance on:

- The basic principles of personal finance and investing

- Managing credit and debt responsibly

- Creating a budget

- Saving for major life goals, such as purchasing a first home, while also saving for long-term goals, such as retirement

- Understanding how investments align with values and risk tolerance

Personalized attention helps younger generations feel seen and supported, while reinforcing strong habits early.

Gifting with Intention

Another effective tool is “gifting with a warm hand.” Instead of waiting to pass on wealth through an estate, families can transfer smaller amounts during their lifetime. This allows heirs to practice managing resources, with the benefit of guidance from parents, grandparents, and their financial advisor.

For example, a family might provide a gift earmarked for starting a business, contributing to a down payment on a home or engaging in philanthropic work. These experiences teach financial responsibility and provide lessons that last far longer than the gift itself.

Estate and Legacy Planning

Even with education and coaching, a sound wealth transfer requires current estate planning. Many families delay this step. According to a recent report, 41% of Baby Boomers and 45% of Gen Xers do not have a will, and nearly half of those who do have not updated their documents in more than three years3.

In client meetings, our planning teams along with our in-house Estate Planning Specialist can review these important pieces and consult with your external professionals to ensure they remain up-to-date. This often includes reviewing wills and trusts, establishing or revisiting powers of attorney and ensuring tax-efficient strategies are in place. We treat these conversations as ongoing rather than one-time events, recognizing that families, laws, and priorities evolve over time.

Why It Matters

The $84 trillion wealth transfer is not just about assets. It represents opportunities for families to strengthen relationships, reinforce values, and create impact for generations to come. Yet without preparation, those opportunities can quickly erode.

We believe that families that combine financial education, intentional conversations and tailored guidance, delivered in partnership with their fiduciary financial advisor, are better positioned to preserve wealth across generations. By investing in education and engagement today, families can improve the odds that their legacy will last for decades, not just years.

Your legacy deserves more than good intentions – it deserves a plan. Reach out to start the conversation today!

[1] Cerulli Associates: Cerulli Anticipates $84 Trillion in Wealth Transfers Through 2045, January 2022.

[2] Williams and Preisser, Preparing Heirs: Five Steps to a Successful Transition of Family Wealth and Values, January 2010.

[3] Legal Shield: New Study Finds America’s Largest Wealth Transfer Faces Unexpected Obstacle: The Family Dinner Table.