Trade policy shockwaves are just beginning to reverberate.

Key Observations

- Tariff Escalation Raises Recession Risk – U.S. tariffs, despite a temporary pause, have intensified global trade tensions. Without policy offsets, the economic drag increases the likelihood of recession. Markets briefly rallied on tariff delays but remain vulnerable to policy uncertainty.

- Economic Placebo: The Bump then Fade – Tariffs could spark a short-term boost as consumers front-load purchases with the expectation of higher future prices. However, as higher costs hit profits and confidence, businesses and consumers may pull back.

- Core Market Drivers Still Matter Most – Tariffs have dominated headlines, but they do not dictate the full story. Fundamentals like earnings growth, valuations, and bond yields remain key drivers of long-term returns. Should growth falter, the Fed may pivot. And if tariff revenue is redirected into a “big, beautiful bill,” fiscal policy could become more supportive. Tariffs and the shifts in U.S. policy are clearly relevant, but they are not all-encompassing.

Liberation, Escalation, Respite, Limbo…The Current State of Things

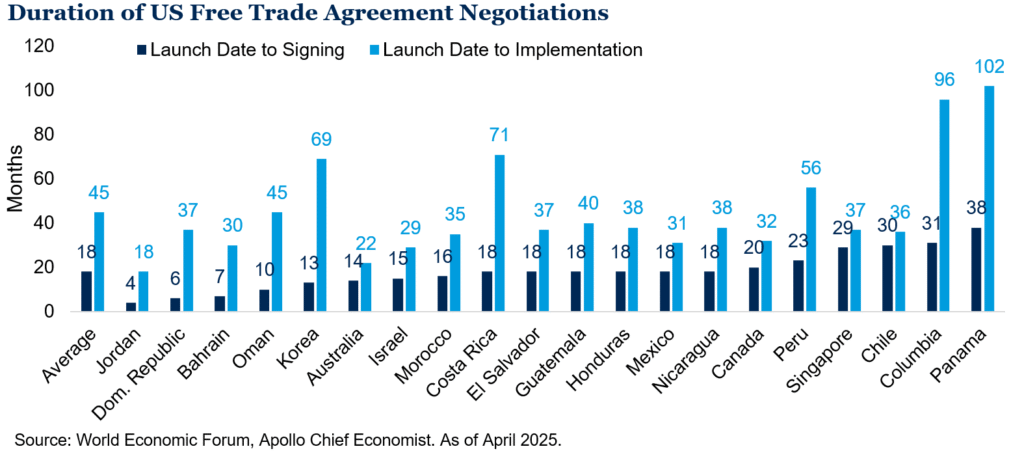

April opened with a bang, marked by an assertive shift in U.S. trade policy. Even with a 90-day reciprocal tariff pause in place, the U.S. has implemented a 10% universal tariff, renegotiated trade agreements with Canada and Mexico, implemented auto tariffs, and engaged in a trade war with China, the world’s largest export economy. We could debate the merits or intent of these policies, but the reality is simple: they are here. And without meaningful resolution, monetary or fiscal offsets, their presence increases the probability that the U.S. economy slides into recession.

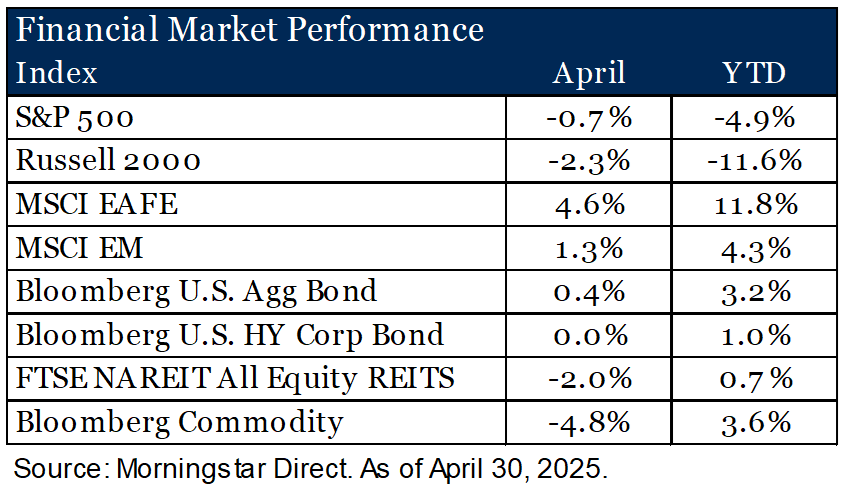

With many investors glued to ticker movements in recent weeks, we will keep this market recap concise and focus more deeply on the policy shifts driving the bigger picture.

In April, growth equities outpaced value across market capitalizations, as value-heavy sectors like energy, materials and financials lagged behind growth-oriented sectors such as technology and consumer sectors. International equities extended their lead, supported by a weaker U.S. dollar and relatively stronger local market performance. Mexico stood out, rising 13%, as tariff attention shifted from North America to other regions.

While headline fixed income returns looked muted on the month, they were anything but beneath the surface. Yields on the long end of the curve spiked mid-month, pressuring bond prices down. Speculation swirled from rising inflation expectations and weak Treasury auction demand, to foreign central bank selling, questions over the U.S. dollar’s reserve status, or even a hedge fund unwinding a position. But by month-end, cooler heads prevailed and the 30-year yield closed almost where it began: 4.66%.

Tariff Ripple Effects

We are reminded of Newton’s third law: for every action, there is an equal and opposite reaction. The global economy is contending with a powerful new force: tariffs. While the headline rates are easier to measure, the equal and opposite ripple effects are far more complex. A computer, for example, is built from thousands of components sourced from dozens of countries. Many of these parts cross borders multiple times before reaching the end consumer. That complexity does not cleanly translate to a new sticker price. Even if that complexity were fully transparent, it still would not be simple arithmetic. It is also a behavioral equation: how much cost companies will eat, how much they pass along, and how consumers respond. The reality is more tangled than any headlines may let on. In uncertain times, we must distill noise to primary signals and in this case we do so through pragmatic human behavior.

The Economic Shot Clock: A Bump, Then a Fade

Holding all else equal, meaning tariffs remain in place, our expectation is a temporary bump in economic activity and inflation followed by a fade in both. Why the bump? Consumers may front-load purchases they believe will become more expensive, temporarily boosting retail sales and corporate earnings.

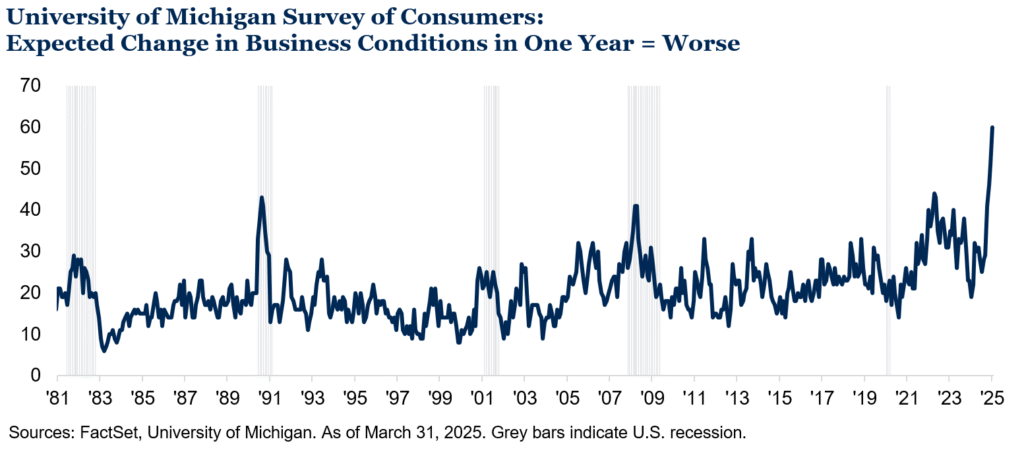

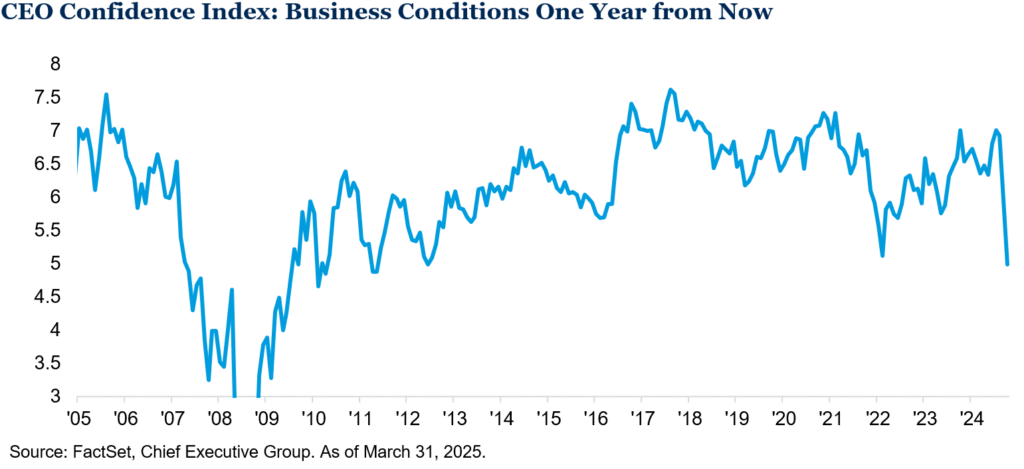

When this economic placebo fades and businesses and consumers face higher costs and growing uncertainty, they begin to pull back. This translates to something like “plan for the worst and hope for the best.” For businesses, planning for the worst rarely includes hiring. Additionally, as profits compress, costs come under the microscope. Falling corporate profits are among the most reliable leading indicators of rising unemployment. That is why we believe the economic shot clock is running. Sentiment clearly has shifted as shown below and without an offset or de-escalation, current policies are likely to exert greater downward pressure on the economy.

The Path(s) Forward

Any attempt at a prescriptive version of the future is fraught with error. We also know that reality rarely colors inside the lines we draw for it. That said, we can envision a number of likely paths in which this could unfold.

Door #1: A Tweet Will Set You Free

There is a non-zero chance the current economic course we have set abruptly shifts. The same stroke of the pen that imposed tariffs could just as swiftly undo them. If so, while real economic damage has been done, markets may peer through their newly applied black eye and regain optimism.

Door #2: It Takes Time, But Is Resolved In Time

The U.S. is currently navigating what we call an “event-led correction.” As a self-inflicted event, it also means the remedy is within reach. Over time, trade concessions are negotiated and the market could slowly recalibrate. The key factor here is that it will take time and in the interim, prices may continue to drift lower with uncertainty. In such an instance a classic rebalance may be required, simply selling what has done well to buy what has done poorly. Yet, the dislocation may not be large enough to fundamentally alter our 10-year forward view and we choose to rebalance back to the targeted allocations with which we began the year.

Door #3: Oops

Should the situation deteriorate further, the U.S. could shift from an event-led correction into a recession-led bear market. In that case, asset prices would likely decline sharply and forward-looking assumptions would need to be reset. Still, such a scenario may also present opportunity. For example, in such an environment, wider credit spreads may offer more attractive entry points, potentially shifting our current positioning from a multi-year low to something more substantial.

While committing the cardinal sin of prediction, our base case is Door #2. Doors #1 and #3 are a toss-up. While current rhetoric suggests a willingness to walk through Door #3, the pragmatism of facing a short-sighted U.S. electorate means that as the potential for recession draws nearer, Door #1 becomes all that much more compelling.

Outlook

Tariffs have commanded much of our mental bandwidth recently, but several other forces remain equally, if not more, critical to market outcomes.

Market Conditions – Current valuations, the trajectory of earnings and current fixed income yields matter greatly to future outcomes. These factors have a far stronger connection to forward returns than trade policy in isolation.

Monetary Policy – The Federal Reserve thus far has shown restraint, keeping policy in a relatively restrictive territory. However, we believe the Fed will act in good faith if clear signs of economic weakness emerge. While timing and magnitude remain uncertain, history suggests the Fed is more likely to support than to stand still if growth falters.

Fiscal Policy – It stands to reason that the receipts collected from tariffs will be used in the political budgetary machine to create equally stimulative fiscal policies such as corporate and personal tax cuts, incentives for domestic manufacturing or infrastructure. While no such details have emerged, if it is indeed “big” or “beautiful” the markets may react favorably.

We believe our positioning coming into the year remains as relevant today as it did then. Fragility, Durability and the Age of Alpha help frame our positioning to weather both uncertainty and elevated volatility.

Listen and subscribe to our Wealthy Behavior podcast to stay up-to-date on the latest market, economic and investment news that affects your wealth. If you like what you hear, please leave our show a review on Apple Podcasts or Spotify so we can reach more people like you!